Investors should be familiar with the risk/reward equation – you have to take risks to have any chance of getting the reward.

This Bonfire Night, Trustnet asked experts which funds they would pick to reach the sky, with the reassurance that for as daring as they might seem, none will be as risky as the infamous plot to blow up Parliament.

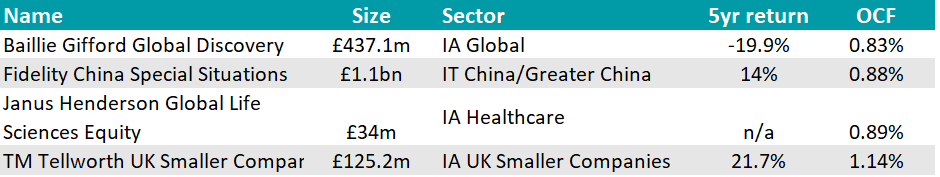

For investors who like to plot in the dark and are always siding with the underdogs, Laith Khalaf, head of investment analysis at AJ Bell, chose the Fidelity China Special Situations trust, which he said should be a good option to add some spark to well-diversified portfolios.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Manager Dale Nicholls looks for cash-generative companies that offer long-term growth prospects and are trading at attractive valuations. The smaller-companies tilt “adds to the risk of the fund but also opens up the possibility of higher returns from a fast-moving area of the market”, Khalaf said.

The manager draws upon the resources of Fidelity’s sizeable analyst pool, including 13 analysts specifically dedicated to China, Khalaf pointed out.

“The Chinese stock market has been on a bit of a rollercoaster ride of late, but investors have broadly responded positively to economic stimulus coming from the central government,” he said.

“The Chinese stock market can be vulnerable to government intervention, but it will also respond to global factors, in particular more defensive US and European trade policies. Investors lately seem to have turned their attention towards India, which has been seen as the next big thing, so China represents a bit of an underdog story at the moment”.

Investing in a single country, however, even one as large as China, comes with “a large risk warning” so this first pick should only be considered by investors with all the main regional bases covered, Khalaf warned.

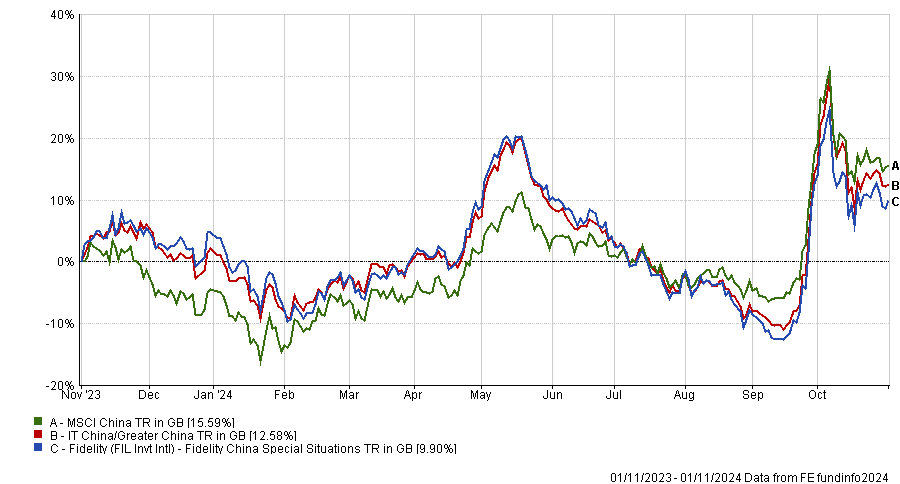

Lovers of British traditions like Bonfire Night might also love UK smaller companies portfolios such as Tellworth UK Smaller Companies, a higher-volatility option selected by FE fundinfo deputy chief investment officer Charles Younes.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The fund comprises, approximately equally, growth and value stocks with strengths in four main areas: product, market leading, margin and management team.

FE fundinfo Alpha Managers John Warren and Paul Marriage exclude a few areas, such as oil and gas, mining and biotech, but otherwise don’t follow a benchmark closely, preferring a bottom-up selection of 40 to 60 stocks in the portfolio.

Younes likes their bottom-up style, with an emphasis on meeting management teams and “understanding the businesses they invest in deeply”. This is further differentiated from peers as they are looking “outside typical growth stocks” at more unloved areas of the market.

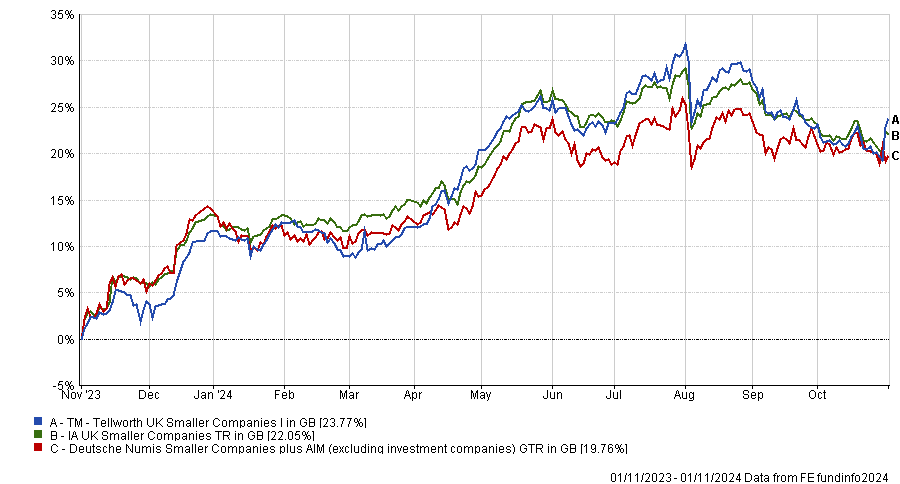

For higher-risk, higher-return opportunities across the globe, Younes picked the Baillie Gifford Global Discovery fund.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The team, led by Douglas Brodie, focuses on companies’ fundamental characteristics, favouring strong management teams and innovative products, which can generate sustainable profits to fund future growth opportunities, Younes said.

The fund has a high number of positions below 0.5%, which represent the riskier ideas in the portfolio that may or may not work out.

“It doesn’t add to these names, but lets them climb or fall based on performance, which helps to mitigate some of the risks associated with investing in smaller companies by minimising the impact from a potential bad investment,” Younes said.

Although in isolation the fund is high risk, it could be suitable as an addition to an already-diverse global-equity allocation that is lacking smaller company exposure, the CIO concluded.

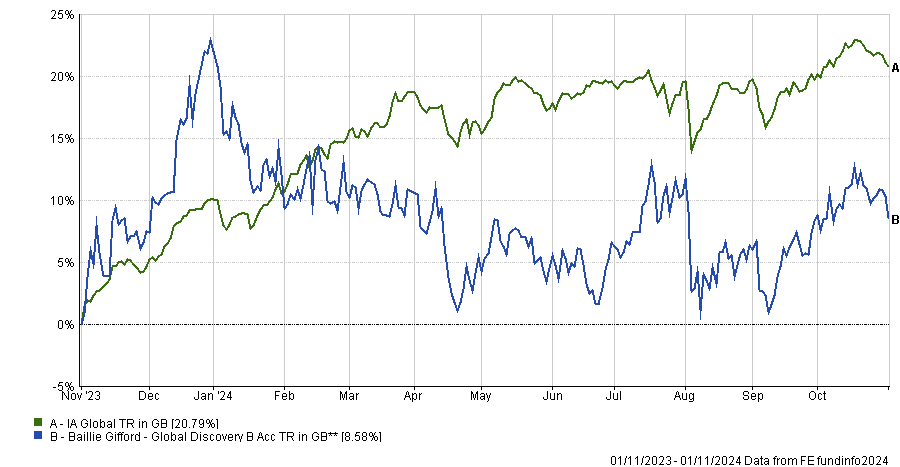

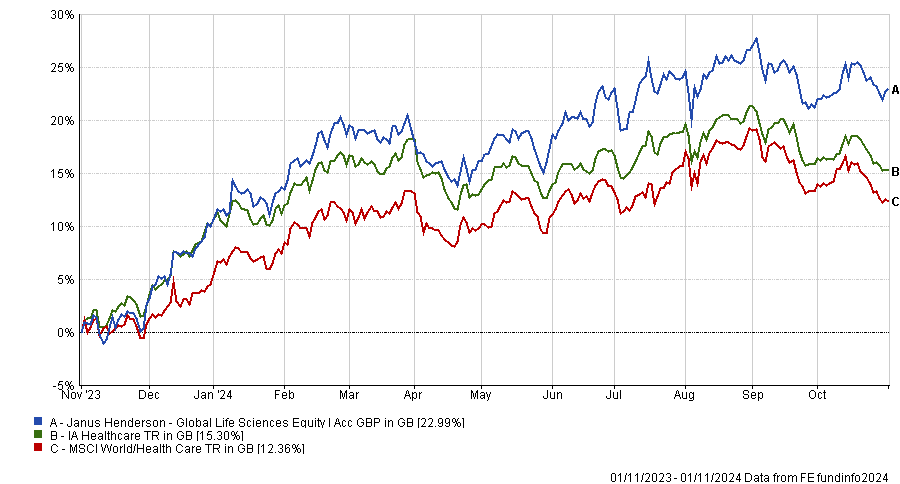

Still within global equities, Rob Burgeman, investment manager at RBC Brewin Dolphin, said that from weight loss drugs to vaccines, healthcare is currently undergoing “radical changes”.

According to him, an ideal way of participating in this revolution is through the Janus Henderson Global Life Sciences fund.

Performance of fund against sector and index over 1yr

Source: FE Analytics

It invests at least 80% in shares of life-sciences companies of any size and in any country, preferring those that are addressing unmet medical needs or seeking to make the healthcare system more efficient.

Managers Andy Acker and Daniel Lyons aim to maintain a balanced portfolio across subsectors such as biotechnology, healthcare services, medical devices and pharmaceuticals.

“Picking winners in this space can be very difficult, so this fund is an ideal way to gain exposure to the wider industry and the tail winds propelling it forwards,” said Burgeman.

Finally for a more specialist pick, Momentum Global Investment Management senior research and portfolio analyst Gregoire Sharma went for the Global Evolution Emerging Markets Blended High Conviction fund.

This high-conviction, blended EMD strategy is a best-ideas collection form various portfolio managers at Global Evolution, with a static 25% allocation to sovereign hard currency debt, sovereign local currency debt, corporate hard currency debt and frontier local currency debt.

Since inception in 2022, it delivered a 33.7% return gross of fees, beating many of its peers.

“The strategy has been very successful, outperforming both in bull months and bear months. When the market turns negative, frontier positions tend to outperform, whereas when it turns positive, hard currency tends to outperform,” Sharma said.

“Given frontier markets are so under-researched relative to more ‘vanilla’ EMD asset classes, they offer significant opportunities for outperformance.”