Investors have turned to reliable, experienced fund managers to help them through a tough 2021, according to data from the UK’s three largest DIY investor fund platforms.

There has been £28.9bn invested in Investment Association (IA) funds so far this year, but with changing markets – a value resurgence to start the year based on a recovery from a global pandemic followed latterly by fears of interest rate rises – it has been tough to know where to turn.

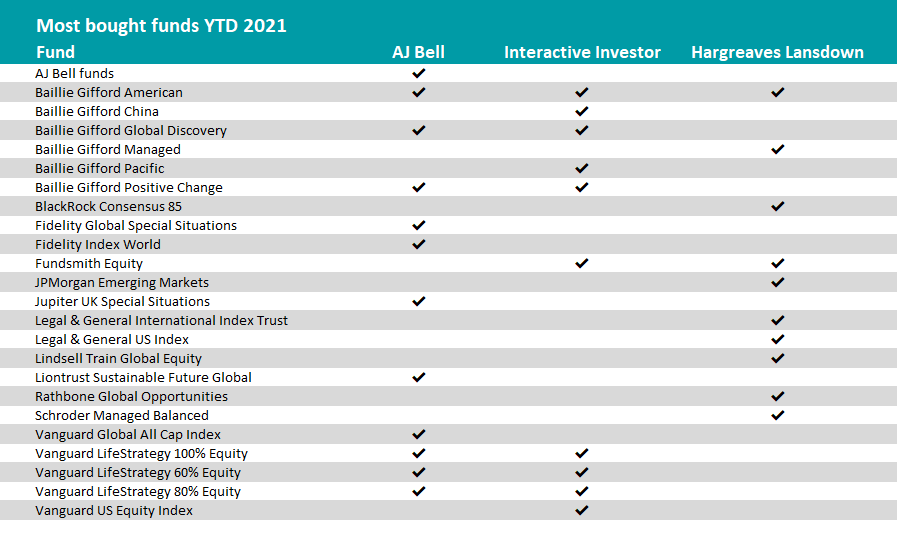

As such, Trustnet asked fund platforms AJ Bell, interactive investor (ii) and Hargreaves Lansdown which funds had been bought the most during that time.

Below the table shows that there were a few recurring names across the top 10s, including Baillie Gifford American, Fundsmith Equity, Vanguard LifeStrategy range, Baillie Gifford Positive Change and Baillie Gifford Global Discovery.

All of the highlighted funds run a growth style investment process, which caused their performance to lag during 2021’s value rally but over the long-term has delivered investors exponential outperformance.

Baillie Gifford in particular has become highly affiliated which this style of investing and evidenced by having numerous funds in these top 10 lists they have been highly sought after by investors.

Baillie Gifford American, Positive Change and Discovery

The core element to fund house’s approach is identifying a concentrated group of stocks which will deliver major growth outperformance, the ‘outliers’ of the market.

As such, funds under the Baillie Gifford banner tend to have a general bias towards technology, a dominant theme in this style of investing over the past decade.

Baillie Gifford American is no different, with the US market regarded as a hotspot for tech names. Almost 43% of the fund is invested in the telecom, media and technology sector.

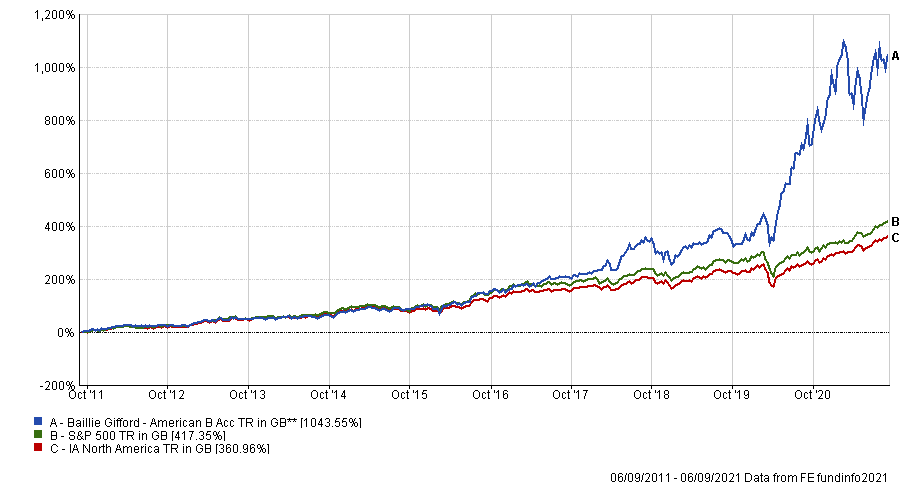

Ryan Hughes, head of active portfolios at AJ Bell, said the fund “has managed to capture the technology revolution” and showed that “despite many saying it’s impossible to outperform the S&P 500, it can be done.”

The £7.7bn fund is run by a four strong team, FE fundinfo Alpha Manager Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski.

Over the past 10 years Baillie Gifford American has made the best returns in the IA North America sector, returning more than 1,000%. In 2020 it maintained this top spot, generating 122%.

Emma Wall, head of investment analysis at Hargreaves Lansdown, said that the fund has benefitted enormously from the growth trade in markets in recent years “which has seen growth stocks outperform value by the greatest differential since records began.”

But she cautioned investors pilling into the fund now that they are “chasing past returns with this fund, and need to be mindful that it is no guarantee of future performance.”

The other Baillie Gifford funds on the list have also benefited from the growth trade that has dominated the past decade, although the Baillie Gifford Positive Change fund also keys in on sustainability.

Managers Kate Fox and Lee Qian pick companies that deliver a positive change in at least one of four themes: social inclusion and education, environment and resource needs, healthcare and quality of life, and ‘base of the pyramid’ – addressing the needs of the world's poorest populations.

Part of the fund’s popularity has been this combination of growth and sustainability, two factors investors have sought out recently.

Dzmitry Lipski, head of funds research at interactive investor, recommended the fund as an “adventurous option” for investors.

Since launch in 2017 the fund has made 332%, the second highest returns in the IA Global sector for that timeframe, and has been in the top quartile of its sector in each calendar year.

Baillie Gifford Global Discovery meanwhile has a tilt towards smaller companies, differentiating it from the other Baillie Gifford portfolios above.

Lipski said that this tilt had “rewarded investors well”, over the long-term, where the fund has achieved significant outperformance.

Run by FE fundinfo Alpha Douglas Brodie and deputy managers Luke Ward and Svetlana Viteva, over 10 years it made the second highest returns in the IA Global sector.

The fund’s small-cap bias does make it more volatile though meaning it needs to be used “sensibly” in investors portfolios, he added.

Fundsmith Equity

Away from Baillie Gifford, Fundsmith Equity has been another popular fund for investor this year. The flagship fund of FE fundinfo Alpha Manager Terry Smith, Fundsmith Equity is the largest fund in the IA universe at a titanic £27.8bn.

It invests in high quality, well-established companies i.e. ‘big brands’ and the manager’s approach is to pick a small selection of resilient, global growth companies which are good value, and stick with them. Indeed some holdings have been unchanged since the fund’s inception in 2010.

It has made top-quartile returns over 10 years and was the fourth best performing fund during that time.

The fund has large regional and sector weightings, with around two-thirds in the US markets and “punchy weights” to the consumer goods, computer services and medical equipment sectors, Wall said.

These concentrations do increase the investment risk, Wall said, “meaning that investors should look to hold differentiated funds alongside Fundsmith Equity which add diversification.”

Vanguard LifeStrategy

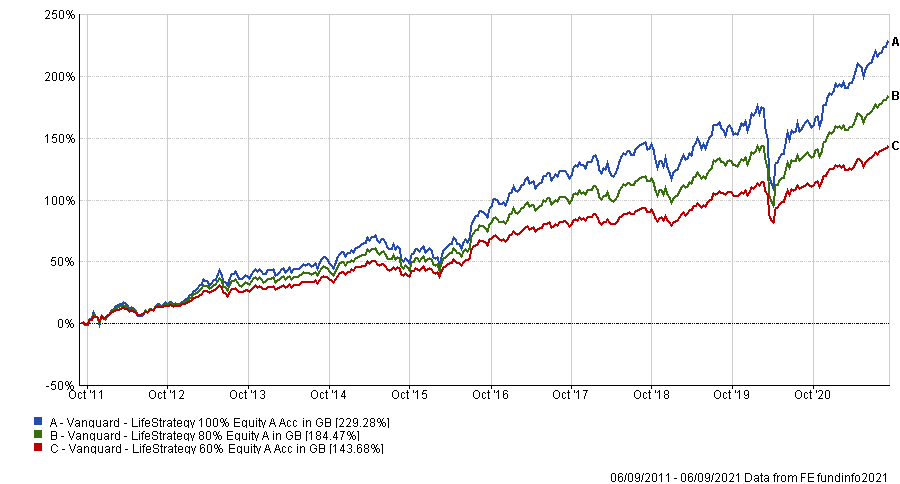

Last up is the Vanguard LifeStrategy range, which comprises five multi-asset funds built from a mix of equities and bonds Vanguard trackers.

Lipksi called the range a “one-stop shop” for globally diversified exposure, with the Vanguard LifeStrategy 60% Equity, Vanguard LifeStrategy 80% Equity and Vanguard LifeStrategy 100% Equity specifically highlighted on ii’s top 10.

Over the past few years investors have sought a balance of investing for the long-term and saving money, which low cost, passive strategies like Vanguard LifeStrategy have reaped the benefits of, Hughes said.

He said the range has “captured the imagination of investors” offering a cheaper option to simple market exposure while still delivering “good returns”.

Over 10 years the funds have outperformed, the higher the equity allocation and risk generating the higher returns. All the funds were top quartile in their respective sectors, IA Global and IA Mixed Investment 40-85% Shares.

All the funds in the list have an FE fundinfo Crown rating of five apart from the Vanguard LifeStrategy which range from three to five crowns.