As the dust settles on an incredibly divisive US election, all eyes are on what impact president-elect Donald Trump will have on the world's largest economy.

Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers, believes 'Trump 2.0' will differ substantially from his 2016 presidency.

While Trump may currently control both the Senate and House of Representatives, Chetouane noted that without the potential for a third term, he is at liberty to be far more aggressive in his economic policy than he was the first time, and the market has generally neglected that fact. “The market has become too complacent with Trump,” Chetouane concluded.

His new tenure as president will bring greater uncertainty to the global market, because all his proposed fiscal policies are full of contradictions and potential for risks. “The great paradox is that Donald Trump has promised to fight against inflation, but all of his policies will bring more inflation into the US economy,” the strategist said.

Immigration

First, Chetouane identified the economic discrepancies in Trump’s ambition to cut immigration.

Immigration policies may seem comparatively easy to implement, particularly when compared to more complicated economic policies such as taxation. However, slashing immigration is not necessarily the beneficial economic decision that Trump seems to have convinced the American people it is.

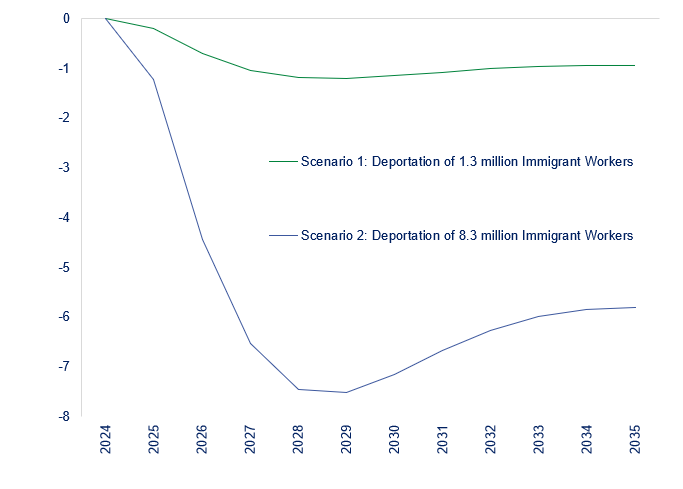

Estimated impact of migrant policy on GDP growth

Source: Natixis IM, Refinitiv, NIM Solutions

In the chart above, Chetouane presents two scenarios: The first demonstrates what would happen to US gross domestic product (GDP) if 1.3 million people were deported and the second shows what would happen if 8.3 million people were deported.

In the first scenario, GDP growth would negatively deviate from the benchmark by roughly 1% over the next 10 years. In the latter case, GDP could fall by as much as 7% by 2027, creating enormous inflationary pressures, according to Chetouane.

“When you look at the promises he has made to the US people, the only thing he can do now is close the border, which will generate less growth and more inflation.”

Indeed, for an economy as dependent on migrant workers as the US, deportation of this size and scale would cause a large-scale supply shock as labour scarcities become more common.

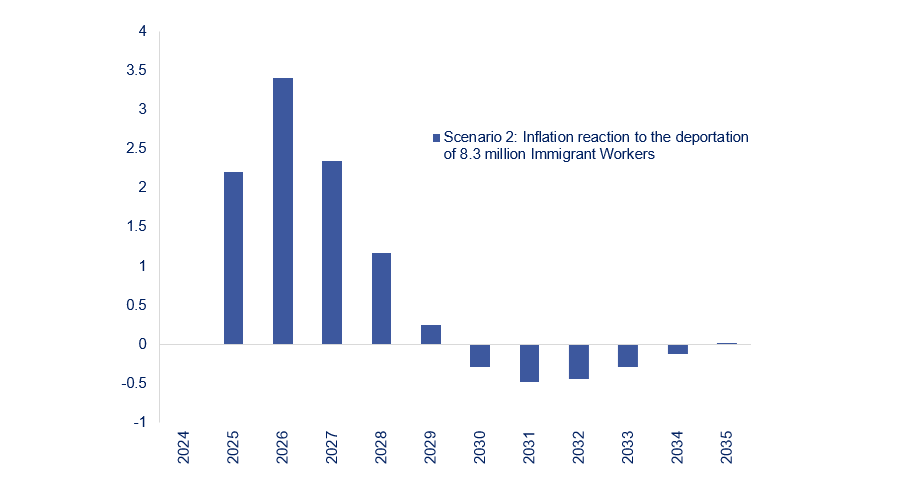

Estimated impact of migrant policy on US inflation

Source: Natixis IM. Refinitiv, NIM Solutions

In the scenario that Trump successfully deports 8.3 million immigrant workers, Chetouane calculated that US inflation could surge by as much as 2% next year alone. The following year, inflation could peak at about 3.5% higher than the current baseline, before finally declining in 2030.

Despite Trump’s commitments to the contrary, Chetouane believes his immigration policy is more likely to increase inflation, not decrease it.

Tariffs

Trump’s plans to impose new tariffs on imports face similar issues. “The sentiment of the US people is that they are being invaded, not just by people, but by products coming from China and the rest of the world,” Chetouane said.

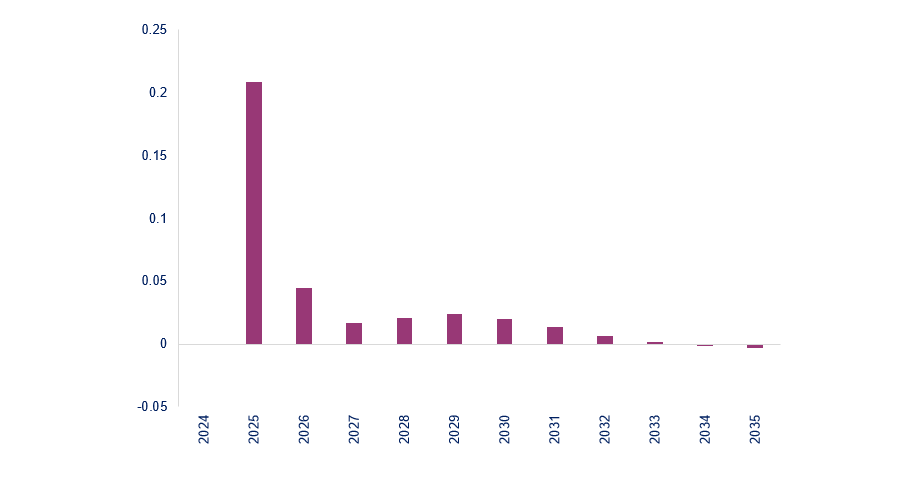

Predicted impacts of tariffs on European inflation

Source: Natixis IM, Refinitiv, NIM Solutions

In the above chart, Chetouane calculated the impact a 10% tariff would have on European inflation rates. The results were surprisingly modest, with inflation predicted to rise by just 0.2% on average above the baseline.

“It is clear that we are overestimating the impact of these tariffs in Europe," Natixis’ head of market strategy admitted.

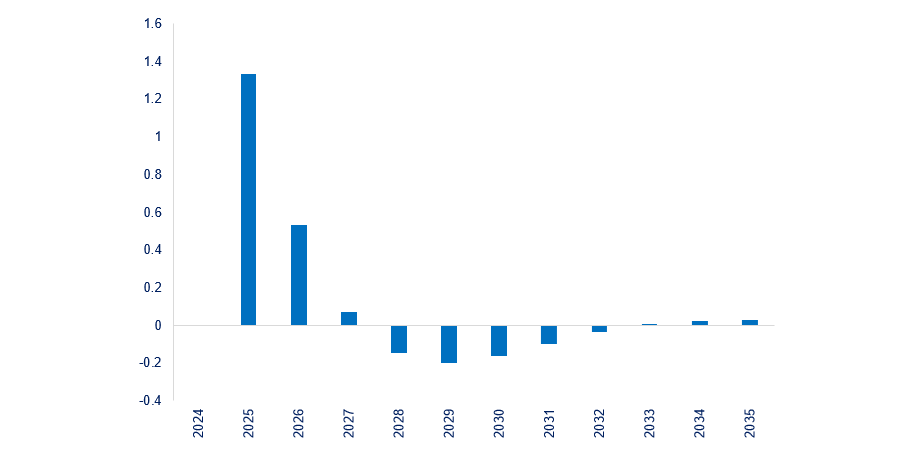

By contrast, under the same proposed 10% tariff rate, US domestic inflation will rise by almost 1.4% compared to the baseline in 2025.

In 2026, while inflation will decline again, it is still expected to be 0.5% above its current levels.

Predicted impacts of tariffs on US inflation

Source: Natixis IM, Refinitiv, NIM Solutions

Similarly to his other fiscal policies, Chetouane believes that Trump's approach to tariffs is paradoxical. If successfully implemented, the US economy will feel the inflationary shock most starkly.

Tax and debt

Finally, Trump’s approach to tax and debt is equally contradictory.

Trump is inheriting an economy facing an enormous fiscal debt of roughly $35trn, with Chetouane predicting that this could rise to as much as $50trn over the next 10 years. Even taking median estimates of the impacts that Trump’s policies may have, if all his fiscal policies were implemented as outlined, US debt would increase by £7.5trn over the next 10 years.

Trump has promised to reduce corporate taxes to 15% under his tenure. Such a policy would add a further $800bn to the current US debt alone, according to the team at Natixis.

Alternatively, Trump could bank on rising inflation to reduce the debt pile, which would force the Federal Reserve to maintain a relatively accommodative monetary policy.

“This is another paradox – the best way to for Trump to reduce the pressure of debt on the economy is to generate growth, and yes, to generate inflation as well.”

Moreover, Chetouane added that this would raise serious concerns from the Fed about the sustainability of the government debt. “The problem is, when the market is asking for some evidence that your level of debt is sustainable, it is perhaps already too late," he concluded.