Fidelity investment director Tom Stevenson will be adding to two equity funds, a government bond fund and a conservative multi-asset strategy in his portfolio over the coming year, as he expects conditions to improve on 2022’s harsh sell-off.

“No-one knows what the future holds. A year ago, few (if any) would have predicted the war in Ukraine. So, we need to be prepared for the unexpected. But we also need to imagine what could go right. One of the hardest things an investor has to do is to fight the temptation to become more bearish as the market falls,” Stevenson said.

“That’s the backdrop to my picks for 2023. A belief that markets will move ahead of the real economy. But a cautious respect for Mr Market too. The journey might not be smooth next year. The bear market may have further to go before it is done.”

However, he believes that 2023 will end will stock prices higher than where they started and this is why two of his picks are global equity funds.

The Dodge & Cox Global Stock fund, which takes a contrarian, value-focused investment approach, is the more defensive of these two picks.

Performance of fund vs sector and index over 2022

20221210_fidelity_2023_fund_picks_1  Source: FE Analytics

Source: FE Analytics

“It looks for shares that are out of favour in the short term, but which have longer-term growth potential,” Stevenson explained. “The companies it invests in tend to be medium-sized or large and well-established. And they tend to be cheaper than their peers. Shares in the portfolio are likely to have a higher-than-average dividend yield too.”

Dodge & Cox Global Stock was in the IA Global sector’s bottom quartile in 2020, it has outperformed its average peer in 2021 and 2022 – making 4.3% this year while the sector dropped 10.6%.

The second global equity pick is the Edinburgh Worldwide Investment Trust. Baillie Gifford manages this trust and the firm looks for companies with high growth potential, especially those that are disrupting their industries; Edinburgh Worldwide concentrates on smaller companies, including those in the unquoted space.

“This is a much higher-octane fund and its recent performance shows that investors should be prepared for greater volatility,” Stevenson said.

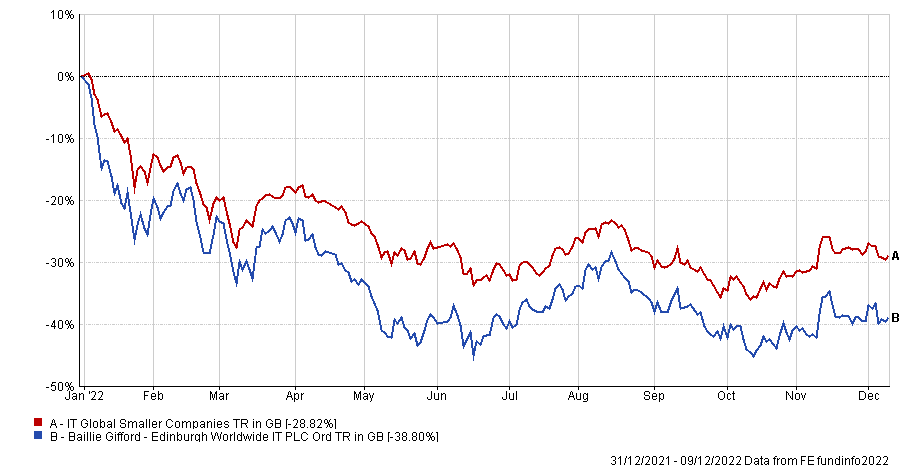

Performance of trust vs sector over 2022

Source: FE Analytics

Over 2022, the trust has lost 38.8% and is the worst performer of the five members of the IT Global Smaller Companies sector – this came after a 21% loss in the previous year. However, when market conditions favour the trust it can outperform by a spectacular margin as suggested by an 87.7% total return in 2020 when its average peer was up 35.2%.

“This is a risky way to invest, and it is only sensible to do so in a closed vehicle like an investment trust, which can take a longer-term view and avoid being forced to sell investments at the wrong moment,” Stevenson added. “When the market turns up, this investment is likely to outperform more defensive funds. But it is definitely an ‘eyes wide open’ choice.”

Colchester Global Bond is the Fidelity investment director’s third pick for 2023, based on his expectation that interest rates will ultimately start to fall again as recession hits both sides of the Atlantic and inflation eases.

Performance of fund vs sector and index over 2022

Source: FE Analytics

Lower rates would benefit both stocks and bonds but Stevenson said government bonds, which are the most sensitive to interest rates, will outperform corporate bonds in these conditions.

“Colchester is a bond specialist and lends to governments all over the world, but this fund is focused on those in the developed world. I would expect this fund to do well as we move into recession and investors look out for safer havens,” he said.

While the fund has fallen 4.5% in 2022, this is still a first-quartile showing in the IA Global Government Bond sector; it is also top quartile over three and five years.

Stevenson’s final pick is Pyrford Global Total Return, which he said combines many of the above points in “one defensive package”. The fund invests in multiple asset classes and has a contrarian approach that allows it to lift exposure to stocks when they fall and become cheap.

Performance of fund vs sector and index over 2022

Source: FE Analytics

“This fund is conservatively run and offers a potentially smoother ride to investors who would prefer to hand over their asset allocation decisions to a professional manager rather than do it themselves,” he finished.

Pyrford Global Total Return is up 1.7% this year, putting it in the top decile of the IA Flexible Investment sector. However, its more conservative approach means it is fourth quartile over five years, making 10.6% compared with 19.1% from its average peer.