Global equity income funds managed by Barclays, Morgan Stanley and Vanguard are among those that have had the most stable yields over recent years, research by Trustnet has found.

However, our research also suggest that – like in the UK – investors have had to hold funds with more volatile yields if they wanted to achieve higher income payouts from global equity income strategies.

Last week, Trustnet research on the IA UK Equity Income sector found that the most stable yields there came from the likes of Schroder Income Maximiser, abrdn UK Income Equity and Vanguard FTSE UK Equity Income Index.

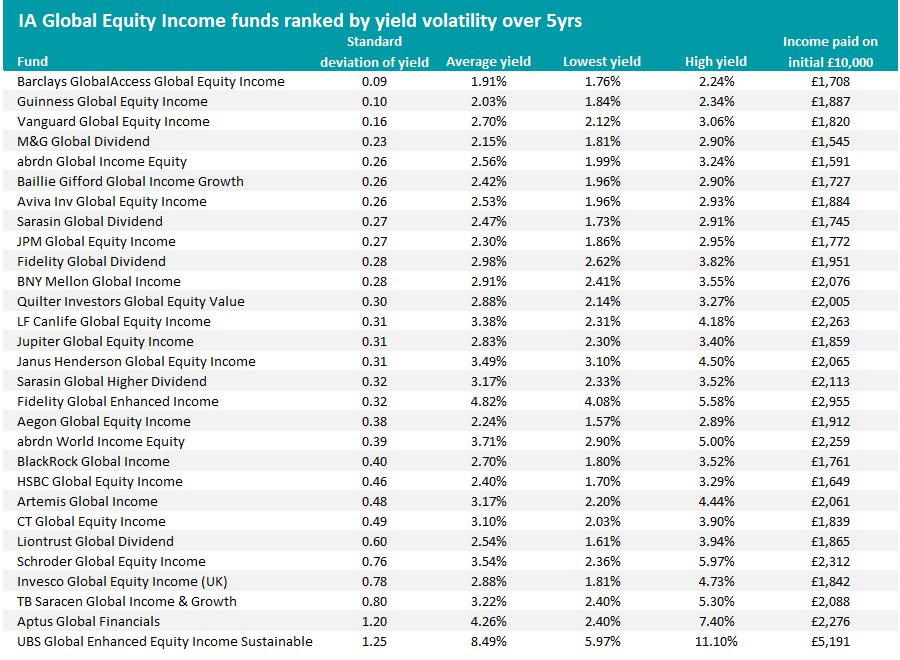

Turning our attention to the IA Global Equity Income sector, there are 29 funds that FE fundinfo has data on their monthly yields for the past five years and the total income paid over that time on an initial investment of £10,000.

After calculating the standard deviation on the funds’ monthly yields, the resulting yield volatility for all 29 funds can be found in the table below. We’ve also included the average, maximum and minimum yield as well as income paid over five years.

Source: FinXL, FE Analytics

At the top of the list is the £51m Barclays GlobalAccess Global Equity Income fund, where the standard deviation on the monthly yield has been just 0.09 over the past five years. During this period, the fund’s yield has ranged between a low of 1.76% and a high of 2.24%, averaging 1.91%.

But as last week’s Trustnet research on UK equity income funds discovered, this stability of yield appears to come at the expense of a higher income. The average five-year total payout of the 30 funds in the table is £2,099 on an initial £10,000 and this fund is about £400 below that; its average yield is also the lowest on the table.

It’s a similar story with most of the funds towards the top end of that table. Guinness Global Equity Income, Vanguard Global Equity Income, M&G Global Dividend and abrdn Global Income Equity, for example, have some of the least volatile yields in the sector but have a lower average yield than their peers and paid out below average dividends.

Things get more interesting mid-table, where IA Global Equity Income yields don’t appear to be too volatile but income payouts are much closer to the sector average.

Fidelity Global Dividend, for example, has a standard deviation on its monthly yield of 0.28 but has an average yield of 2.98% (which is broadly that of a typical fund in the sector) and has paid out £1,951 in the past five years.

The £3.2bn fund has been managed by Daniel Roberts and is found on the FE Invest Approved List. Analysts at FE Invest said: “Roberts’ approach to equity income is not revolutionary and does not differ too much from other equity income managers. Nevertheless, he has been more successful in implementing it as he truly is a long-term investor and does not make decisions based on market noise.

“We believe this fund is an obvious choice for cautious investors searching for a global source of dividends.”

BNY Mellon Global Income, Quilter Investors Global Equity Value, LF Canlife Global Equity Income and Janus Henderson Global Equity Income are examples of other funds that appear to be doing a good job of maintaining a better-than-average payout without too much volatility in their yield.

At the bottom of the list is UBS Global Enhanced Equity Income Sustainable, which has the most volatile yield with a standard deviation of 1.25.

It has the highest average yield and income payout of the IA Global Equity Income funds looked at in this research, owing to its ‘enhanced income’ approach that sees call options written on the fund’s underlying equities to boost the income stream.

Conventional funds with some of the sector’s most volatile yields but a history of paying out more than their peers include Aptus Global Financials, TB Saracen Global Income & Growth, Schroder Global Equity Income and Artemis Global Income.