Apple has become the first company in the world to reach a $3trn (£2.2trn) valuation on the first day of trading in 2022.

The computer and mobile gadget giant has had a very strong start to the year, up 3% at the open, pushing its share price to $182.9, briefly taking its market capitalisation above $3trn, although the share price has dipped since.

Apple share price in the past five days

Source: Google Finance

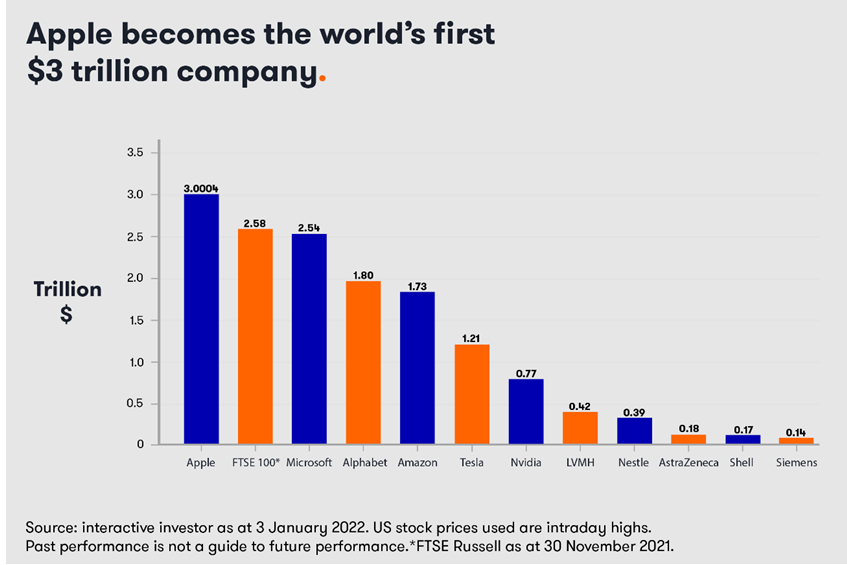

Shares have tripled in value over the past four years, passing the $2trn mark in 2020. It means the tech giant is currently worth more than the entirety of the companies in the FTSE 100, evidencing just how extraordinary this valuation is.

Lee Wild, head of equity strategy at interactive investor, said even with a backdrop of surging Covid cases in the US and rising inflation “traders continue to back the US economy and corporate profits to keep underpinning stock prices”.

Source: interactive investor (ii)

Apple’s exceptional growth has been in spite of a disappointing fourth quarter last year, when its revenue fell short of analysts’ expectations by around $1.45bn. Apple’s chief executive Tim Cook said this was due to supply chain issues and chip shortages, headwinds the entire tech sector has faced due to Covid.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, noted that, while Apple was not immune to the ongoing supple chains issues, the popularity of its iPhone handsets meant these had only been a “small bump in the road for the tech giant rather than a series of potholes”.

Its mega-cap US-technology peers, Meta, Amazon, Netflix, Alphabet and Microsoft have been some of the highest returning companies of the past decade, and have consequently taken up a bigger and bigger piece of the global market. The FAANG acronym makes up 14% of the MSCI World Index alone and 20% of the S&P 500.

All of these companies have continued to break valuation records at a faster and faster rate, a factor many investors have become concerned about.

Discussing the outlook for 2022 Gill Hutchison of The Adviser Centre and Emma Wall of Hargreaves Lansdown told Trustnet that the US market was one area worth steering clear of in 2022, due to being “egregiously priced”.

RWC’s Nick Clay was also sceptical about how these companies would be able to maintain their high growth rates, arguing that they were being priced “to perfection” by investors and no matter how good a company was it was too great an expectation to meet.

“Even the best companies in the world, when trading on an excessively high valuation, become the riskiest in the world,” he said.

However, the optimists think that these highly valued technology companies can climb higher, including Apple.

Wild said: “Can Apple become the first $4trn company? Of course it can. Wall Street analysts certainly think the stock can go even higher.

“JP Morgan hiked its price target before Christmas. Analysts at the bank think the stock could be worth $210 compared with $180 previously. Do that and the company would be worth over $3.4 trillion,” he said.

The rise of Apple has not just benefited individual investors, but fund managers also. Below is the list of funds with a minimum 8% weighting to the stock.

Several passive funds on the list track the S&P 500 index which has a very high weighting to the FAANG stocks. Among the active options many focus specifically on US large caps.

The Brown Advisory US Flexible Equity fund had the highest allocation to Apple among the active funds listed at 9.9%. Several of the others had around an 8.8-9% weighting, including the £1.3bn Janus Henderson Global Technology Leaders and GS US Focused Growth Equity Portfolio.