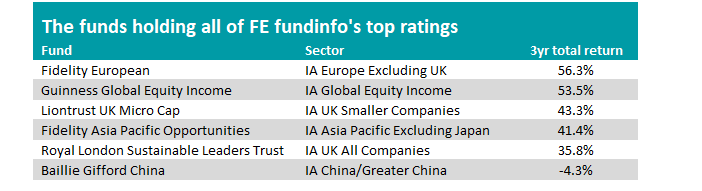

Just 0.1% of funds in the Investment Association universe have won all of FE fundinfo’s top ratings over recent years, including a couple of well-known names.

Of the 5,238 funds in the Investment Association’s sector, just six hold the top FE fundinfo Crown Rating of five, have an FE fundinfo Alpha Manager at the helm and have been selected for the FE Investments Approved List.

FE fundinfo Crown Ratings assess funds based on historical performance, volatility and consistency. Crown Ratings range from one to five, with higher ratings indicating better performance. The system aims to help investors assess funds based on risk-adjusted performance, stability and risk level.

Meanwhile, FE fundinfo Alpha Manager ratings assess fund managers on their ability to consistently generate risk-adjusted outperformance relative to a benchmark index. The rating aims to identify managers who have demonstrated skill in adding value to their funds over time by taking into account factors such as alpha and consistency of performance.

Finally, funds on the FE Investments Approved List are those that have passed a rigorous vetting process established by the analysts in the FE Investments team and can be included in their model portfolios.

Source: FE Analytics

The only six funds in the Investment Association universe that hold all three of these ratings can be seen in the table above, ranked by their total return over the past three years.

Samuel Morse’s £4.1bn Fidelity European fund tops the table with its 56.3% total return (which is a second-quartile result for the IA Europe Excluding UK sector).

The fund uses a stock-picking strategy that revolves around the belief that companies which consistently grow their dividends outperform the wider market over time. Morse also likes companies with sustainable margins, a strong balance sheet and preference for funding dividends through organic growth rather debt.

FE Investments analysts said: “The fund would suit an investor looking for core European exposure amongst a diversified portfolio of funds.”

Next up is Guinness Global Equity Income, which is run by Alpha Manager Ian Mortimer and Matthew Page. It is in the IA Global Equity Income sector’s second quartile after making 53.5% over three years.

The £4.3bn fund prefers companies with quality characteristics and low debt. A differentiator is the fact that the portfolio is equally weighted between around 35 names, which means it ends up being meaningfully different to the benchmark.

“The fund has shown consistent, best-in-class performance over a long period operating under a well-defined and robust process that is repeatable and has been kept unaltered since launch,” FE investments said. “Managers Matthew Page and Ian Mortimer bring considerable intellectual heft to the strategy, which has a stellar record versus peers over all time periods.”

Liontrust UK Micro Cap is one of two UK equity strategies to hold five crowns, have an Alpha Manager running the portfolio (two actually: Anthony Cross and Julian Fosh are among its five-strong team) and appear on the FE investments Approved List.

It applies Liontrust’s Economic Advantage process, which looks for companies with hard-to-replicate intangible assets such as intellectual property, infrastructure advantages or significant recurring business to the smallest companies in the market.

“This is a true micro-cap fund with stocks over £275m being removed from the portfolio in a timely manner. The process has been proved successful through the team’s management of three other UK funds,” analysts with FE Investments said.

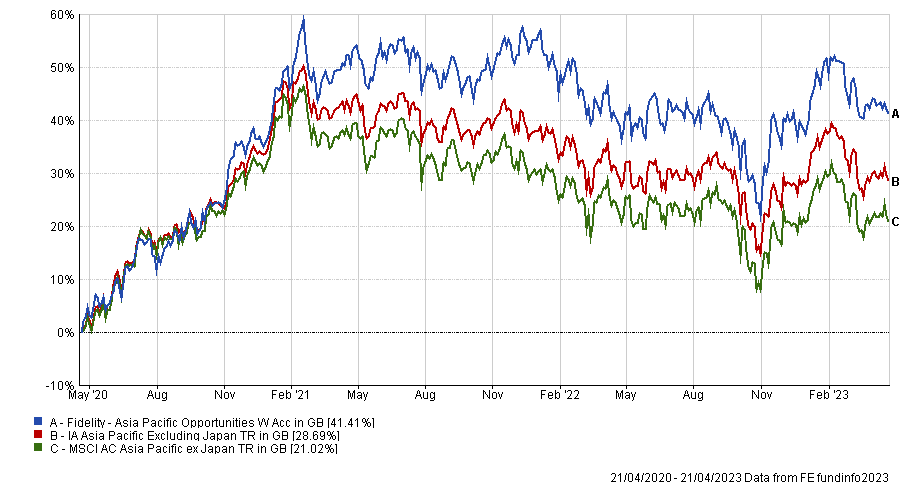

Fidelity Asia Pacific Opportunities is managed by Anthony Srom, who concentrates on three factors that influence the performance of a stock: fundamentals, sentiment and valuation.

Performance of Fidelity Asia Pacific Opportunities vs sector and index over 3yrs

Source: FE Analytics

FE Investments likes the £1.5bn fund because of Srom’s “excellent track record” in both rising and falling markets, which they argue is more impressive because he avoids the larger companies that most managers flock to.

“We like that the manager has no deliberate style bias and that the focus is entirely on stock selection,” the analysts added. “Having said that, new positions typically exhibit a contrarian bias and he prefers to buy stocks that are under-owned and underappreciated by the market.”

Mike Fox’s £3.2bn Royal London Sustainable Leaders Trust is next. It resides in the IA UK All Companies sector and has environmental, social and governance (ESG) embedded in its process.

Fox and his co-managers will only look at companies with strong ESG credentials, while excluding those exposed to controversial activities. They tend to narrow the search to those that are actively trying to contribute to a more sustainable society while being relatively undervalued by the market.

The FE Investments team said: “It is a very good candidate for investors who specifically want exposure to companies that are making a positive impact for society or operating in a sustainable manner. Mike Fox is a very experienced manager and his track record highlights the benefits of his style.”

Baillie Gifford China is the final fund on the list. It is run by FE fundinfo Alpha Manager Sophie Earnshaw, along with Mike Gush and Roderick Snell.

It buys companies with an ability to deliver earnings growth over the long term, ultimately aiming for those that can double their profitability over a five-year period.

“Given the time horizon of the team’s views and the potential volatility experienced by underlying holdings, the fund is best suited to those who have a strong conviction in China and who are willing to hold for the very long run,” FE Investments added.