Taiwan Semiconductor Manufacturing Company (TSMC) makes artificial intelligence (AI) chips for Nvidia at margins of at least 50% and has become immensely popular amongst fund managers wanting exposure to the semiconductor boom. With demand for AI set to increase exponentially, the consensus view is that TSMC will “take over the world”, said Redwheel’s Nick Clay.

He begs to differ and has just sold the stock from his Redwheel Global Equity Income fund. “People think we’re idiots”, he admitted. Its valuation has increased to such a high level that TSMC’s shares have a high change of underperforming and even losing money, he argued.

“We love TSMC, we think it's an amazing company, but if it gets too expensive then it becomes very difficult for that company to continually deliver on elevated expectations.”

Clay has sold Qualcomm for similar reasons but bought LVMH and thinks the odds are stacked in the favour of Gucci owner Kering as well. Both luxury goods companies are priced as if Chinese consumers will never buy a designer handbag again, which he does not believe to be the case.

Below, Clay explains why he thinks TSMC’s margins will be eroded and why Zara owner Inditex has outperformed.

Please describe your investment strategy.

When we designed the strategy in 2005, our starting point was: what works in investing? When you look at the makeup of total returns, compounding dividends over a long period of time is statistically attractive.

Companies that pay dividends tend to have discipline in how they allocate their capital, which leads you to quality companies whose cash flows and dividends are durable, but you need to buy them cheaply.

You can only buy these good companies cheaply when something's going wrong. Controversies can present an opportunity to buy into a good company at a really attractive valuation. Our job is to determine whether those controversies are temporary and our opportunity to get in, or permanent and therefore a trap. This process tends to encourage us to get in and out at the right time.

We also have a buy and sell discipline. We can only buy stocks for the first time when they yield 25% above the market. The MSCI World today is yielding a 1.7% so we've got to get 2.2%. We have to sell everything that yields less than the market. The yield on the fund is just over 3.5% at the moment.

What controversies have led to buying opportunities recently?

We've just bought LVMH for the first time. In 19 years of running this strategy, LVMH has never yielded 25% above the market until now, which shows you how unloved it must be, because it's obviously a great company.

We're told on a daily basis that the Chinese consumer is never going to buy a handbag again but it’s our job is to ask whether that is true. Chinese consumers have been saving a lot and their net worth will continue to go up, even though their properties have declined in value. Luxury sales in Japan are growing 75% because Chinese consumers are traveling to Japan as the yen is so cheap and buying their handbags over there.

Chinese consumers just don't have any confidence, which seems like a temporary thing and we are being paid in dividends to wait for confidence to return.

It's only because of our disciplines that we're able to buy into stocks which, quite frankly, are very difficult to buy into because everyone's telling you you're a complete idiot given something's going wrong. What makes buying these companies with controversies even harder is that we are not clever enough to be able to pick the very bottom of the controversy, so invariably, it gets worse before it gets better.

What has been your worst performing stock in the past year?

Gucci’s owner Kering. Gucci has changed its creative director but it takes time to come up with a new collection and nobody wants to buy the old one, so there has been a hiatus in purchasing. Gucci is quite popular in Asia, so its exposure to China is greater than most luxury goods companies.

Everybody thinks Gucci is broken but we think that’s ridiculous. Social media allows us to track brand strength and relevance, which is still incredibly high, particularly in Asia. Some of the new collection is hitting the stores and initial indications show it is popular.

Kering continues to invest in the brand, which is why margins are under pressure, but that is exactly what we want to see it do, so we're happy to sit and wait, while we're being paid 4%-plus yield. It's costing us money, but we think it's an opportunity cost rather than permanent loss.

And your best performers?

TSMC and Qualcomm have been strong but their valuations today are skewed to the downside so we sold them.

Everything we do, we're told we're fools, because we’re going against the herd every single time but statistically, the majority of the things we sell go on to underperform our portfolio.

TSMC’s chips will probably commoditise over time. Valuations today are assuming amazing growth at a permanently high margin and we think the margin assumption will come under pressure. We'd rather bet on a luxury handbag than we would on TSMC continuing to make GPUs for Nvidia at a 50% gross margin.

Qualcomm does all the things that allow AI to happen in our devices. So obviously, we're all going to get AI and Qualcomm chips will facilitate that in our devices. But none of this will happen at today’s high margins, which are much too expensive to be scalable. Some parties are paying dramatically over the odds to get a first mover advantage.

Which other holdings have done well?

We bought Zara owner Inditex during the pandemic when the share price collapsed. We liked the strength of the company and its ability to suffer through difficult times and continue to do the right things.

During the pandemic it invested heavily, particularly in technology, and that has allowed it to endure an environment of cost inflation and ever-changing weather far better than any other fast fashion retailers.

It has been able to keep its inventories-to-sales ratio much lower, around 10% of sales, whereas the sector average is in the mid-teens. It’s supply chain in Spain and Turkey is closer so it can respond faster. That strength has allowed Zara to continually take market share.

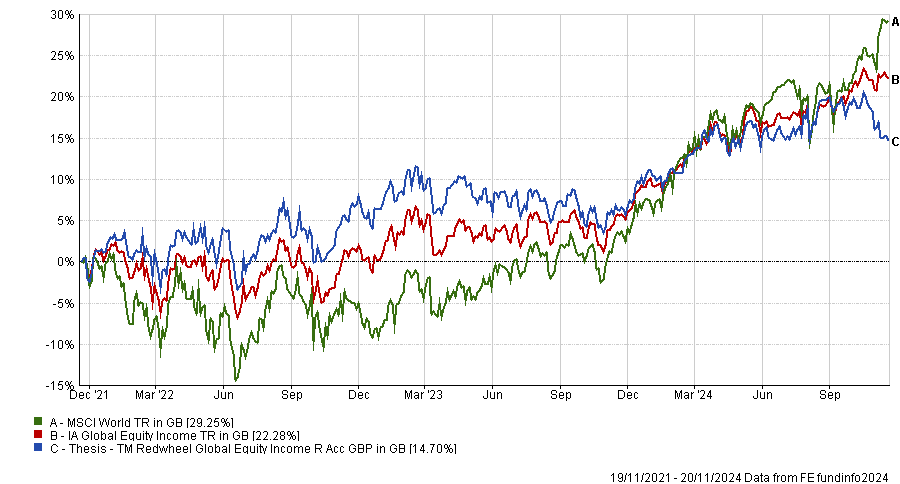

The fund outperformed significantly in 2022 but underperformed in 2023 and 2024. What was that?

In 2022 interest rates were going up and investors were worried about inflation, a recession and volatility. Anything that could keep volatility lower than the market and was not invested in uber-growth stocks did well.

Performance of funds vs sector and benchmark over 3yrs

Source: FE Analytics

In 2023, confidence started to pick up and this year, everything went turbo charged. Our fund, which can’t be exposed to the ‘Magnificent Seven’, has suffered dramatically. The only saving grace for our clients is they know we can't own this stuff, so they own it elsewhere.

The valuation of our portfolio looks incredibly attractive compared to the market. When our portfolio is cheap, historically that tends to be a good time to look at the strategy but obviously, trying to get anyone to think like that when performance looks terrible short term is a hard thing to do.

What do you enjoy doing outside of investing?

With three kids I don’t have much time for hobbies, but if I did, it would be art. I love oil painting, doing portraits and drawing. I used to sell my paintings in Covent Garden on Sundays.