Investors hunting for income have a difficult decision to make whether to chase the high yields on offer or take less money but make up for it with capital gains.

While high yields mean more income, if the capital (the total cash pot) falls, then next year that yield will be worth less. Conversely, a lower yield but growing dividend (and capital), is the right way to invest for the long term but might not provide enough to live on in the short term.

The holy grail therefore is a high yield with a strong total return, indicating that the fund has risen in capital terms as well, but it is not easy to find.

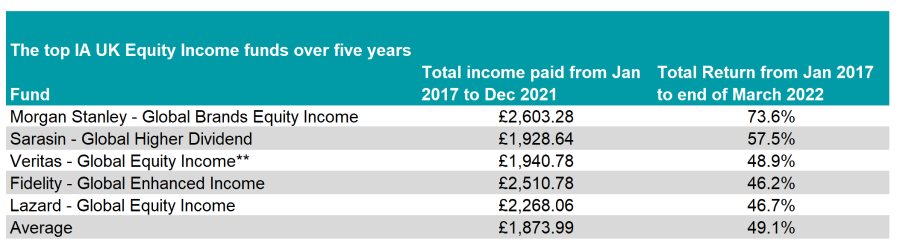

This conundrum is highlighted by funds in the IA Global Equity Income sector, where just three portfolios have paid out more than the average peer over the past five calendar years, as well as making an above-average total return.

Below, the table shows the portfolios that have achieved this. The data below shows the total amount paid out in the calendar years 2017-2021 based on an initial £10,000 investment at the start of the first year, while the total returns are from the start of 2017 to the end of March 2022.

Source: FE Analytics

The only fund to make a top-quartile return over that time is the Morgan Stanley Global Brands Equity Income fund. Unlike its much larger peers, the income version of the strategy has just £52.8m in assets under management.

The fund has an almost identical top 10 holdings to the £1.3bn Morgan Stanley Global Brands fund, with all of the same companies in the same positions (although weightings differ slightly).

A key difference is the yield. The income version has a 3.7% dividend yield, while the non-income option pays 0.96%.

The strategy has benefited from the tailwind of low interest rates and inflation over much of the past five years. Around a third of the portfolio is invested in technology, while consumer discretionary stocks have also benefited from low input costs, which have increased margins.

However the fund has struggled so far in 2022 as these fortunes have reversed. Indeed, it has lost 8.3% year-to-date, placing it among the bottom quartile of its peer group.

Total return of fund vs sector and benchmark YTD

Source: FE Analytics

The £457m Sarasin Global Higher Dividend fund was the second-best performer on the list, making a total return of 57.5% over the past half a decade – good enough to place it in the second quartile among its peers. It did so while paying out £1,928.64 in dividends over the past five years, which was above average.

It was the only other fund to beat the sector average returns over the five-year period, with Veritas Global Equity Income, Fidelity Global Enhanced Income and Lazard Global Equity Income all failing to match the average peer.

However, all three funds sat in the second quartile of the sector. This can happen when there are large outliers – those that have performed well have far exceeded those that have performed poorly, dragging the overall average above the median.

Fidelity Global Enhanced Income is the only non-traditional equity fund. It must invest at least 50% in equities, with derivatives such as covered call options used to enhance payouts.

At present the fund is 99.3% weighted to equities, with 13.9% in call overwriting, taking its net exposure to 85.4%.

Previously, Trustnet looked at the UK funds that had paid the most in dividends and made top returns.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

| Fidelity Global Enhanced Income | IA Global Equity Income | £304m | Daniel Roberts, David Jehan, Fred Sykes, Jochen Breuer, Vincent Li | 5.3% | 0.94% | 02/10/2013 |

| Lazard Global Equity Income | IA Global Equity Income | £78m | Kyle Waldhauer, Ronald Temple, Jimmie Bork, Nicholas Sordoni | 3.0% | 0.91% | 01/11/2012 |

| Morgan Stanley Global Brands Equity Income | IA Global Equity Income | £53m | Vladimir Demine, Alex Gabriele, Bruno Paulson, Dirk Hoffmann-Becking, Marcus Watson, Nic Sochovsky, | 3.7% | 1.00% | 30/08/2016 |

| Sarasin Global Higher Dividend | IA Global Equity Income | £457m | Neil Denman, Alex Hunter | 2.7% | 0.96% | 15/10/2012 |

| Veritas Global Equity Income | IA Global Equity Income | £243m | Ian Clark, Andrew Headley | 3.0% | 0.88% | 02/07/2012 |