When investing in the US, conventional wisdom has been that the sheer dominance of large-cap technology stocks such as Meta, Netflix, Amazon, Apple and Alphabet suggests tracking the market has been the most efficient way to invest. But does the data prove this correct?

In its latest series, Trustnet looks at market capitalisation, investment style and active vs passive funds to figure out what has been the best way to play each major market over the past decade.

Previously we looked at the domestic UK market, where smaller companies funds were the clear winners, while in the global sector, large-cap passive funds came out on top as the dominance of the large US stocks made it very difficult for active managers.

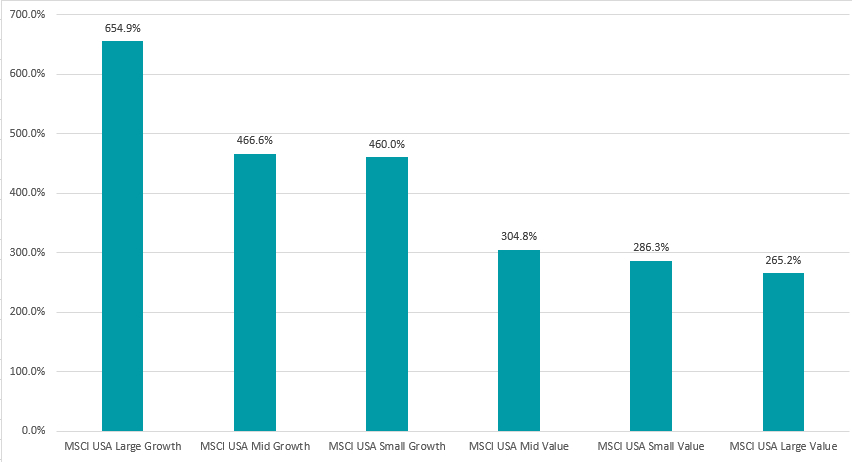

In theory the same rule should apply. Indeed, over the past decade the US’ large-cap growth stocks – which are dominated by the technology names – has been the best way to invest, as the below chart shows.

Performance of indices over 10yrs

Source: FinXL

Next is mid-cap growth and small-cap growth, where there is little to choose between the two, while value stocks have lagged significantly.

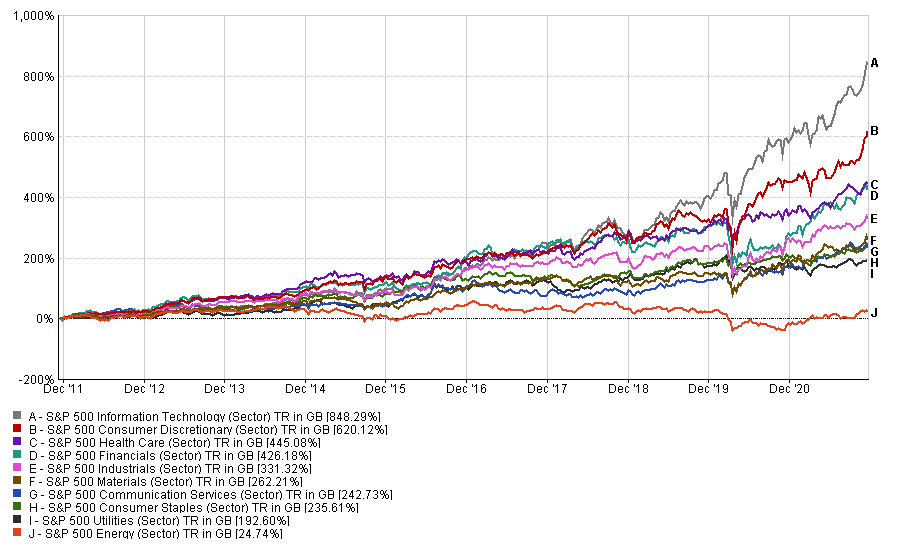

This is borne out at a sector level as well. Looking at the top-performing sectors of the S&P 500 index, technology has romped home in first place, returning 848.3%, more than 220 percentage points ahead of the second-placed consumer discretionary stocks. Value areas such as energy and utilities are at the bottom, with relatively meagre returns.

Performance of indices over 10yrs

Source: FE Analytics

Having concluded that growth has been the way to invest in the US over the past decade, comparing market capitalisation also proves decisive.

Over the past 10 years the S&P 500 index has made investors 421.7%, almost 100 percentage points more than the Russell 2000 index (323.5%).

When comparing the return of the S&P 500 to the average of the funds in the IA North America (363%) and IA North American Smaller Companies (364.7%) sectors, it is indeed the market that has won.

For investors that believe this is the best way to invest, the $14.9bn (£11bn) Invesco S&P 500 UCITS ETF is the cheapest option, costing just 0.05%. Fidelity Index US and HSBC American Index also track the S&P 500 index and cost just 1 basis point more.

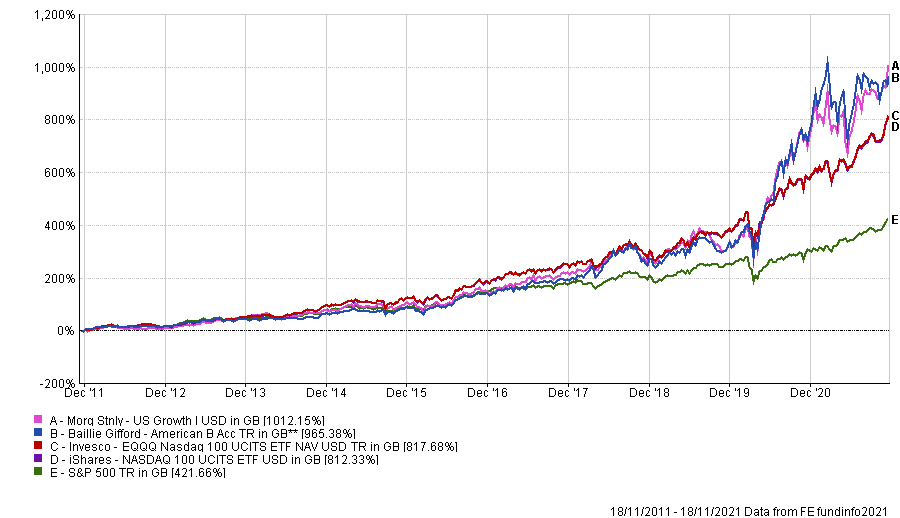

However, there are other options that have proven even more successful. Investors that bought into the technology focused Nasdaq 100 index would have made even better returns.

Indeed, the Invesco EQQQ Nasdaq 100 UCITS ETF and iShares NASDAQ 100 UCITS ETF have made 811.8% and 803.5% over the past 10 years, almost double that of the wider S&P 500 index.

The growth-heavy index is dominated by the decade’s biggest winners, with more than half of it weighted to the top 10 largest companies, which include Apple, Microsoft, Amazon, Tesla and Alphabet.

For fans of active management, there were just two funds that beat these passive options – Morgan Stanley US Growth and Baillie Gifford American.

Performance of funds vs S&P 500 over 10yrs

Source: FE Analytics

The $8bn Morgan Stanley US Growth fund is managed by FE fundinfo Alpha Manager Dennis Lynch and his team, investing in “established and emerging large-cap companies”.

The fund managers look for businesses with sustainable competitive advantages, healthy balance sheets and the ability to invest capital for high rates of return.

It is technology heavy, with 54.6% allocated to the sector, while 19% is in communication services and 12.6% in healthcare.

None of the FAANG stocks appear in the portfolio’s top holdings, however, with cyber security firm Cloudflare and cloud computer specialist Snowflake its two biggest positions.

The £7.5bn Baillie Gifford American fund, run by Alpha Manager Tom Slater, Gary Robinson, Kirsty Gibson and Dave Bujnowski, has made its returns without the same heavy reliance on tech.

Currently the fund is a third invested in the sector, with 25.4% in consumer discretionary firms and 20% in healthcare stocks.

Shopify and Tesla are the largest positions in the portfolio, although Amazon was a large holding for many years before the managers sold it down. It remains a 3.9% holding, the seventh-largest in the fund.

| Fund | Sector | Fund size | Manager name(s) | OCF |

| Baillie Gifford American | IA North America | £7,523.3m | Gary Robinson, Tom Slater, Kirsty Gibson, Dave Bujnowski | 0.51% |

| Invesco EQQQ Nasdaq 100 UCITS ETF | IA North America | £5,161.1m | Brian McGreal, Josh Betts, Peter Hubbard, Travis Trampe | 0.30% |

| iShares NASDAQ 100 UCITS ETF | IA North America | £6,825.5m | Quantitative Strategies Group | 0.33% |

| Morgan Stanley US Growth | IA North America | £5,971.6m | Dennis Lynch, David Cohen, Sam Chainani, Alexander Norton, Armistead Nash, Jason Yeung | 0.89% |