More than 90 investment companies charge shareholders a performance fee when returns exceed their targets, which investors must pay on top of other ongoing charges, but not all are worth the additional charge.

These extra costs and the hurdle that funds must achieve for them to apply differ. Here, Trustnet asks expert analysts which of the 39 equity trusts that charge one are worth buying and which may not be worth the price.

Earlier this week, we looked at every equity trust charging a performance fee and spoke to investment company experts on what role they play in today’s market.

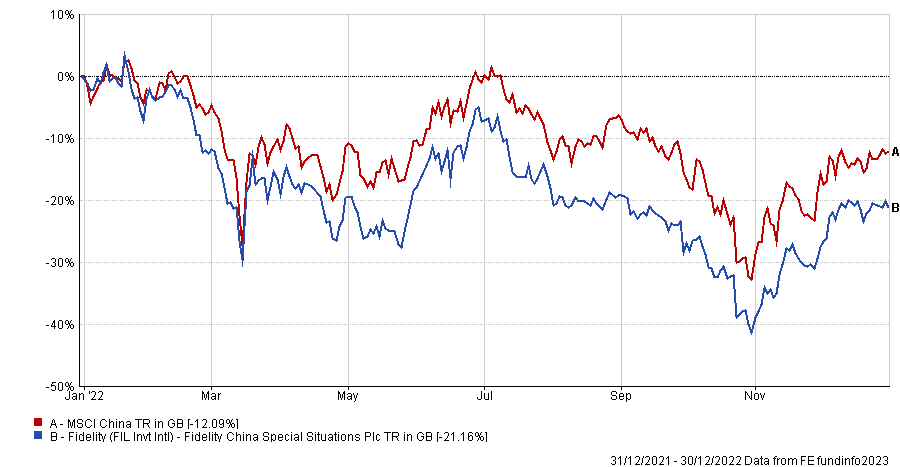

Fidelity China Special Situations was the pick of Juliet Schooling Latter, head of research at Chelsea Financial Services, who said that China’s reopening story could boost the trusts performance moving forward.

The £1.4bn portfolio soared 257.2% over the past decade, but China’s reluctancy to lift lockdown measures has dampened performance in the short-term, with returns down 21.2% last year.

If China lifts its zero-Covid policy this year, as many analysts predict, this could be a boost to the trust’s returns in 2023. Indeed, early hints from the Chinese government that it will relax restrictions has already been well received by the market, with the MSCI China index recovering 23.1% over the past three months.

Schooling Latter said: “Clearly it has risks, but there is significant scope for outperformance from here. The discount has come in a bit but the ramp up in the economy could see that improve further.”

Fidelity China Special Situations is currently selling on a 5.6% discount, which investors may want to utilise now if they think that could shrink or even switch to a premium.

Total return of trust vs benchmark in 2022

Source: FE Analytics

On the other hand, Schooling Latter said that she would avoid the Augmentum Fintech trust due to its highly concentrated portoflio.

It holds just 24 names, which could put it at high risk of downgrades if these volatile market conditions continue.

The trust is up 8.5% since launching in 2018, but momentum was slowed by the market downturn, with returns sinking 29.9% over the past year.

Schooling Latter said: “Personally, I think this is a bit too concentrated and high risk in today’s market, which isn’t favouring this type of company. It may be one to revisit in the future, but it’s not one I favour today.”

Total return of trust vs sector over the past year

Source: FE Analytics

A performance fee would not necessarily be her biggest concern, with Schooling Latter stating that returns take priority over charges.

“I obviously prefer investments without, but if the fee is not too prohibitive and performance is good then it’s the returns after fees that are important to me,” she said. “What I don't like is when you get high performance fees on a low target.”

The River and Mercantile UK Micro Cap trust is also worth looking at, according to Ben Yearsley, director of Fairview Investing.

It is up 61.6% since launching in 2014, trailing 41.6 percentage points behind its peers in the IT UK Smaller Companies sector.

Indeed, it sunk 37% last year while the rest of the sector dropped 20.6%, but Yearsley says that it is one of the few trusts where the performance fee is appropriate.

Total return of trust vs sector in 2022

-1.png)

Source: FE Analytics

The £55m portfolio will charge shareholders when returns exceeds a 15% lead on the Numis Smaller Companies index, which is a high enough water level to warrant a performance fee, according to Yearsley.

He said: “I have nothing against performance fees as long as they are appropriate and the annual fee is commensurately lower. Too often they aren’t though.”

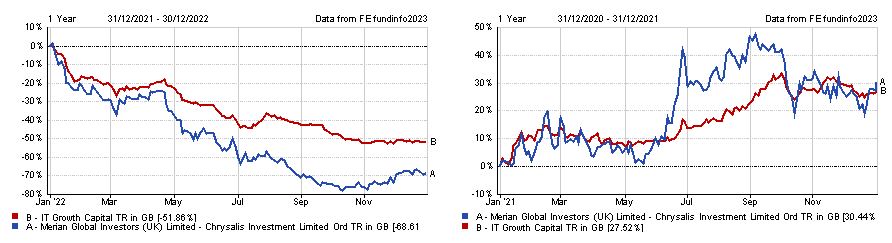

Contrastingly, Yearsley said that he would avoid the Chrysalis trust largely based on its high performance fee. It charges investors a fee every time returns peak above 8%, which it last did in 2021 after the trust leapt 30.4% throughout the course of the year.

Last year, however, returns sank 68.6% as rising inflation and high inflation put pressure on smaller companies.

Total return of trust vs sector in 2022 and 2021

Source: FE Analytics

The board of Chrysalis announced a cut to the performance fee after a meeting in November, but Yearsey said that the charge should have been scrapped altogether.

He added: “Not wishing to knock them when they are down, but why didn’t they the board and Jupiter take the opportunity recently to abolish the performance fee altogether especially after last year’s egregious payout?”

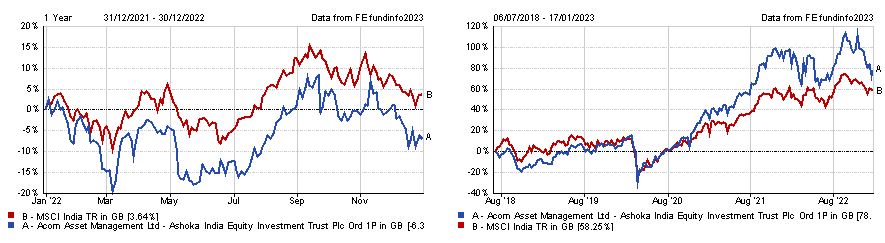

Of all the equity trusts with a performance fee, the Ashoka India Equity trust deserves the most attention, according to Thomas McMahon, investment trust research manager at Kepler Partners.

There is no ongoing management fee, so shareholders only pay when the trust beats the MSCI India benchmark index.

McMahon said that this “creates a very strong incentive for the managers to generate outperformance, which should benefit shareholders”.

Total return of trust vs benchmark in 2022 vs since launch

Source: FE Analytics

It failed to beat the index in 2022 for the first time in three years after return sank 6.3%. Over the long term, Ashoka India Equity outperformed the benchmark by 20.5 percentage points since launching in 2018, climbing 78.7%.

McMahon said: “In our view it is silly to object to paying a high fee when net performance has been so good – the beauty of the fee is that if performance is bad in future periods, investors will not pay a management fee at all.”