Sustainable funds had their second year of underperformance in a row in 2022 after rising rates put investors off stocks where there’s a long wait for future earnings, Trustnet research shows.

While most parts of the market struggled last year because of high inflation and rising interest rates, some parts were hit worse than others.

The growth style of investing – when investors buy companies on the promise of higher future earnings but often have to tolerate higher valuations because of these expectations – is one area that tanked in 2022.

This is because future earnings look less attractive when interest rates are higher; investors instead turned to cyclical value stocks, which are more likely to pay out today.

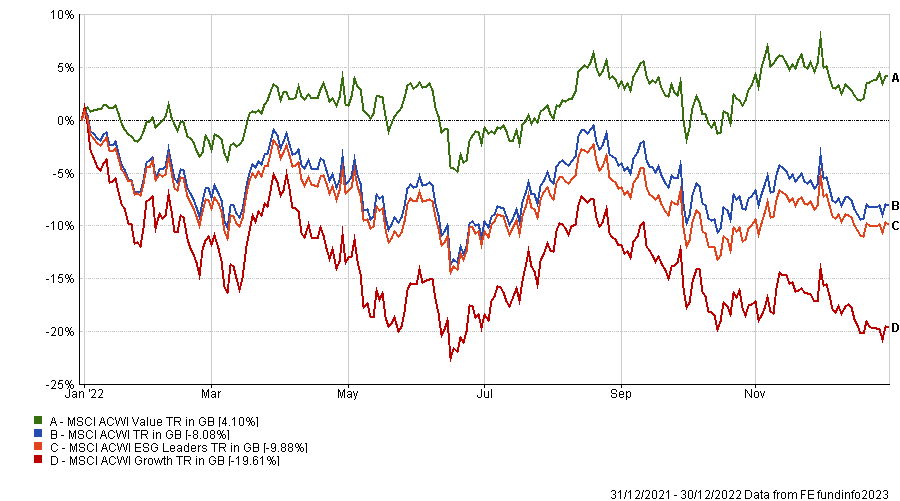

Performance of various investment approaches in 2022

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Dec 2022

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Dec 2022

Funds with a focus on sustainable investing or environmental, social and governance (ESG) factors tend to fall into the growth investing camp as they are naturally led to buy companies in emerging fields that are developing solutions for the future.

As the chart above shows, the MSCI ACWI ESG Leaders index underperformed the broader MSCI AC World index with a loss of 9.9% last year. However, this was significantly better than the near-20% drop in the MSCI ACWI Growth index.

To see how this dynamic translated into fund performance, Trustnet took all the funds that have told us they hold Article 8 or 9 status under the Sustainable Finance Disclosure Regulation or have an ethical/sustainable investment focus and compared their 2022 returns with their conventional peers.

This showed that the average sustainable fund underperformed its conventional peer in 36 of the Investment Association’s 47 sectors that have at least one sustainable member. For all of these sectors, 2022 was the worst year for sustainable investing out of the past four.

It also follows underperformance of sustainable funds in 32 sectors during 2021 and looks very different to 2020, when sustainable funds outperformed in 41 of the 47 peer groups.

The worst showing from sustainable funds in 2022 came from the IA Technology and Technology Innovations sector, where the average loss was 28.7%. However, this wasn’t too far behind the 26.9% loss incurred by the average conventional tech fund, as the growth nature of tech stocks – and their high valuations – meant they were one of the hardest hit parts of the stock market last year.

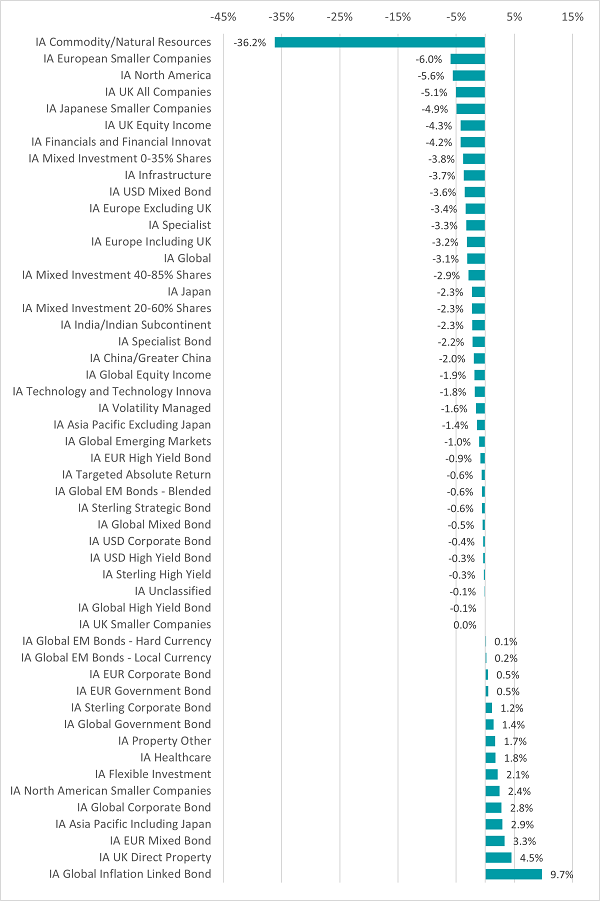

But the area where sustainable funds underperformed their conventional peers by the most was the IA Commodity/Natural Resources sector – there’s a 36.2 percentage point gap between the 34.1% gain made by the average conventional fund here and the 2.1% loss of sustainable funds.

This stark difference, like so many explanations for 2022, is down to inflation and interest rates. Commodity prices last year surged because of supply bottlenecks and the war in Ukraine, causing stocks like the oil & gas majors to rally, but clean energy funds – which tend to finance their projects with debt – fell as interest rates rose in response.

The difference between the other sectors was less was less extreme but still notable. IA European Smaller Companies was the next-worse for sustainable funds after underperforming conventional strategies by 6 percentage points), followed by IA North America (5.6 percentage points), IA UK All Companies (5.1 percentage points), IA Japanese Smaller Companies (4.9 percentage points) and IA UK Equity Income (4.3 percentage points).

Global equity funds, where ESG strategies bucked the trend for investors to drop funds last year and captured positive inflows according to Calastone, withsustainable strategies underperformed conventional ones by 3.1 percentage points after losing 12.8%.

Performance of sustainable funds relative to their conventional peers in 2022

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2022