Some 15 European equity funds are charging investors more than double the stated ongoing charges figure (OCF) because of their added transaction costs, research by Trustnet has found.

In this study Trustnet looked at the additional transaction costs (referred to as ex-ante costs) of the IA Europe Including UK, IA UK Excluding UK and IA European Smaller Companies sectors so far this year, having previously looked at the IA Global, UK and Asia sectors already.

The Markets in Financial Instruments Directive (MiFID II) regulations requires investment houses to disclose additional transaction costs, which are charged on top of published OCFs – the umbrella term for investing in a fund.

It covers the fees investors pay for the management of a fund, but it does not including any charges related to buying and selling stocks. Ex-ante costs are an additional but unavoidable cost when investing in funds, which will inevitably have to trade at some point.

However, higher trading volumes could be making the cost of holding a fund much higher than the advertised ongoing charge.

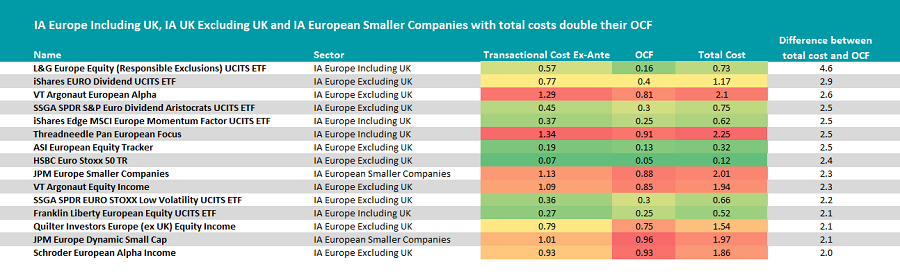

The results for the European sectors are below, which shows the transaction costs, original OCF and the total cost, as well as how many times more an investor is paying overall versus the stated fees.

It is also conditionally formatted against the sector. The colours represent how expensive a fund’s cost is relative to the entire sector. Those in green are the cheapest among their peers, while red indicates the most expensive. Orange and yellow represent the middle portion, with the former above average, while the latter is below average.

The OCF figures were based off the main driver share class in FE Analytics and charges may vary depending on the share class available.

Source: FE Analytics

L&G Europe Equity (Responsible Exclusions) UCITS ETF had the biggest difference between the stated OCF and total charges across the three sectors. Its published OCF was 0.16% but its ex-ante costs were 0.57%, making the total cost 0.73%.

Although still cheap compared to its peers, as indicated by its green colouring, the total cost for investors was more than four times higher than the stated OCF.

Passive options have frequently appeared throughout this study. Although they are typically seen as a cheaper way to invest in the broader market than active funds they are unable to avoid trading when markets move. This does not mean that trackers are expensive but the unaccounted fees could mean they are costing investors more than they realise.

In some cases ex-ante fees push passives into active fee territory. iShares EURO Dividend UCITS ETF for example had a total cost of 1.17%, equivalent or higher to some active funds. Its stated OCF was 0.4% but the overall cost was almost triple due to ex-ante costs of 0.77%.

Other passive funds in the study were: iShares Edge MSCI Europe Momentum Factor UCITS ETF, ASI European Equity Tracker, HSBC Euro Stoxx 50 and Franklin LibertyQ European Equity UCITS ETF.

Focusing on the active names, there were three funds in the IA Europe Excluding UK sector: VT Argonaut European Alpha, VT Argonaut Equity Income and Schroder European Alpha Income.

The two Argonaut funds are run by Barry Norris and have consistently underperformed the MSCI Europe ex UK benchmark and sector, although he only took over management of the VT Argonaut Equity Income last year. Since Norris took charge it has made 11.2%, underperforming the sector (21.6%) and the benchmark (19%).

Norris has run VT Argonaut European Alpha since launch in 2005 and over 10 years was the sector’s second-worst performer, making 108.7% versus the sector’s 183% and the benchmark’s 169.1%.

VT Argonaut European Alpha had the second highest total cost in the study at 2.1%, which was almost three time higher than its stated OCF (0.81%).

Norris runs shorts across his funds, which tend to result in more frequent trading and can therefore lead to higher fees.

The only active fund from the study in the IA Europe Including UK sector was the Threadneedle Pan European Focus fund, which had the highest total cost overall at 2.35%, 2.5 times higher than the stated OCF of 0.9%.

It has been one of the best performers in that universe, generating 235.4% returns over 10 years, ninth-best overall.

It is run by FE fundinfo Alpha Manager Frederic Jeanmaire and holds a Five FE fundinfo Crown rating. It aims to deliver capital growth through a concentrated portfolio – for example, its top 10-holdings account for almost 50% of assets.

There were two IA European Smaller Companies funds on the list: JPM Europe Smaller Companies and JPM Europe Dynamic Small Cap.

Both had total costs that were more than double their OCF’s, 2.01% and 1.95% respectively. They also made second-quartile returns over 10 years of 345.9% and 321%, beating the sector average’s 255.3%.