Some major investment trusts are increasing their gearing to profit from undervalued UK companies. If they’re right, the gearing should help magnify returns as the UK’s shares catch up with international peers after a painfully prolonged period of underperformance.

Unlike other collective investment vehicles, investment trusts are able to borrow to invest. If implemented correctly, this can turbocharge the performance of their holdings in rising markets.

Much is made by investment trust advocates, including me, about the benefits of gearing. It is a key contributor to investment trusts’ outperformance of open-ended funds over the long term.

Unfortunately, quantifying exactly how much gearing adds can be a bit of a challenge. Fund managers rarely break down returns so that investors can see how much performance is down to their investment decisions and how much is a result of the gearing strategy.

This is a shame, because during recent conversations with trust managers, I discovered just how great the impact of a well-executed gearing strategy can be, contributing a substantial proportion of the growth in net asset value (NAV). All things being equal (which of course they are not), this should boost share price returns for investors.

One way that gearing helps is by enabling fund managers to borrow and invest during market sell-offs, whereas open-ended funds would have to sell existing holdings to raise the cash to invest. That process can act as a drag on performance.

James Mowat is head of investment companies at Liontrust Asset Management, which manages the Edinburgh Investment Trust. This trust is unusual in breaking down some of its gearing data in its annual report.

He explained: “Gearing has really boosted our returns; we benefitted from both borrowing at historically low levels, and at a time when markets had sold off indiscriminately, and so could pick up stocks at bargain levels with very cheap debt.”

Over the four years to the end of its last financial year on 31 March 2024, Edinburgh Investment Trust’s NAV increased by an average of 17.1% per annum, compared to an annualised FTSE All Share index return of 12.4%.

“That is 4.7% a year above the FTSE All Share and of that 4.7% outperformance, 2.3% came from gearing. In other words, 49% of our outperformance relative to the FTSE All Share was thanks to our gearing strategy,” Mowat said.

That gearing has helped Edinburgh Investment Trust rise to second in its sector over five years, with an NAV return of 52% and a share price return of 59%, according to Morningstar data.

Merchants gearing into the UK

Simon Gergel is portfolio manager of Merchants Trust, which currently has net gearing of 11%. The board has recently increased gearing to take advantage of low UK equity valuations and reasonable debt costs.

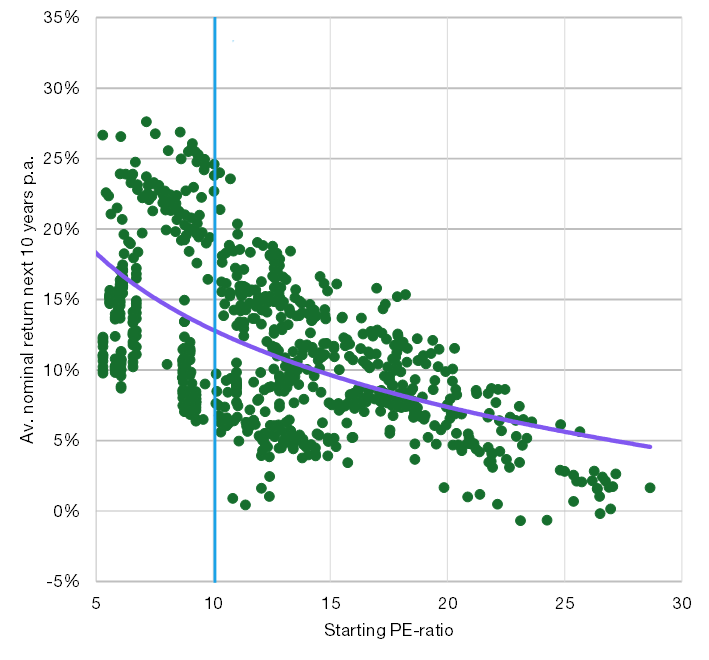

Gergel said his trust has an average price-to-earnings (P/E) ratio of just 11x and analysis shows that when P/E ratios have previously been at this level, UK equities have returned an average of 13% a year for the next decade. The study he’s referring to dates all the way back to the second world war.

The chart, below, shows returns in periods after shares were at various P/E ratios.

Source: Liberium

Of course, history is no guarantee of future performance but it’s a compelling long-term pattern. Let’s hope it continues – and if it does, Merchants’ gearing is set to magnify those returns further.

Aside from Merchants, the managers and boards at two Schroders trusts, Schroder Income Growth and Schroder UK Mid Cap, have recently increased their net gearing levels to 12% and 13%, respectively, to help take advantage of what they see as attractive valuations in their UK holdings.

Their gearing strategies have certainly been a valuable boost to their portfolios at a time when the UK market has been underperforming.

For instance, Schroder Income Growth has grown its NAV by 21.3% over five years to 31 October 2024, of which 1.9% came from gearing (equating to approximately 10% of NAV growth). Over 10 years, its NAV has grown by 74.5%, of which 10% came from gearing once again.

On the Schroder UK Mid Cap fund, NAV is up by 8.1% over five years, of which 1.9% is down to the gearing. It doesn’t sound much, but it means that gearing was responsible for 23% of its total NAV return over the period.

Over 10 years, NAV grew by 83.4%, of which 6.4% is down to gearing. Whatever way you look at it, the strategic use of gearing clearly has the power to help underlying performance, even in a subdued market.

So I look forward to seeing what the same strategy can do if and when the UK market actually takes off. It could give trusts a triple whammy of a share price recovery, narrowing discounts and boosts from gearing. I’m very much hoping more trusts take the time to break down their returns so we can see how valuable their ability to gear really is.

Annabel Brodie-Smith is communications director of the Association of Investment Companies. The views expressed above should not be taken as investment advice.