Small-caps can fly under the radar, as most investor portfolios tend to be skewed toward larger businesses, particularly those that invest in passive funds, which are naturally weighed to the largest stocks in an index.

They represent, however, a larger opportunity set compared to their large-cap peers due to their sheer number and the breadth of sectors that they cover.

Jason Hollands, managing director of Bestinvest, said: “While the FTSE All Share Index has 580 constituents, of which 230 are small-caps (almost 40% of the total), when weighted by market-cap these are reduced to just 2.4% exposure – around the same as healthcare group GSK and less than half that of HSBC.”

Small-caps can be rewarding for an investor with a long-term horizon using them as a diversifier in their portfolio as, by virtue of their scale, they have a greater scope to grow their earnings at a quicker rate than large-caps.

In addition, small-caps are under-researched and the odds of spotting a hidden gem are, therefore, higher.

Alex Watts, investment data analyst at interactive investor, said: “Research and coverage of these companies tends to be thinner than for large companies, giving scope for substantial value to be uncovered by sufficiently diligent and skilled managers.

“The Fama French factor model posits that, over the long term, investors will find the best returns in smaller-cap stocks and companies that are trading below their fair value.”

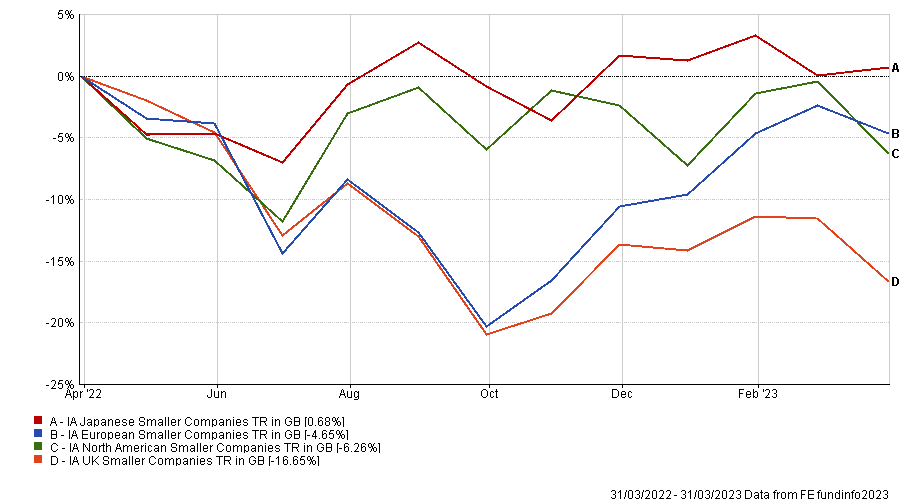

The Investment Association (IA) splits small-caps in four geographical regions: IA UK Smaller Companies, IA North American Smaller Companies, IA European Smaller Companies and IA Japanese Smaller Companies. There are also small-cap funds investing with a global or regional mandate, but they do not have their dedicated sector.

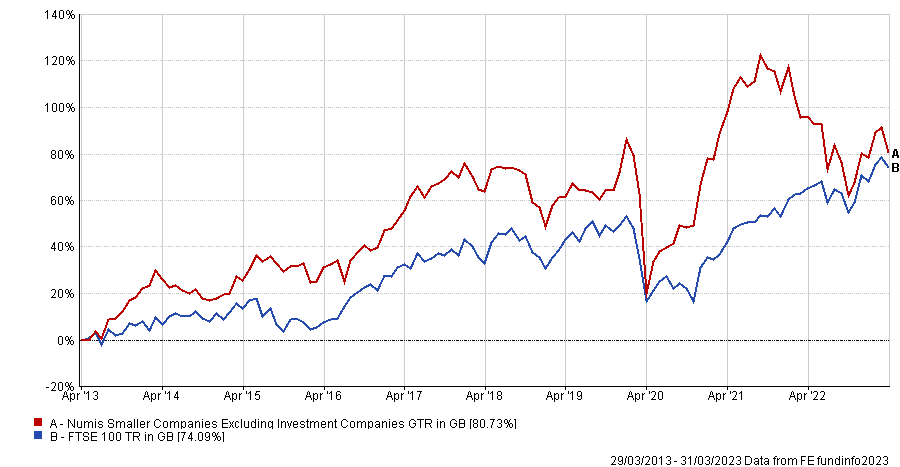

In general, the Fama French factor model proves to be correct across geographies. Taking the UK for example, whether we look at it via sectors or indices, small-caps have historically outperformed their large-cap peers. This is also true for Europe and Japan.

Total return of indices over 10yrs

Source: FE Analytics

North America, however, is the outlier, being the only market where large-caps usually outperform small-caps.

Hollands said: “That probably reflects the much better track record in the US of small, innovative companies being scaled up to become large ones, whereas in the UK such companies are often sold to larger acquirers part way through their growth journey.”

Total return of indices over 10yrs

Source: FE Analytics

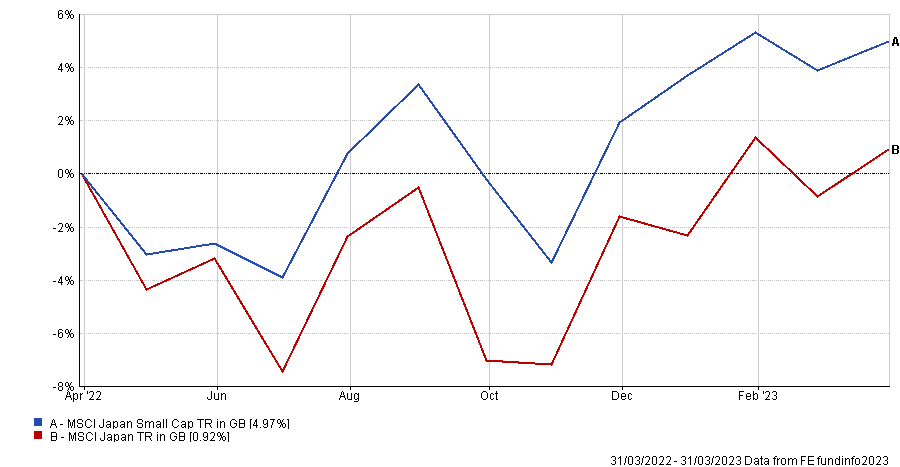

However, the trends reversed last year with the FTSE 100 outperforming the Numis Smaller Companies index, while the S&P 500 underperformed the Russell Nomura Small Cap.

US large-caps are concentrated within the technology sector which suffered in the first three quarters of 2022, while global firms in defensive areas, which dominate the UK stock market, soared.

European large-caps also beat their smaller peers over one year, whereas the dynamic remained unchanged in Japan.

Total return of indices over 1yr

Source: FE Analytics

The definition of what constitutes a small-cap varies from one region to another. For instance, Iridium is the largest stock in the Russell 2000 index, with a market capitalisation of $7.8bn (£6.3bn).

Hollands said: “Were that a UK company, that would place it in the FTSE 100 index of large-cap stocks.”

In contrast, the largest company in the Numis Smaller Companies index of 714 UK small caps has a market cap of £1.6bn, which is smaller than any company in the Russell 2000.

Due to those large contrasts in what constitutes a smaller company, Hollands warned that comparisons across different geographies are “not overly useful”.

Investing in small-caps is nonetheless risky and Laith Khalaf, head of investment analysis at AJ Bell, warned that market falls can be “particularly punitive” for this part of the market.

The risk comes in the form of heightened volatility of returns, liquidity risk as well as a greater exposure to the company’s domestic economy and currency.

Watts added: “An allocation to smaller companies can provide greater potential for long-term price appreciation but there may well be more substantial drawdowns in the near term and investors must be willing to weather this volatility.”

There are also different reasons why small-caps have not become behemoths and this is a factor investors have to take into account.

Hollands said: “Companies can either be small because they are young and fast growing, but also because they are struggling and valuations have shrunk. This means you really do need to be super-selective and sort the wheat from the chaff when investing in small-cap stocks.

“These parts of the market can also be at the brunt of changes in sentiment, with investors typically shying away from small-cap stocks during times of economic uncertainty, favouring more mature and liquid stocks.”

Despite the risks, small-caps offer more attractive valuations and higher-growth prospects than large-caps.

Watts said: “When we look at historic valuation ratios of global companies, the discrepancy in valuations of small versus large companies was exacerbated in recent years and, across the board, smaller companies are trading at low current valuations versus historic averages.

“Looking at the regional IA fund sectors assessed, the forward price-to-earnings ratios (which utilises a forecast of future earnings), with the exception of the US, are currently higher for smaller companies sectors, implying expectations of future growth.

Given the low valuations, it might be tempting for investors with a contrarian mindset to position themselves in this area of the market. However, Hollands warned that it might be too soon, given the outlook for economic growth with higher borrowing costs, tighter lending conditions and declining real wages.

Total return of smaller companies sectors over 1yr

Source: FE Analytics

For investors wishing to try their luck with small-caps, Khalaf showed a preference for both active funds and the investment trust route.

He said: “The small-cap area of the market is populated by companies on the way up, companies on the way down, and those treading water, so it’s an area where good active management has been shown to be worth its weight in gold.

“Investors can also gain exposure through investment trusts whose fixed pool of capital is well suited to investing in smaller companies, albeit with even greater volatility as a result of the discount and premium mechanism.”

Hollands warned, however, that investors should be wary of small-cap funds that have grown rapidly in size. This is because they have natural capacity limits, which means they may no longer be able to replicate past performance.