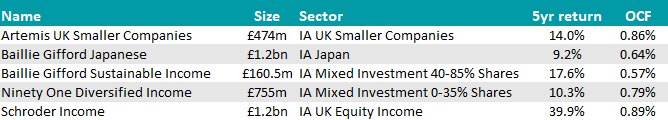

Multi-asset, UK and Japan funds have been the focus of analysts at Hargreaves Lansdown in 2024, with at least one fund in each of these sectors added to the platform’s 69-strong Wealth List. Income was also a persistent theme across the board.

At Trustnet, we are deep-diving into the best-buy lists of the five major UK platforms. Earlier this week, we covered Fidelity and ii; today, it is Hargreaves Lansdown’s turn.

We begin with the domestic market, where the firm believes income seekers should take a look at Schroder Income. This £1.2bn fund is managed by value managers Andrew Evans and Nick Kirrage, who invest primarily in above-average yielding equities with a contrarian approach.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Its top holding are Barclays (3.8%), HSBC (3.7%) and British American Tobacco (3.6%), which, among others, have allowed the fund to grow income and capital over the long term, while paying a historic yield of 4.25%.

The fund maintained a first-quartile ranking against its IA UK Equity Income peers over 10, five and one year, slipping down to the second quartile over three.

Hargreaves’ analysts noted that the “distinct value-style bias means the fund can look quite different to the index at times”. As for how to use this vehicle, they said it could “diversify an income-focused portfolio or offer value exposure to a more general portfolio”.

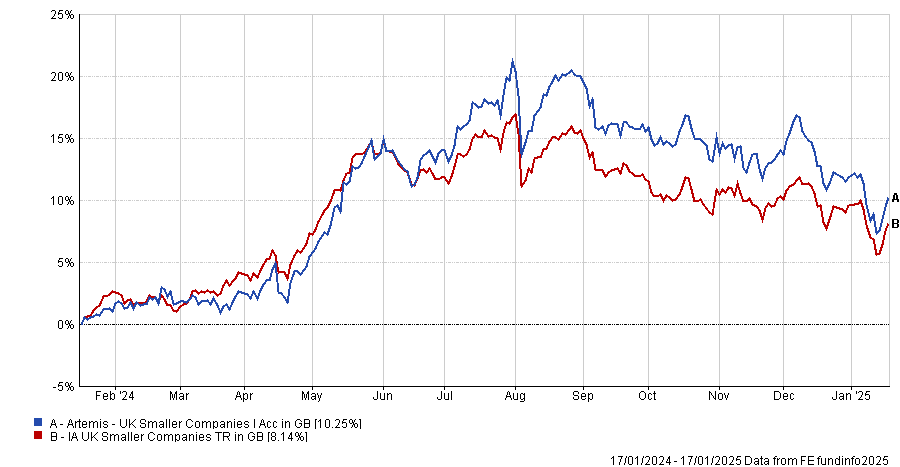

Another UK favourite was the five FE fefundinfo Crown-rated Artemis UK Smaller Companies. This £474m mandate was highlighted for its higher-quality approach and focus on valuation, meaning Hargraves’ analysts expect it to not fall as much as some other funds during down markets.

Performance of fund against sector and index over 1yr

Source: FE Analytics

However, “this does mean it could lag its growth-focused UK smaller companies peer group in a strongly rising market”.

While Hargreaves analysts have a positive view of both managers, Mark Niznik and William Tamworth, Niznik’s vast experience of investing in smaller companies means , at present, their conviction in this fund “is based on his continued involvement”.

Investors in this fund could benefit from additional diversification to the UK portion of their adventurous global portfolio or use it as a complement to a UK-focused portfolio orientated towards larger, more established businesses.

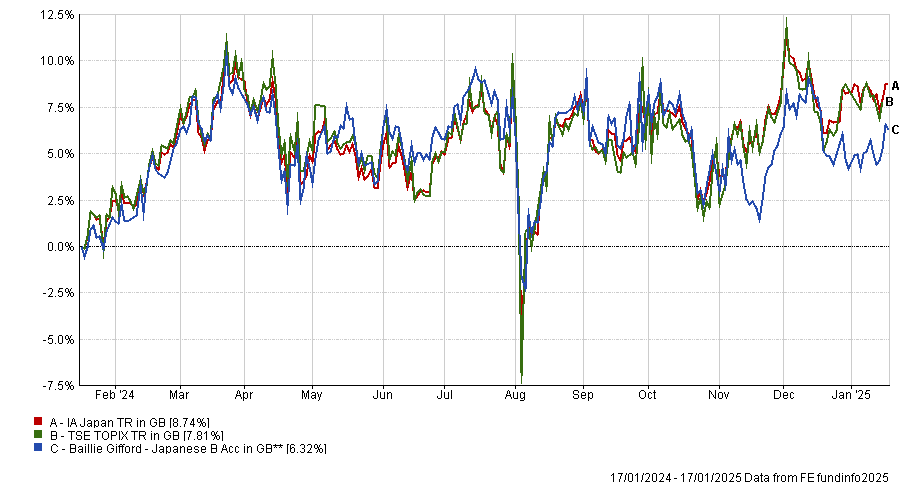

The third and final equity fund to have made the Wealth List in 2024 was Baillie Gifford Japanese, which is also included in Fidelity’s Super 60 list but was instead dropped by AJ Bell.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Given the fund’s growth-focused investment style, it tends to perform better when growthier companies are in favour but not as well when value-focused companies or those undergoing a recovery are performing well.

Still, Hargreaves’ analysis showed the manager, Matthew Brett, has added value through his stock picking, regardless of what sector the stocks are in and without making ‘bigger picture’ economic calls.

Admittedly, this fund didn’t perform as well as the broader market or average fund in the IA Japan sector from 2021-23, which the analysts attributed to the manager’s growth investment style being out of favour and as well as “some stock selection issues”.

“While it’s always disappointing to see a fund go through a bad spell, this reminds us that different investment styles come in and out of favour. As a result, it’s important to maintain a diversified investment portfolio, spread across different geographies and investment styles,” they said.

“Over the longer term we expect the manager to deliver performance from good stock picking, though there are no guarantees.”

The fund was in the third quartile of the IA Japan sector over the past 10 years, but fourth across all other relevant time frames for its returns.

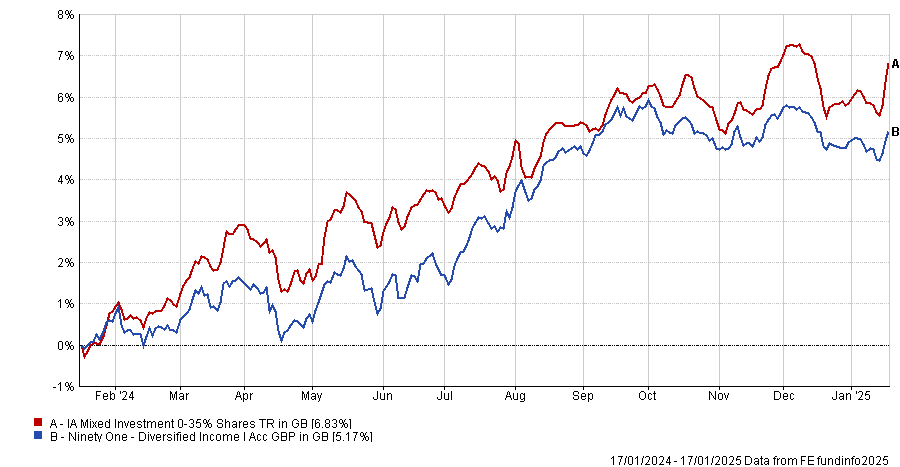

Away from pure-equity plays, two mixed portfolios made the list – Ninety One Diversified Income (which is more defensive, being able to invest a maximum of 25% in equities) and Baillie Gifford Sustainable Income, whose equity allocation can range between 40% to 85%.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The former strategy focuses on providing income through mainly investing in bonds and is “a good option to provide some stability to an investment portfolio focused on growth or a portfolio focused on company shares. Given the focus on providing an income, it could also form part of a portfolio focused on income.”

Hargreaves’ analysts were convinced by John Stopford’s track record and the income offered (historically 4.25%), which should remain “relatively consistent and increase over time”.

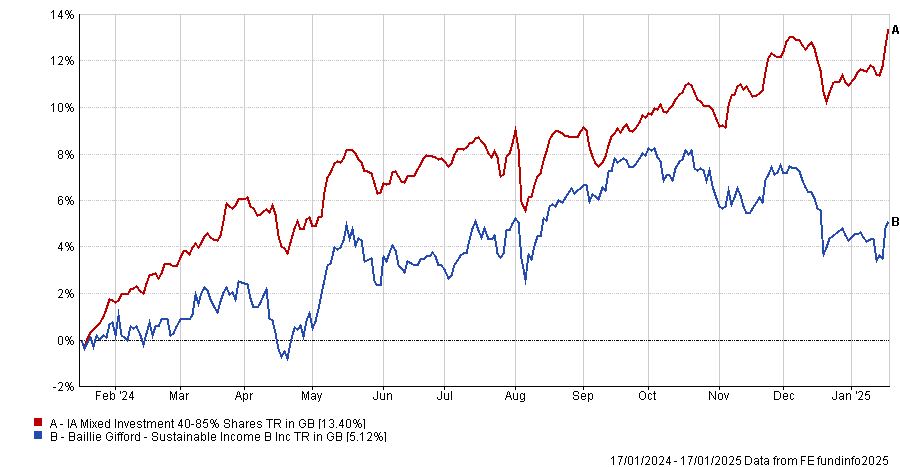

Finally, the Baillie Gifford Sustainable Income focuses on providing a resilient level of income for today and into the future with emphasis on responsible investing.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The income focus means that Baillie Gifford’s growth investment style is less pronounced than in some of their other multi-asset funds, the analysts noted.

“We think this is more appropriate for a fund focused on income and should mean that this fund doesn’t exhibit the same swings in performance that other Baillie Gifford funds have seen in recent years,” they said.

“It could be used to provide diversification to an investment portfolio focused on growth or be a useful addition to a portfolio focused on providing an income. The fund takes its charges from capital, which can increase the yield on offer but reduce the potential for capital growth.”

Source: FE Analytics