Equity income strategies such as BNY Mellon Global Income, JPM Global Equity Income and Artemis Income became increasingly popular with investors during the opening three months of 2023, Trustnet factsheet traffic suggests.

Equity income investing fell out of favour during the post-financial crisis bull run, when low interest rates favoured growth investing. But it has returned to the fore in recent months as central banks hiked rates and investors tries to make their money work harder amid high inflation.

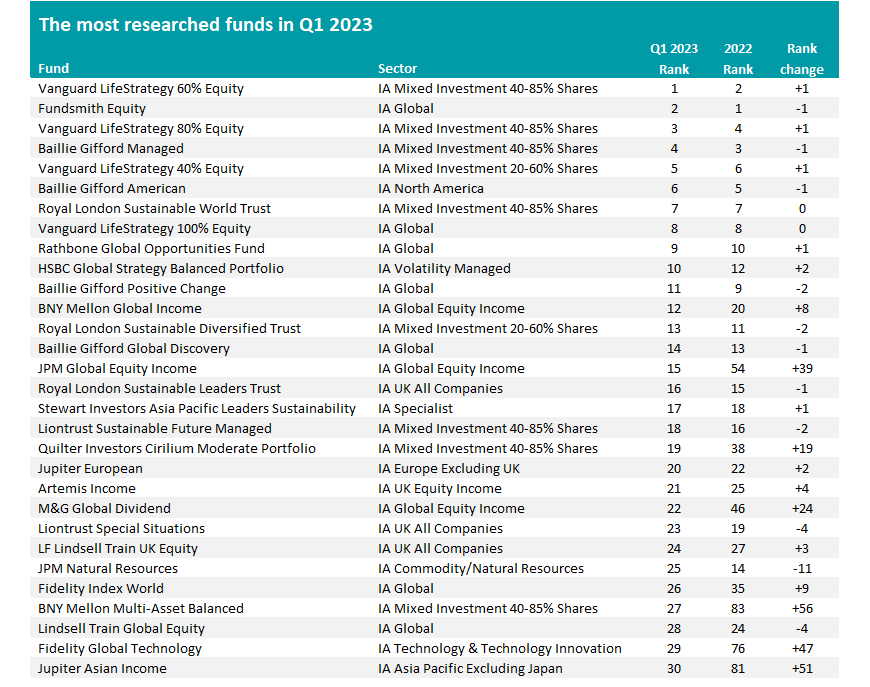

The attention that fund factsheets received on Trustnet in the first quarter of 2023 backs up this view. The table below shows the 30 most viewed factsheets in the Investment Association universe over 2023 so far, along with where they ranked in 2022 and the change in rank between the two periods.

There’s been some change at the very top of the table: Vanguard LifeStrategy 60% Equity has overtaken Fundsmith Equity to become the most-researched fund, Vanguard LifeStrategy 80% Equity has replaced Baillie Gifford Managed in third place and Vanguard LifeStrategy 40% Equity has switched with Baillie Gifford American to take fifth place.

Source: Trustnet, Google Analytics

However, several equity income strategies have climbed up the rankings over the past quarter with BNY Mellon Global Income sitting closest to the top. It’s gone from being the 20th most-researched fund in 2022 to the 12th in 2023’s opening quarter.

The fund, which is the biggest in the IA Global Equity Income sector with assets of £3.6bn, uses a top-down thematic overlay to identify powerful structural forces of change and the companies that can benefit from them. It was the second-best fund in its sector in 2022’s challenging conditions, but slipped into the third quartile for the most recent quarter.

JPM Global Equity Income has made a strong jump up the research rankings, going from being the 54th most-viewed fund factsheet last year to the 15th in the first quarter. It looks for companies with sustainably high dividends and/or sustainable dividend growth potential. It has been in the sector’s first quartile for the past four full calendar years and is second quartile over 2023 to date.

Artemis Income, M&G Global Dividend and Jupiter Asian Income are the other equity income funds to be among the 30 most-researched on Trustnet.

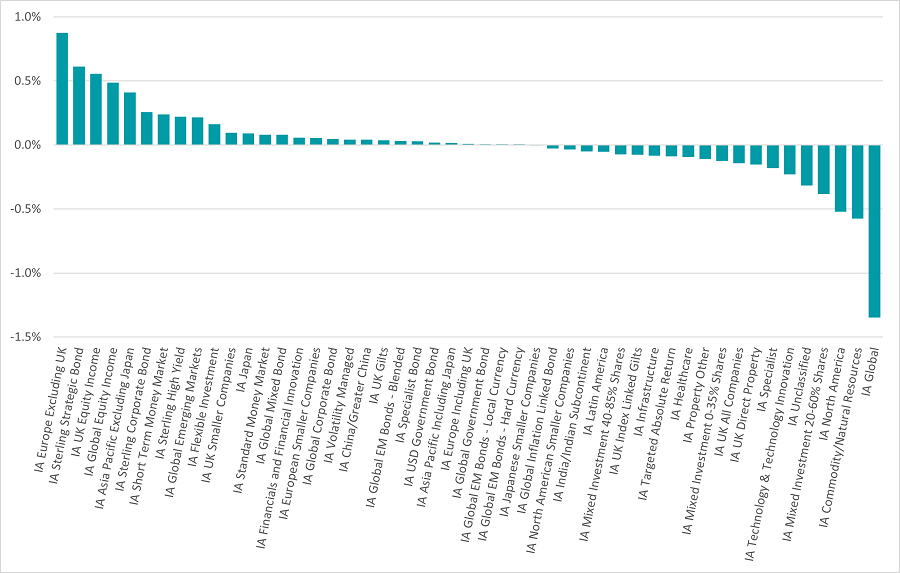

Source: Trustnet, Google Analytics

The chart above shows the change in popularity with Trustnet readers for the 57 sectors in the Investment Association universe.

Funds in the IA UK Equity Income sector accounted for 5.527% of pageviews during 2022 but this grew to 6.084% in 2023’s first quarter, while the IA Global Equity Income sector’s research share went from 3.726% to 4.214%.

It was the IA Europe Excluding UK sector making the largest gains in the first quarter, however, adding almost 1 percentage point to take its share of Investment Association factsheet views to 4.513%.

European equities spent most of 2022 beneath a cloud because of the war in Ukraine and fears that reliance on Russian gas would push the continent into recession. However, a mild winter meant that economic activity was relatively buoyant and investors have been getting more interested.

The most popular IA Europe Excluding UK funds with Trustnet readers include Jupiter European, Fidelity European, Liontrust European Dynamic, BlackRock European Dynamic and BlackRock Continental European Income.

IA Sterling Strategic Bond funds have also increased in popularity as investors seek income over growth and fixed income starts to look more attractive after years of ultra-low rates. Royal London Sterling Extra Yield Bond, Invesco Monthly Income Plus (UK), Jupiter Strategic Bond, Artemis High Income and Janus Henderson Strategic Bond are some of the most-viewed funds in this peer group.