Commodities haven’t had a good start of the year, but there are “strong structural underpinnings” that could prop the asset class back to the top of the performance tables, according to Nitesh Shah, head of commodities and macroeconomic research at WisdomTree.

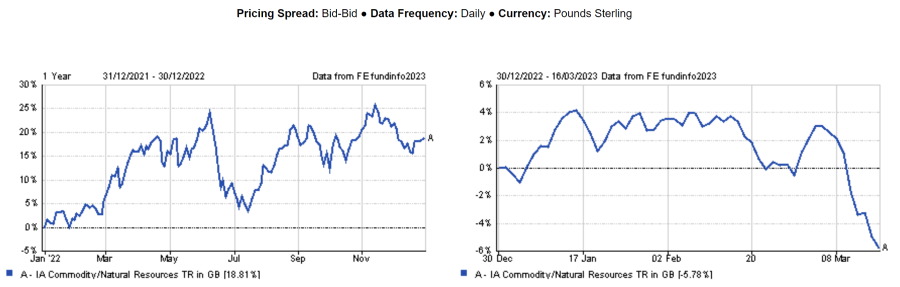

In the past two years, commodities have had a phenomenal rally. Returns for the average fund in the IA Commodities/Natural Resources sector were up 25% in 2021, when Covid-19 restrictions were lifted and life went back to normal. In 2022 the sector gained 20% following Russia’s invasion of Ukraine, which caused a series of supply shocks.

But the asset class has fallen back out of favour so far this year, losing 5.8% since the beginning of 2023. This, according to Shah, is due to cyclical headwinds.

“Energy prices, which had been propelling commodities, declined by the third quarter of 2022 as economic deceleration resulting from monetary tightening in developed nations also weighed on the asset class,” he said.

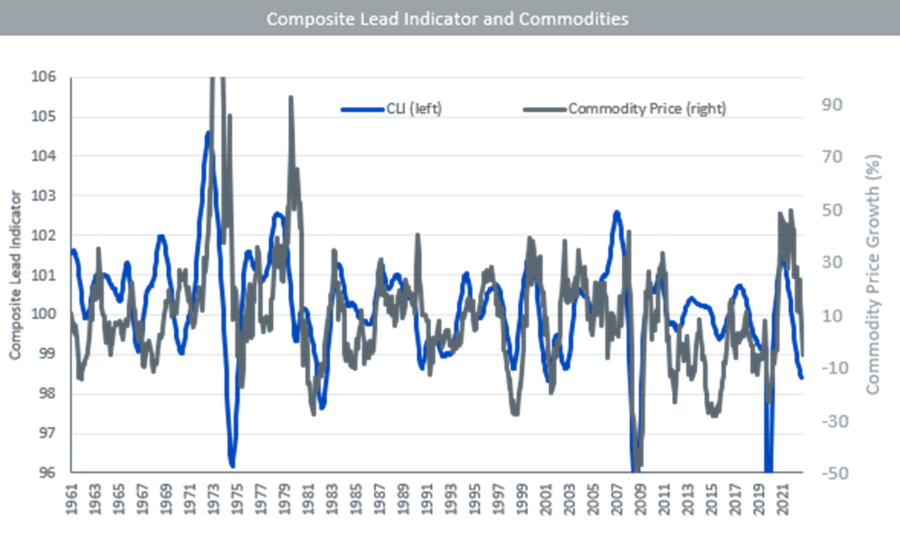

“Composite lead indicators designed to provide early signals of turning points in business cycles turned decisively even before 2022 and are still declining, indicating the cyclical headwinds faced by commodities are still present.”

Source: WisdomTree, Bloomberg, OECD, June 1961 to February 2023

But this is only the short-term picture, according to Shah, who said that commodities should benefit from long-term structural support deriving especially “from the energy transition and an infrastructure spending rebound. These catalysts could drive another supercycle in commodities”.

Supercycles coincide with periods of industrialisation and urbanisation when the supply of commodities failed to keep up with the growth in demand.

“The last supercycle occurred after China joined the World Trade Organization in 2001, which turbocharged development as barriers to commerce were removed,” he said.

“Could we be on the cusp of another supercycle? We believe there are some strong structural underpinnings but, for now, business cycle dynamics (including a rising risk of recession) could dominate price behaviour in the short term.”

Performance of sector over 2022 and year-to-date

Source: FE Analytics

To get a sense of what the future performance of commodities might look like, some experts will be looking closely at the upcoming macro data from the US and whether it will allow the Federal Reserve to stick to its current 25-basepoints hiking pace.

Investors will find out if that is the case on later today, when the monetary committee will make the decision. Should it rate increase by the predicted 0.25 percentage points, commodities are likely to jump, according to Stephen Innes, managing partner at SPI Asset Management.

“A 25 basis point hike could allow oil and other commodities to rally, especially if upcoming activity data supports China-related optimism and triggers recent Dollar strength to fade,” he said.

“But on the other hand, if the Fed reaccelerates and policy tightening once again becomes front-loaded, yields could remain under upward pressure, risky assets could sell off more sharply, commodities could decline, and the dollar could move even higher.”