Ruffer Investment Company has been a stalwart for people looking to protect their capital, with the investment trust proving a popular choice among cautious investors. But more recently the trust has come under pressure.

While it continues to perform well – it holds maximum FE fundinfo Crown Rating of five – it made the headlines two weeks ago when its manager Duncan MacInnes announced his immediate departure from the firm.

This was an “odd” affair, according to Ben Yearsley, director of Fairview Investing, who said it was “all very cloak-and-dagger” and “didn’t inspire confidence”.

However, it is not a reason to sell, said Chris Metcalfe, managing director at iBoss, who typically does remove funds and trusts when there is a manager change, but did not in this instance.

The arguments for selling are that it is “challenging, if not impossible” to tell from the outside who has been making the decisions driving performance.

This issue takes on greater significance in some sectors and the funds with the most flexible remits fall into this category, Metcalfe explained.

“Of course, there will be situations where a manager leaving a team will lead to better performance, but rarely can we not find alternatives where the management team is in place, and switching removes the risk of uncertainty,” he said.

“We conclude that no two situations are the same, and each has to be judged on the evidence available. At the very least, we would want to meet with the remaining team and managers.”

After MacInnes’ departure, Alexander Chartres and Ian Rees have stepped in to flank the trust's current co-manager, Jasmine Yeo, who has been in this role since 2022.

Chartres, who joined Ruffer in 2010, is a lead manager on its Total Return and Absolute Return funds, while Rees has been in charge of Ruffer Diversified Return since 2021, giving a sense of continuity to the portfolio.

MacInnes leaving is not the only concern around the trust: in the past year, investors had an overall positive attitude towards risk, and Ruffer’s signature defensive and contrarian approach has been a drag on performance.

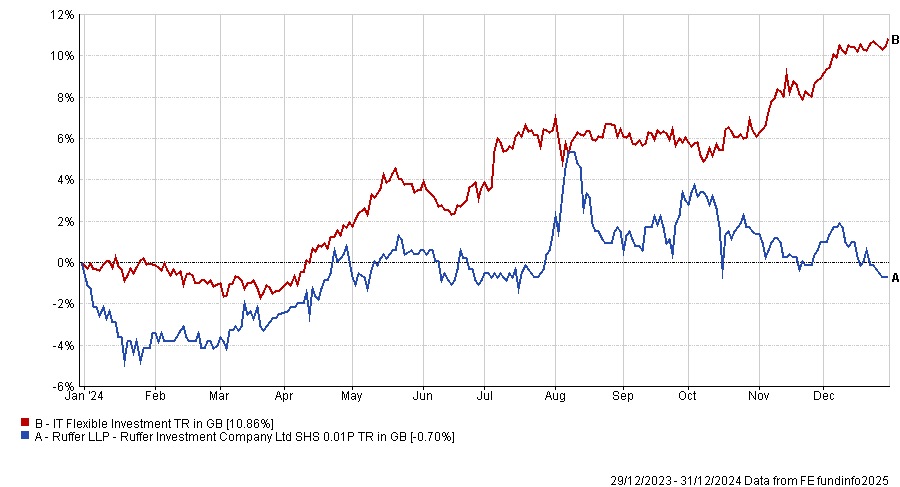

The open-ended WS Ruffer Total Return fund was the second most-sold multi-asset fund of last year and in the same timeframe, while Ruffer Investment Company has lagged its average peer by more than 10 percentage points over 12 months, as the chart below shows, although it recovered somewhat over the year to date and surpassed the IT Flexible Investment sector by 2 percentage points.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Yearsley noticed that Ruffer’s underperformance started with the failure of Silicon Valley bank in 2023, but said two average years for a trust with a stellar long-term track record “isn’t a massive cause for concern.”

The fund’s biggest problem, he said, has been the cost of the protection strategies that haven’t been needed.

“I still think there is a place for lower volatile funds and trusts in portfolios and, for the moment, I will give it the benefit of the doubt,” he said.

“Yet there are different alternatives waiting in the wings – Tellworth and Janus Henderson Absolute Return to name two.”

Chris Salih, head of multi-asset and investment trust research at FundCalibre, was surprised that, with rising geopolitical tensions, lingering uncertainty over potential Trump tariffs and a mixed economic outlook across Europe, capital preservation trusts such as Ruffer have not been more popular.

This could be because, in a world offering 4% risk-free returns on cash, their relevance has waned somewhat, while lacklustre performance over the past three years, modest dividend yields and broader headwinds facing the investment trust sector, have also contributed to investors looking elsewhere.

And yet, the defensive nature of the Ruffer trust makes it worth considering at this point, according to Salih.

“The Ruffer Investment Company offered investors downside protection during bear markets, producing strong returns during the dot.com bubble, the great financial crisis and Covid,” he said.

“We might need a strong period of outperformance relative to equity markets – particularly in the next market downturn – to remind people of its value.”