Stocks have tanked in recent weeks after investors fled from the uncertainty caused by Donald Trump’s new administration, but where has the pain been felt the most?

Most equity markets – especially in the US – started 2025 on a positive footing as investors piled into the ‘Trump trades’ that would benefit from the incoming president’s agenda for American exceptionalism.

However, the picture changed more recently when Trump pushed ahead with his economic policies, especially tariffs on Canada, Mexico and China that spooked markets. Although he quickly exempted many Canadian and Mexican goods from the levies, investors rotated out of equities amid the uncertainty.

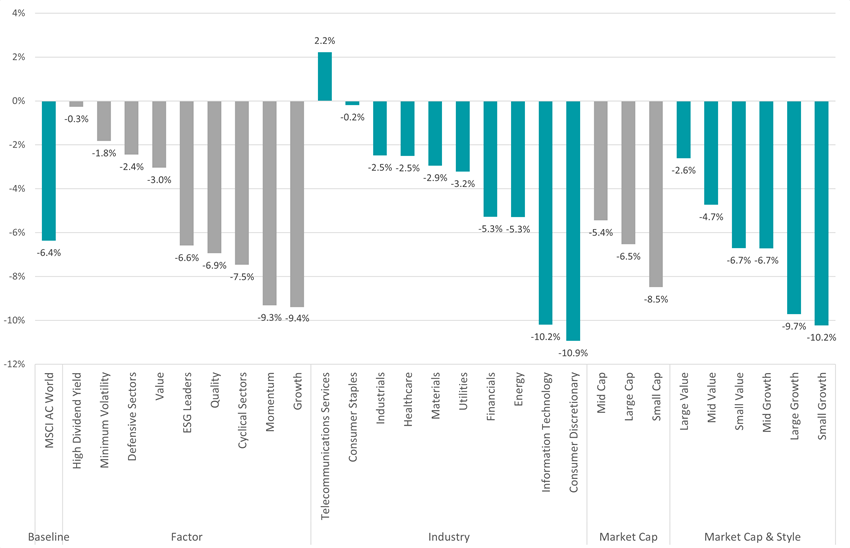

Performance of global equities over 1 month

Source: FinXL

As the chart above shows, the MSCI AC World index is down 6.4% in sterling terms over the past month because of these concerns.

What’s more, almost every sub-index in the MSCI AC World series is in negative territory, with the worst losses coming from the likes of growth, momentum, tech and consumer discretionary stocks.

Axel Rudolph, senior technical analyst at online trading platform IG, said: “The uncertainty created by the US administration with regards to tariffs is starting to hurt investor confidence with US stock indices hitting five-month lows.

“US president Trump's bewildering tariff policy is creating heightened uncertainty and investor concern with hedge funds having liquidated global equity positions at the fastest rate on record.”

Given that the US accounts for more than 65% of the MSCI AC World, its recent troubles have weighed heavy on the index while other areas have been stronger.

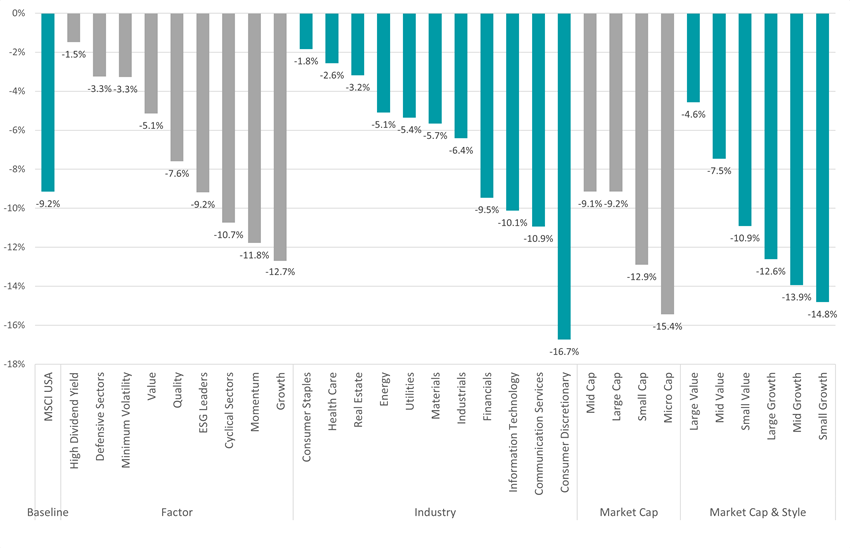

Performance of US equities over 1 month

Source: FinXL

Having spent recent years surging after of its peers on the back of the ‘US exceptionalism’ narrative and receiving an initial post-election bump, the US stock market has struggled more than others this year.

The MSCI USA index is down 9.2%, with every sub-index in the series also in the red. US consumer discretionary stocks have been the worst place to be invested, down 16.7% over the past month.

The Trump administration is approaching its first 50 days in office and, for a president who has previously gauged his success on the performance of the stock market, the results might be disappointing: the S&P 500 is down 9.1% (in sterling) while the MSCI AC World has lost 5.8%.

Furthermore, recession fears have returned to the US. The Federal Reserve Bank of Atlanta’s GDPNow model forecasts US economic output will contract by 2.4% annualised in 2025’s first quarter.

On Friday, Goldman Sachs lifted the probability of a US recession in the coming 12 months to 20%, up from 15%, citing Trump’s economic policies as the “key risk”.

In an interview with Fox News at the weekend, Trump refused to say whether the US is facing a recession, saying: “"I hate to predict things like that. There is a period of transition because what we’re doing is very big.”

But while US markets are trading at five-month lows, Europe stocks have rallied on the hope of Germany launching a €500bn infrastructure fund and the promise of boosted defence spending.

Pictet Asset Management has downgraded US stocks to neutral while upgrading Europe to overweight. The firm has a neutral stance on equities, bonds and cash, but is overweight select areas including Europe, emerging markets excluding China, financials, utilities, European high yield and gold.

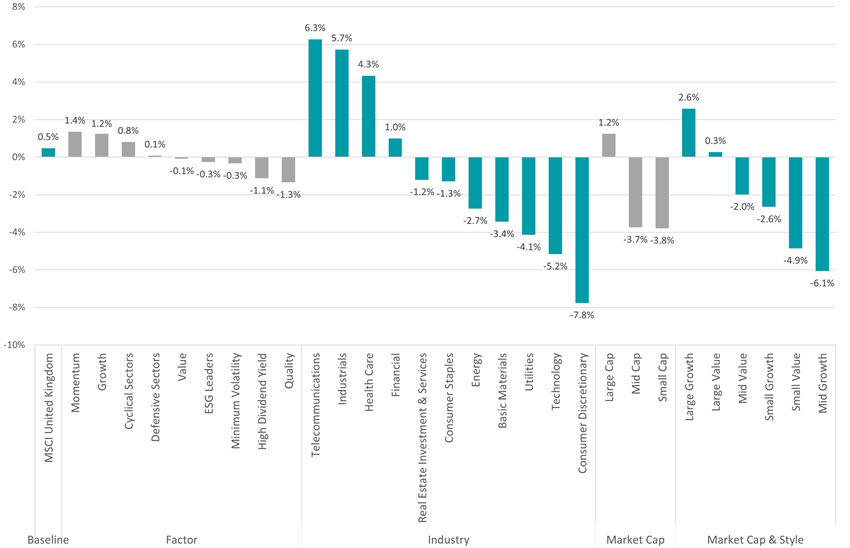

In contrast to the US, the MSCI Europe index is in positive territory – up 2.4% in sterling over the past month. What’s more, most of the sub-indices in the MSCI Europe series are positive as well with with European financials gaining 7.2%.

Performance of European equities over 1 month

Source: FinXL

Luca Paolini, chief strategist at Pictet Asset Management, noted that 12-month forward earnings expectations for eurozone companies are rising faster than the US for the first time in two years.

He attributed this to anticipation of an economic cycle recovery, potential relief from a Ukraine ceasefire and the possibility of increased government spending, combined with favourable monetary policy.

“US stocks, by contrast, face a steep uphill struggle. The US market is trading on abn average price-to-earnings ratio of 22x relative to the long-run average of our fair-value estimate of 19x,” he added.

“When comparing the valuations of US and European stocks, the latter still trade at an attractive 30% discount, even after adjusting for sector composition differences.”

However, the signs of vulnerability in the US are not enough to turn Pictet bearish on equities and bullish on bonds, because previously weak areas – such as Europe and the manufacturing sector – are showing signs of recovery.

“It makes for a healthy market rotation, a broadening of investor demand that should keep the markets supported,” Paolini finished.