Funds that can make strong capital gains while paying out high dividends are the holy grail for many investors, particularly those in retirement.

As investors get nearer to stopping work, the focus moves from growing their cash pot to making sure that their investments can supplement other forms of income to make up for the shortfall in salary.

Income funds have proven particularly popular for this, as the high dividend yields make it easier to compare the money generated each month versus a monthly wage.

However, the companies that these funds tend to buy are often mega-caps that no longer have the potential to grow as quickly as their smaller counterparts.

Additionally, the higher the dividend yield, the more risk the market believes investors are taking in owning the stock.

Therefore, these investments can be slow-growing and higher risk – not something that comes to mind when thinking of cautious, capital-preservation-minded retirees.

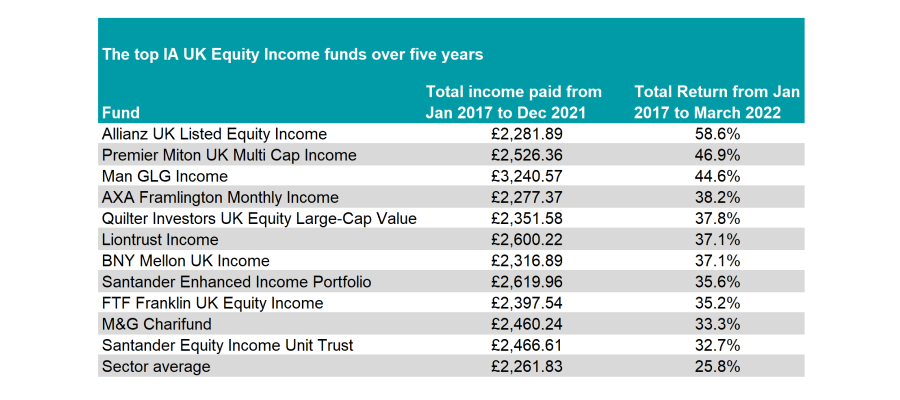

Yet with little by way of alternative – some alternatives can be even riskier, while other global stock markets tend not to pay as much out in dividends as the UK – below Trustnet looked at the IA UK Equity Income funds that have made top-quartile total returns while also paying out above-average income over the past five years.

Source: FE Analytics

*All income figures are based on an initial £10,000 investment on 1 January 2017.

Top of the pile was the Allianz UK Listed Equity Income fund managed by Simon Gergel since 2006, with Richard Knight joining him as co-manager in 2020.

Over the past 10 years, the fund has paid out £2,281.89 on an initial investment of £10,000, just £20 higher than sector average. However, it has been the best for total returns over that time – combining capital gains with the income paid.

Indeed, investors would have made 58.6% over the past five years, more than double the IA UK Equity Income sector average.

The portfolio is heavily weighted to financials (23.7%), but with large-cap dividend giants such as cigarette makers British American Tobacco and Imperial Brands as well as oil giants Shell and BP among its largest holdings.

Second was the Premier Miton UK Multi Cap Income fund managed by Gervais Williams and Martin Turner who take a different approach, investing predominantly in the small- and mid-cap end of the market.

Indeed, the fund has just 24% in FTSE 100 stocks, with firms quoted on AIM the largest allocation at 32.3% of total assets.

This difference in style has equalled strong results for investors, however, returning 46.9% on a total return basis and paying out £2,526.36 in dividends over the past five years.

The third-best performer has been the Man GLG Income fund run by Henry Dixon. The portfolio has made 44.6% over five years while paying out £3,240.57 – the highest dividend on the list.

Dixon uses a value-based approach, focusing on unloved areas of the market. His current largest positions are to financials – namely insurers – as well as energy stocks, while he has little in the higher growth areas of healthcare or technology.

The fund has had a mixed five years, topping the charts in 2017 and 2018 while struggling last year. Overall it remains a top-quartile performer over the past half-decade.

Another fund with a differing strategy is Liontrust Income, which buys predominantly large-cap income stocks and supplements these with a number of well-known US tech names.

Although it has fallen out now, Microsoft has long been a top-10 holding for the fund, which is 18.5% weighted to the US and 18.1% in the technology sector.

This combination has worked well, with the fund making 37.1% over five years while paying out £2,600.22 in income over that time.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

| Allianz UK Listed Equity Income | IA UK Equity Income | £304m | Simon Gergel, Richard Knight | 3.5% | 0.77% | 23/04/2014 |

| AXA Framlington Monthly Income | IA UK Equity Income | £260m | George Luckraft, Simon Young | 4.3% | 0.83% | 16/04/2012 |

| BNY Mellon UK Income | IA UK Equity Income | £1,116m | Jon Bell, Ilga Haubelt, Tim Lucas | 3.7% | 0.79% | 04/09/2012 |

| FTF Franklin UK Equity Income | IA UK Equity Income | £866m | Ben Russon, Colin Morton, Will Bradwell | 4.1% | 0.52% | 31/05/2012 |

| Liontrust Income | IA UK Equity Income | £388m | Robin Geffen, Clare P-Bouverie, James O’Connor | 3.9% | 0.85% | 03/10/2012 |

| M&G Charifund | IA UK Equity Income | £948m | Michael Stiasny, Elina Symon | 4.8% | 0.47% | 01/03/1960 |

| Man GLG Income | IA UK Equity Income | £1,689m | Henry Dixon | 5.2% | 0.90% | 05/03/1999 |

| Premier Miton UK Multi Cap Income | IA UK Equity Income | £997m | Gervais Williams, Martin Turner | 3.7% | 0.81% | 14/10/2011 |

| Quilter Investors UK Equity Large-Cap Value | IA UK Equity Income | £19m | Newton Investment Management | 3.5% | 0.75% | 17/02/2014 |

| Santander Enhanced Income Portfolio II | IA UK Equity Income | £61m | Robert McElvanney | 5.5% | 0.56% | 01/04/2009 |

| Santander Equity Income Unit Trust | IA UK Equity Income | £127m | Robert McElvanney | 5.4% | 0.53% | 01/02/1971 |