Income investors have had a torrid time over the past several years but for those who rely on dividend payments there have been pockets that have produced dependable payouts without sacrificing capital gains.

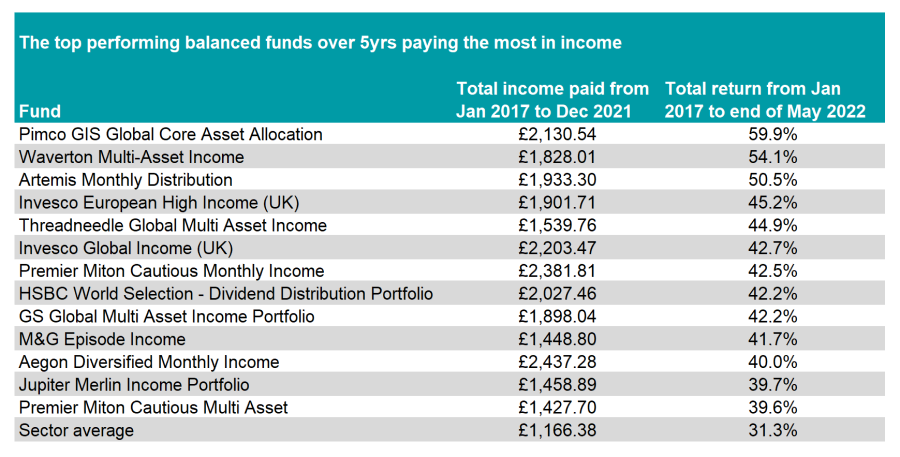

In this series, Trustnet looks at the funds that have managed to make above-average dividend payments over five years by calculating the total paid on an initial £10,000 investment made at the start of 2017.

We also worked out the total returns of these funds from the same period until 31 May 2022, to show those that have managed to make money from capital returns as well.

Previously, we have looked at the IA UK Equity Income, IA Global Equity Income and IA Mixed Investment 0-35% Shares sectors.

However, most investors fit into a balanced portfolio range, meaning that they can afford to take some risk but, at the same time, want to avoid losing too much when the market struggles.

One option is funds in the IA Mixed Investment 20-60% Shares sector, which allocate between equities, bonds and alternatives. While not all of these funds specifically aim to provide a healthy income per se, many of the top performers in the sector have thrown out a healthy dividend over the past five years, as the below table shows.

Source: FE Analytics

The top performer on the list has been the Pimco GIS Global Core Asset Allocation fund managed by Erin Browne. The four FE fundinfo Crown-rated portfolio has made investors 59.9% over the period, while paying out £2,130.54 in total dividends.

It is run with a global unconstrained mandate and has the ability to short stocks. Currently the fund is running a 147% long book with 47% in shorts.

However, the portfolio is not specifically aimed at providing an income, rather focusing on maximising total return with the preservation of capital.

In second place was Waverton Multi-Asset Income, managed by James Mee. Unlike the fund above, this portfolio does aim to provide a “reasonable level of income” while maintaining the capital value over the medium-to-long term.

The fund can use equities, fixed and/or floating rate global government and corporate debt securities, structured products, deposits, cash, money market instruments and collective investment schemes to make its returns.

At present, the five crown-rated fund is 47.2% weighted to stocks, with 18.7% in fixed income and 24.3% in alternatives with the remainder in cash.

Its top holdings include a mixture of funds and stocks, including names such as Shell and AstraZeneca, which will have contributed to the high income payout in recent years.

Another area that has been popular among income-seeking investors in recent years is property, and here Waverton Multi-Asset Income has Real Estate Credit Investments and Starwood European Real Estate Finance among its largest holdings.

In third place was Artemis Monthly Distribution, with a total return of 50.5% and income of £1,933.30 on an initial £10,000 investment.

This portfolio is split between bonds and equities, with a specialist manager taking control of each part. Last year the manager of the bond portion of the portfolio was changed after James Foster retired, with Stephen Baines taking his place. Jacob de Tusch-Lec has remained in charge of the equity portion throughout. Currently the portfolio is split with 51.5% in equities, 1.5% in cash and the remainder in bonds.

The fund is one of six options that pay their dividends monthly, alongside Invesco European High Income (UK), Invesco Global Income (UK), Premier Miton Cautious Monthly Income, M&G Episode Income and Aegon Diversified Monthly Income – the fund that has paid out the most in dividends over the past five years.

The largest fund on the list however is the £1.9bn Jupiter Merlin Income Portfolio, run by FE fundinfo Alpha Manager John Chatfeild-Roberts alongside Amanda Sillars and David Lewis.

Unlike some of those above, the portfolio is made up of other funds as well as investment trusts. Towards the end of last year, Lewis told Trustnet that the fund-of-funds range was a “one-stop shop” with the macroeconomic backdrop guiding its asset allocation, before the team invested in hand-selected funds.

It currently has a strong overweight to the UK, with 31.7% allocated to domestic funds, which typically pay higher dividends than their global peers.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

| Aegon Diversified Monthly Income | IA Mixed Investment 20-60% Shares | £880m | Vincent McEntegart, Jacob Vijverberg | 5.3% | 0.58% | 25/02/2014 |

| Artemis Monthly Distribution | IA Mixed Investment 20-60% Shares | £677m | Jacob de Tusch-Lec, Stephen Baines | 3.9% | 0.86% | 21/05/2012 |

| GS Global Multi Asset Income Portfolio | IA Mixed Investment 20-60% Shares | £404m | David Copsey, Shoqat Bunglawala | Not available | 0.91% | 18/03/2014 |

| HSBC World Selection Dividend Distribution Portfolio | IA Mixed Investment 20-60% Shares | £396m | Kate Morrissey | 2.7% | 0.76% | 03/09/2012 |

| Invesco European High Income (UK) | IA Mixed Investment 20-60% Shares | £28m | Stephanie Butcher | 3.6% | 0.83% | 12/11/2012 |

| Invesco Global Income (UK) | IA Mixed Investment 20-60% Shares | £57m | Stephen Anness, Alexandra Ivanova, Stuart Edwards | 3.4% | 0.82% | 09/05/2014 |

| Jupiter Merlin Income Portfolio | IA Mixed Investment 20-60% Shares | £1,916m | John Chatfeild-Roberts, Amanda Sillars, David Lewis, George Fox | 2.4% | 1.42% | 19/09/2011 |

| M&G Episode Income | IA Mixed Investment 20-60% Shares | £625m | Steven Andrew, Maria Municchi | 2.6% | 0.65% | 03/08/2012 |

| Pimco GIS Global Core Asset Allocation | IA Mixed Investment 20-60% Shares | £673m | Erin Browne, Geraldine Sundstrom, Emmanuel Sharef | Not available | 0.95% | 07/04/2010 |

| Premier Miton Cautious Monthly Income | IA Mixed Investment 20-60% Shares | £130m | David Jane, Anthony Rayner | 4.0% | 1.07% | 18/10/2012 |

| Premier Miton Cautious Multi Asset | IA Mixed Investment 20-60% Shares | £360m | David Jane, Anthony Rayner | 2.0% | 0.81% | 03/01/2006 |

| Threadneedle Global Multi Asset Income | IA Mixed Investment 20-60% Shares | £49m | Toby Nangle | 2.8% | 0.90% | 31/07/2014 |

| Waverton Multi-Asset Income | IA Mixed Investment 20-60% Shares | £201m | James Mee | Not available | 0.56% | 03/10/2014 |