A decade of low growth, low rates, and low inflation put Terry Smith’s quality-growth style of investing very much in favour, boosting his Fundsmith Equity portfolio 165.3 percentage points ahead of the IA Global peer group over the past 10 years with a total return of 327.3%.

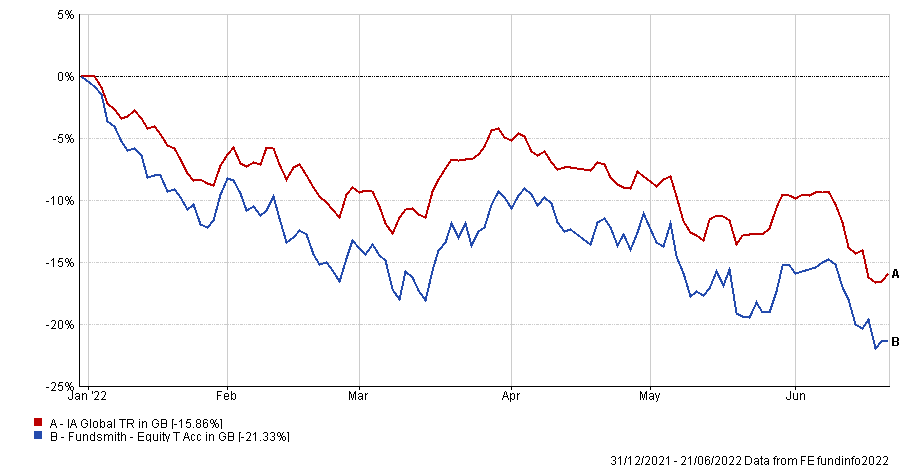

However, the dramatic shift in markets this year has dragged the £21.8bn fund down 21.3% since the start of 2022, resulting in a 5.1 percentage point lag behind the sector.

If performance continues to decline, this could well be the first year Fundsmith Equity has failed to beat its peers in 10 years.

Total return of fund and sector since the start of the year

Source: FE Analytics

Global funds and their broadly growth strategies have all taken a hit from the current rotation into value funds and Fundsmith has been no exception, with its quality-growth style coming under pressure.

Ben Yearsley, investment director at Shore Financial Planning, said that even if the fund’s performance levels out, “it will be difficult to give the same level of returns” as it has in the past.

He added: “The first decade of the fund fitted perfectly to Smith’s style. The coming decade is likely to be much more nuanced – and don’t forget how big the fund is now.”

For example, the fund’s overweight exposure to consumer staples and discretionary, which accounts for 41.1% of sectoral allocations, may be a significant detractor to performance if inflation continues on its steep rise.

Consumer businesses are likely to have their cash flows reduced as customers limit their spending on non-essential items.

Companies such as Uber, Robinhood and Coinbase have already announced cost cutting measures as consumers wind down spending in the face of the cost-of-living crisis.

Darius McDermott, managing director of Chelsea Financial Services, suggested that investors who anticipate inflation will remain high in the long-run may be better off cutting their losses.

“If you see a scenario where we might actually have higher standard inflation for the next two or three years, then that's a period where you could see Smith’s strategy continue to underperform”, he said.

UK inflation hit the 40-year high of 9.1% yesterday, and the Bank of England has forecast rates to reach 11% by the autumn.

That being said, markets could very easily go the other way – if central banks contain the wrath of inflation and in doing so, cause a recession. In this scenario, Fundsmith Equity could be a beneficial holding, according to McDermott.

In fact, the fund could perform a similar role to bonds in investor’s portfolios if a recession were to occur.

With high interest rates lowering the price of bonds, the compounding, long duration assets held in Fundsmith Equity could offer some security in the long run.

Ben Faulkner, communications director at EQ Investors, agreed that people could be “crystallising losses” by selling the fund now, but cautioned those considering an exit not to take a short-term view.

He told investors: “Market timing is a tricky business – there is a reason that most fund managers invest for the longer term.”

Indeed, McDermott also said that many investors were acting irrationally in this rotation by shedding their growth assets, stating: “I think there's too much short termism in our industry and people need to remember the job that Fundsmith Equity has done in their portfolios if they've held it for 10 years.”

In his fund of funds, McDermott said that he is “very happy to continue holding it” as the fund is behaving exactly as he would expect in this kind of environment and Smith’s skilful stock-picking will likely cause performance to rebound.

Despite Fundsmith Equity’s decline over the past year, none of the experts Trustnet spoke to thought that selling it now was a good idea.

Tom Sparke, investment director at GDIM said: “While I have other concerns about the fund, the performance through a harsh rotation from growth toward value is not a reason to sell in my opinion.”

Likewise, Yearsley said that an investor with a well-diversified portfolio, which spread risk across assets in different styles, sizes and geographies, has no reason to sell.