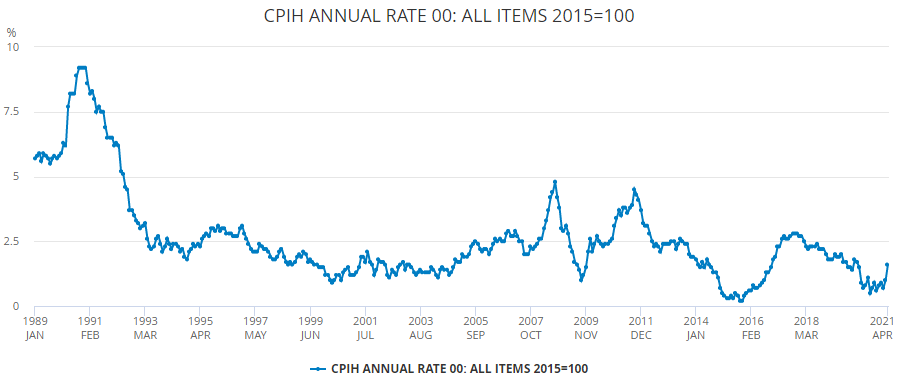

The annual rate of inflation in the UK more than doubled in April compared to the previous month, the latest Office for National Statistics (ONS) data shows.

Consumer price index (CPI) inflation rose from 1.5 per cent in April, up from 0.7 per cent in March.

Source: ONS

This is the highest rate of inflation since March last year, essentially since the start of the Covid-19 pandemic.

The spike in inflation is largely attributed to rising energy, clothing, petrol & oil prices and surging demand as the economy reopens from the latest coronavirus lockdown.

Melanie Baker, senior economist at Royal London Asset Management, said that while inflation has risen, this doesn’t yet reflect rising underlying domestic inflationary pressure. But further increases look likely.

“The UK economy is still operating below pre-crisis levels and inflation expectations look reasonably well anchored,” she said.

“However, as the economy reopens, it seems likely that we will see some further price increases and inflation is likely to end the year higher. Global supply chain pressures may also become more strongly reflected in the price of core goods.”

The inflation increase falls in line with recent comments from the Bank of England, which forecasts inflation moving above its 2 per cent target by the end of the year.

This also reflects the concerns investors have had for several months, allocating towards a higher inflationary environment. This was recently seen in an equity sell-off centred on technology stocks, as these assets are particularly sensitive to rising interest rates and inflation.

The current level of inflation is not yet cause for concern, according to, AJ Bell financial analyst Laith Khalaf, but they could become worrisome later on.

He said: “At current levels, inflation is nothing to fret about, but there is rising concern that the fiscal and monetary response to the pandemic has sown the seeds of an inflationary scare further down the road. For the moment, the Bank of England is dismissing consumer price increases as a natural bounce back from the depths of the pandemic last spring.

“But the economic recovery could be a Trojan horse, smuggling inflation into the UK, right under the nose of central bankers.”

Laith added that the UK is still some way behind the US, where CPI stands at 4.2 per cent, and the Bank of England has stated it will tolerate some higher levels of inflation before raising interest rates.

But Beaufort Investment chief executive Derrick Dunne said investors will need to consider what they would do if interest rates were to be hiked sooner than expected.

“For now, we can expect inflation to continue rising, with the potential to exceed its 2 per cent target in the near-term, which could force the Bank of England to increase its base rate as a cautionary measure in the coming months,” he said.

“Investors should therefore ensure that their plans are equipped to perform in an inflationary environment, without placing too much confidence in any one outcome.”

Indeed, markets have already begun acting out inflation concerns, as AJ Bell’s Laith pointed out that 10-year gilts are now yielding 0.9 per cent, up from 0.2 per cent at the beginning of the year.

He said: “If inflation looks like it’s going to get a significant foothold, markets will take matters into their own hands and raise borrowing costs across the economy.

“If realised, a sustained inflationary period would be a paradigm shift from the last 25 years of extremely benign price rises, which have provided comforting mood music for stocks and bonds.

“Investors don’t need to hit the panic button just yet, but they do need to factor the potential for higher rates of inflation into their plans. Where inflation is concerned, it’s better safe than sorry.”