Metro Bank became one of the UK’s most shorted stocks over the course of the past month as the number of short positions in the company reached 4.3%.

Trouble began for the high street bank in 2019 when an accounting error led to the risk ratings of several commercial loans being mis-reported.

Chief executive Craig Donaldson and a number of other executives resigned due to the controversy, but just as the company planned to rebuild public trust, Covid struck and piled on more challenges.

The share price is down 25.6% in the past year, but high interest rates could offer the bank an opportunity to recover lost ground.

Another new entry to the list was Ashmore Group, an investment company that specialises in emerging markets.

Shorts in the group that runs $91.3bn (£69.8bn) in assets under management (AUM) increased to 4.1% in the past month as some of their top retail funds, which had large allocations in Russia, were impacted by the war in Ukraine.

Some confidence in the company may have dwindled when Ashmore increased its holdings in Evergrande last year – many investment groups began selling out of the Chinese property developer because its debt was becoming too big, but Ashmore saw the nosediving share price as a buying opportunity.

The share price is down 27.6% since they bought more stocks in the business at the end of November and it has fallen 89.2% overall in the past year.

As for Ashmore itself, the share price has fallen 40.2% over the past 12 months.

Share price of company over the past year

Source: Google Finance

Ashmore and Metro Bank pushed Domino’s Pizza off the top 10 list last month with the number of shorted stocks in the takeaway company down 1.2 percentage points after one short position ended.

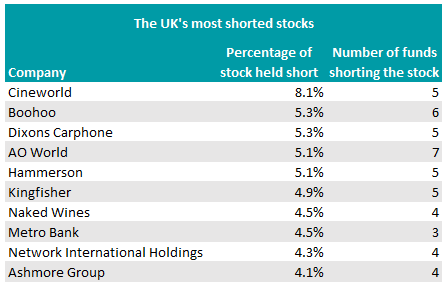

Cineworld remains the UK’s most shorted company, but the amount of shorted shares dropped 0.6 percentage points over the past month reaching 8.1%.

Revenue was essentially halted for the cinema chain during lockdowns and it has struggled to regain its pre-covid inflows.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said that the return of big cinema releases like Spiderman: No Way Home helped narrow losses in 2021 to £708m, a big step down from £3bn outflows seen the year before.

However, the Office for Budget Responsibility (OBR) reported last week that real household disposable income is likely to drop to its lowest level since it began recording data, suggesting that UK consumers may be less inclined spend on luxuries.

This may also impact sales for online retailer, Boohoo, with short sellers upping their positions to an overall tune of 1.1 percentage points over the past month, overtaking four other companies to become the second most shorted UK business.

Share price of companies over the past month

Source: Google Finance

While the share price increased modestly by 0.4% over the past month, past governance issues continue to haunt the company.

Although Boohoo has 2.8 percentage points fewer shorted stocks than Cineworld, it has one more funds betting against it.