Investors in the Vanguard LifeStrategy funds should retain faith in fixed income despite a painful run in 2022 so far and some lacklustre returns from the popular multi-asset range, the investment giant has argued.

The opening half of 2022 saw bonds fall at the same time as stocks when investors worried about the impact of surging inflation and interest rate hikes from central banks. What’s more, further volatility in markets is expected as the major economies sit on the brink of a recession as policymakers continue their battle against inflation.

Mohneet Dhir, a multi-asset product specialist at Vanguard, said: “Global bonds posted their worst first-half returns in decades this year amid rising inflation and interest-rate expectations, while global equities delivered negative double-digit returns. This left some investors questioning the long-term benefits of maintaining a core allocation to high-quality fixed income.”

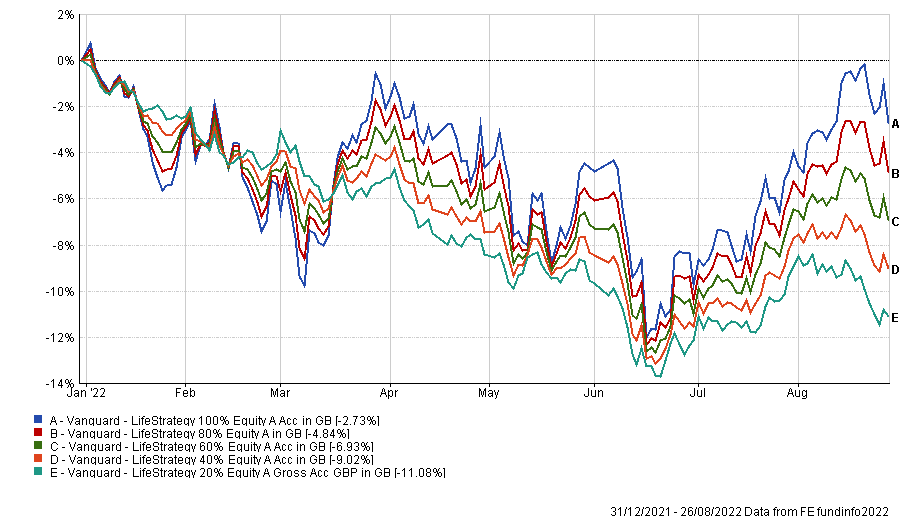

Performance of Vanguard LifeStrategy funds in 2022

Source: FE Analytics

The impact of this is hinted at in the performance of the five funds in the Vanguard LifeStrategy range. Four of these funds have a structural weightings to global hedged bonds.

Vanguard LifeStrategy 100% Equity, which holds no bonds, has posted the best total return year-to-date after falling just 2.7%; Vanguard LifeStrategy 20% Equity, on the other hand, has four-fifths of its portfolio in bonds and is down 11.1%.

The LifeStrategy funds with the lowest fixed income exposure are also performing better than their sector peers. Vanguard LifeStrategy 100% Equity and Vanguard LifeStrategy 80% Equity are in the second quartile of their respective sectors this year and Vanguard LifeStrategy 60% Equity is third quartile, but Vanguard LifeStrategy 40% Equity and Vanguard LifeStrategy 20% Equity have dropped into the bottom quartile.

However, Vanguard has issued an update to reassure investors, arguing that the recent rebound in global bond prices “should offer some comfort” to investors with large bond exposures.

In addition, Dhir said there are four other points that could help reassure LifeStrategy investors.

High-quality bond returns tend to be uncorrelated with equity markets

Dhir noted that the primary reason for investing in high-quality bonds is to act as a buffer against stock market shocks, rather than drive returns. While it might therefore be worrying when stocks and bonds fall together, Vanguard research found this has happened around 30% of the time over the past 20 years.

“Still, the longer equity markets decline, the more likely bonds are to play a stabilising role in a portfolio, we find. While the dynamics affecting asset correlations are complex, a key driver is if economic growth and interest rates are moving in the same direction. When they do, the correlation between equities and bonds tends to be negative,” she added.

“That’s because policy-rate changes are dictated by economic conditions: if equity markets crash, central banks tend to support their economies by cutting interest rates and pushing bond total returns higher. If, instead, inflation is rising because the economy is growing and the labour market is tight, rates are increased and bond returns become negative.”

Today, central banks are lifting interest rates at the same time that economic growth is cooling. This causes stocks and bonds to be more positively correlated.

But Vanguard argued that the impact of future rate rises has now largely been priced in, suggesting that bonds will resume their role as an effective hedge against equity shocks.

Global hedged bonds have dampened risks in previous rate-rising cycles

The volatility of 2022 has been driven by central banks hiking interest rates so Vanguard looked at asset returns through various economic conditions. It found that a core allocation to global hedged bonds served multi-asset investors in most market environments, including a rapid interest rate hiking scenario.

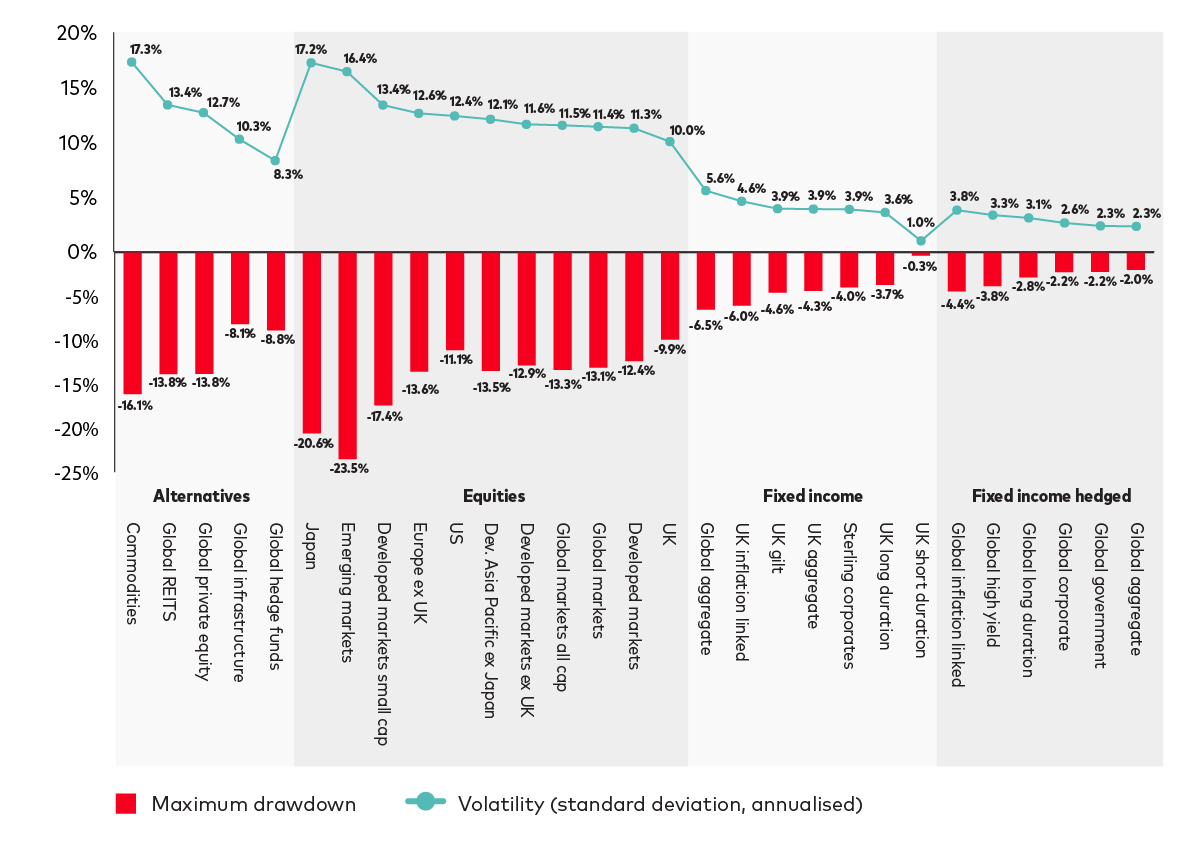

“When US interest rates rose 4.25 basis points (bps) between June 2004 and July 2005, hedged global bonds were among the best risk dampeners,” Dhir said. “As the chart below demonstrates, the asset class experienced low volatility and drawdowns relative to alternatives, equities, fixed income and their major sub-asset class categories as rates rose quickly.”

Maximum drawdown and volatility amid 4.25bps rise in US rates

Source: Vanguard calculations based on data from Bloomberg. Notes: Data is for the period from 1 Jun 2004 to 31 Jul 2006 (extracted from analysis between 1 Jun 2004 and 22 May 2022). Returns calculated in GBP. Annualisation is based on weekly total returns.

When the group analysed the maximum drawdown and volatility of the same assets over a longer time frame – from June 2004 to May 2022, a period that includes the global financial crisis, the modest rate rises between 2015 and 2019, and the Covid-19 crisis – global hedged bonds again proved to be one of the best risk dampeners.

LifeStrategy’s bond diversification

Dhir’s third point is that the Vanguard LifeStrategy portfolios are diversified across the maturity and credit spectrum, which helps to reduce sensitivity to interest rate movements.

She pointed out that around 20% of the fixed-income allocation is held in bonds with a maturity of less than three years, around 40% is held in bonds with maturities of between three and 10 years and around 40% is invested in bonds that mature in 10 years’ time or more.

Likewise, they are diversified in terms of credit quality with around 30% invested in the highest-rated (AAA) bonds, around 15% in the lowest-rated bonds (BBB-) within the investment-grade universe, and the remainder spread across everything in-between.

“This diversified approach to investment grade fixed income has historically played a key role in recessionary environments, which we believe there is an increased risk of over the next 24 months,” she added.

Return outlook for bond and multi-asset investors has improved

Finally, Dhir suggested that the “silver lining” for long-term investors in today’s market is that “the worst is probably behind us”. She noted that the fall in bond prices at the first half of the year has nudged yields higher, which means the return outlook for bond investors is better now than at 2022’s start.

Vanguard’s latest 10-year return forecasts say UK-based investors can expect an annualised return from domestic bonds of around 2.4% to 3.4% over the next decade and one of between 2.3% and 3.3% from global hedged bonds (ex-UK). This is up from 0.8% to 1.8% for both local and domestic bonds at the beginning of 2022.

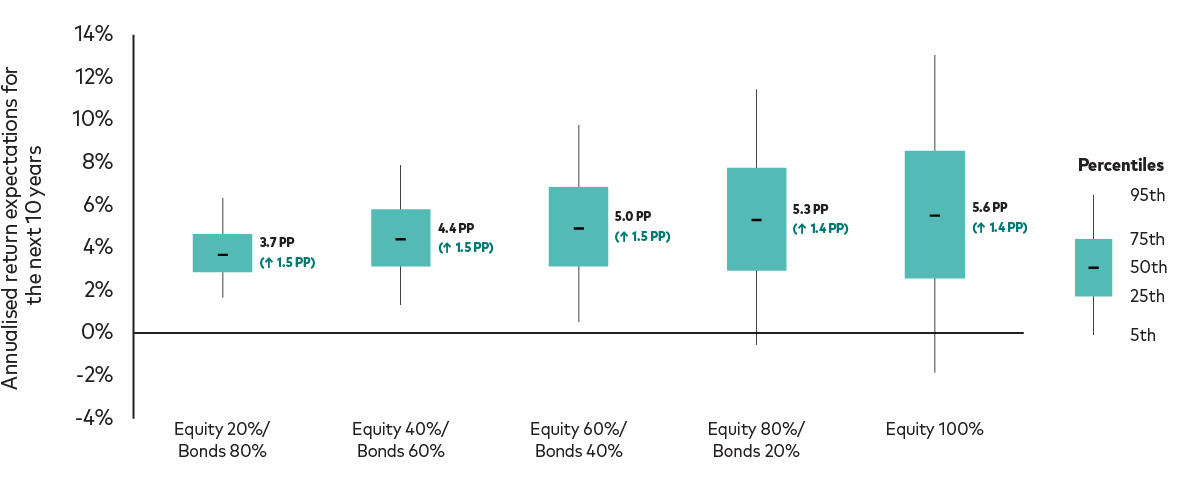

Annualised 10-year expected portfolio returns (nominal)

Source: Vanguard

“It’s a similar picture for multi-asset investors. Our 10-year nominal return expectations for traditional equity/bond portfolios are up since the beginning of the year,” she finished.

“The chart shows the change in our outlook for various stock/bond portfolio mixes that includes a modest tilt to UK markets, in-line with our LifeStrategy fund and ‘classic’ model portfolio ranges.”