Tech stocks plunged yesterday after a low-cost Chinese artificial intelligence (AI) model overshadowed incumbents such as OpenAI’s ChatGPT, but exactly where were the losses felt the most?

Nvidia’s shares dropped nearly 17% during Monday’s session, erasing about $589bn in market value from the semiconductor designer. This marked the largest single-day loss for any company on Wall Street.

The sell-off was sparked by news that China’s DeepSeek had developed an advanced AI chatbot at a fraction of the typical cost. DeepSeek’s model reportedly cost under $6m to develop, compared to the billions spent by US firms like OpenAI and Meta Platforms.

DeepSeek, a Chinese AI startup founded in 2023, has developed an advanced AI model named DeepSeek-V3. This model employs a ‘mixture of experts’ technique that activates only the necessary computing resources for each task, which enhances efficiency and reduces costs. DeepSeek utilised Nvidia’s reduced-capacity H800 graphics processing units (GPUs) to train its model, achieving high performance with lower computational costs.

In contrast, US AI companies often use Nvidia’s H100 GPUs, which are more powerful but more expensive. Investors feared DeepSeek’s efficient approach could reduce the demand for high-end AI chips, which led to a broader sell-off in tech stocks, with the Nasdaq Composite index falling 3.1%.

Other AI-related chip stocks also suffered significant losses. For instance, Broadcom’s stock fell by 17.4% and Marvell Technology’s stock dropped by 19.1%. Microsoft and Alphabet shares also fell yesterday.

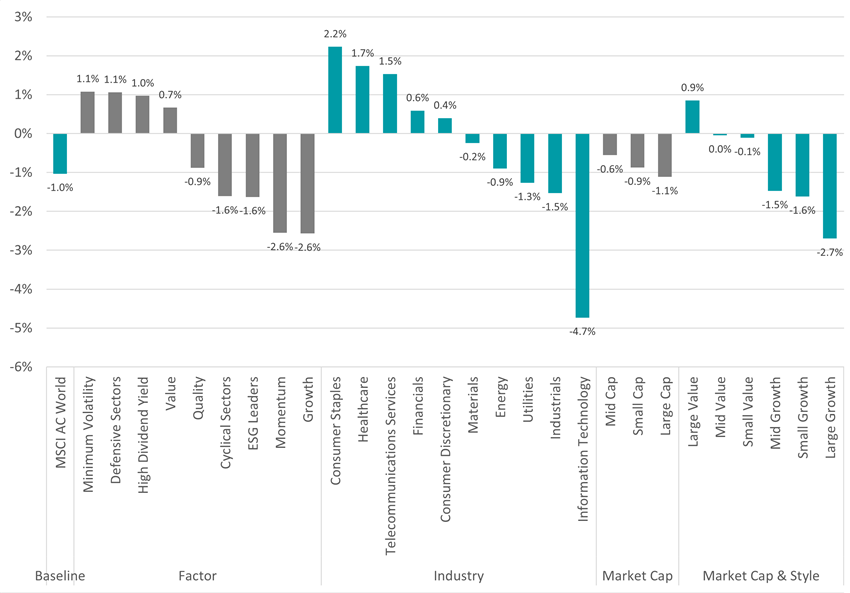

While a day is a very short time frame and many expect the US-led AI boom to continue, yesterday’s trading can offer some insight into what would happen if that narrative started to unravel. The impact on global stocks is shown in the chart below, which uses the MSCI AC World and its various sub-indices.

Performance of global equities on Mon 27 Jan 2025

Source: FinXL. Total return in local currencies.

The MSCI AC World dropped 1% yesterday, with the worst performing industry (predictably) being information technology. Energy and utilities were also hit because more efficient AI suggests lower electricity demand to power the technology.

The growth and momentum investment factors fell the most as did large-cap stocks, which are the areas that have performed the strongest in the AI boom. Value and defensive stocks, which have trailed behind in the rally, held up in yesterday's sell-off.

George Lagarias, chief economist at Forvis Mazars, said: “We have often said that valuations were high and that the market was susceptible to a correction (although the timings are always unsure). Additionally, geo-economic uncertainty is rising. So even a less significant event would be enough to catalyse a correction.

“The underlying narrative that drove equity performance in the past two years, that AI will profoundly change the world, is still very much relevant. The only thing that has changed is that some of the froth is being removed from valuations and earnings expectations, especially around Nvidia.”

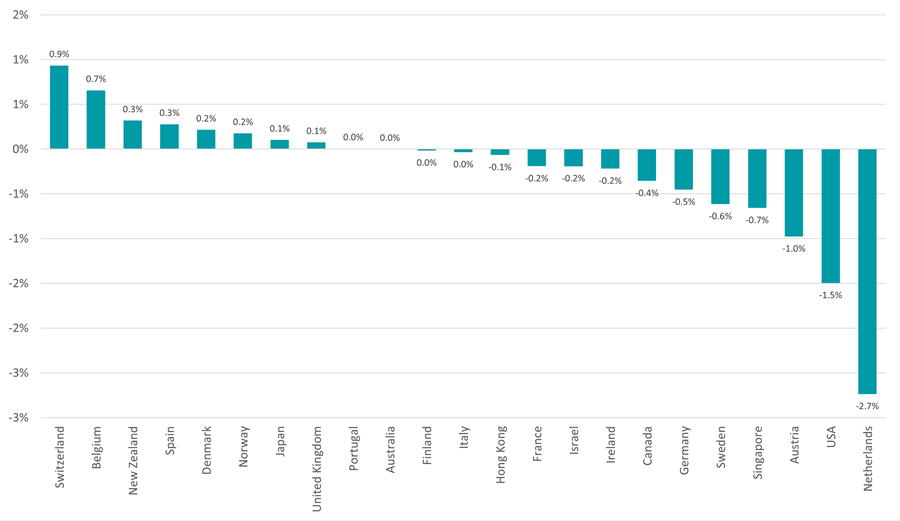

Performance of developed market stocks on Mon 27 Jan 2025

Source: FinXL. Total return in local currencies.

The US market was one of the most sold on Monday, reflecting that many AI companies are based there. However, MSCI Netherlands was the worst-performing developed market index yesterday; ASML, which makes photolithography machines used to produce computer chips, lost 6% and makes up close to 40% of the index.

However, investors appear to be buying the dip. Nvidia’s shares are trading 1.4% higher in pre-market trading, while futures prices suggest small gains for the tech-focused Nasdaq and the broader S&P 500.

Russ Mould, investment director at AJ Bell, said: “The DeepSeek shock has reminded investors they cannot be complacent when trying to play the AI trend. Stocks do not travel in unison and neither do they always travel upwards.

“Sometimes it’s good to be reminded of this. Valuations have been getting lofty in the tech space and investors need to appreciate that richly priced stocks can fall hard on the slightest bit of bad news.”

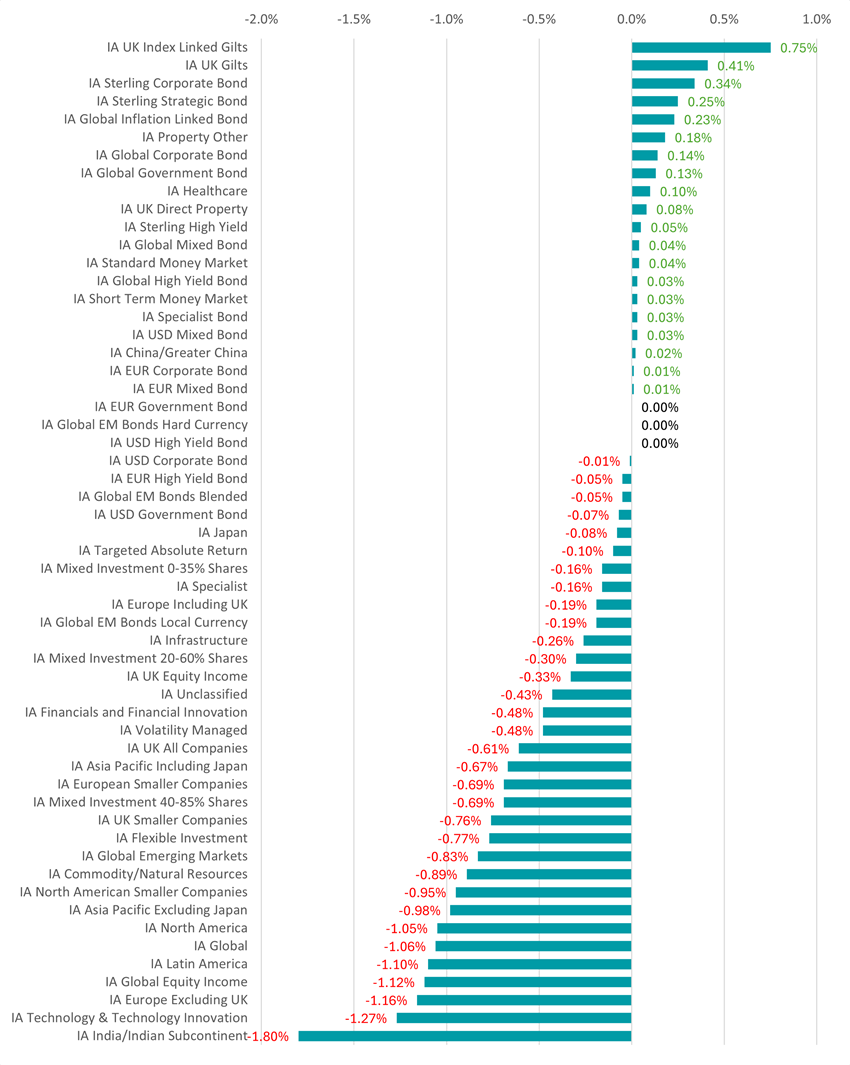

Performance of Investment Association sectors on Mon 27 Jan 2025

Source: FE Analytics. Average total return in sterling.

How all of this impacted Investment Association fund sectors can be seen in the chart above.

The IA Technology & Technology Innovation and IA North America avoided being the worst peer groups yesterday because the average IA India/Indian Subcontinent fund fell 1.8%.

This was not all down to the global rout from tech stocks, although the MSCI India index does have a 12% weighting to information technology companies. Rather, Indian equities have been trending down since last summer on slowing economic growth and corporate earnings.

More linked to yesterday’s DeepSeek volatility, the average tech fund was down 1.3%, the average global equity fund fell 1.1% and the average US equity fund lost 1.1%.

The winners were bonds, as investors moved into safe haven assets. The IA UK Index Linked Gilts sector was up 0.8% while the average IA UK Gilt fund gained 0.4%.

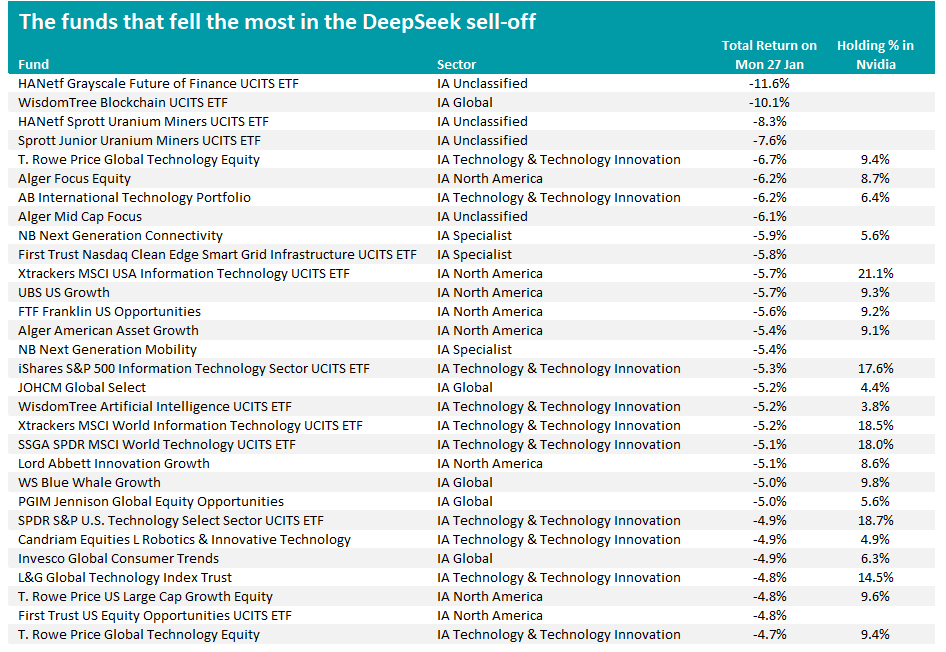

Source: FinXL. Total return in sterling.

When it comes to individual funds, HANetf Grayscale Future of Finance UCITS ETF fell the most with a 11.6% loss. The fund does not have Nvidia in its top 10, but cryptocurrency-linked stocks such as blockchain companies were among those that the centre of yesterday’s sell-off.

However, the majority of the worst performers tended to focus on tech stocks or the US and have a decent allocation to Nvidia in their top 10.

T. Rowe Price Global Technology Equity, Alger Focus Equity, AB International Technology Portfolio, NB Next Generation Connectivity, UBS US Growth, FTF Franklin US Opportunities, JOHCM Global Select and WS Blue Whale Growth are examples of funds that lost 5% more yesterday when the AI narrative soured.

Conversely, ETFs investing in defensive sectors made the highest returns, such as iShares S&P 500 Consumer Staples UCITS ETF, Xtrackers MSCI World Consumer Staples UCITS ETF and SPDR S&P U.S. Health Care Select Sector UCITS ETF.