The world’s two largest asset management houses are taking opposing views on the merits of the 60/40 portfolio, with Vanguard continuing to back the classic model while BlackRock argues it is no longer fit for purpose.

The 60/40 portfolio is a traditional investment strategy that allocates 60% of assets to stocks and 40% to bonds. This balanced approach aims to provide long-term growth and income while reducing risk through diversification: the equities allocation offers potential capital appreciation, while the bonds allocation provides stability and income.

Although historically effective, the 60/40 portfolio has come under increasing scrutiny over the past year or so as rising inflation and interest rate hikes caused stocks and bonds to fall in tandem.

Performance of 60/40 portfolio, equities and bonds in 2022

Source: FE Analytics

The chart above shows how bonds failed to provide a shield from the sell-off in the stock market last year, leaving investors in the balanced portfolio suffering a loss of the similar magnitude to equities.

Defending the role of the 60/40 portfolio, Vanguard multi-asset product specialist Mohneet Dhir said: “Traditional multi-asset portfolios of stocks and bonds, sometimes called the 60/40 model, hinges on investors accepting the trade-off between risk and reward, and appreciating the historical characteristics of different types of investment.

“We can’t control what happens in markets but understanding the historical return patterns of equities and bonds can help manage risk in client portfolios.”

Dhir argued that the positive correlation between stocks and bonds in 2022 is a short-term blip that can sometimes occur in the model, before the long-term trend of negative correlation resumes.

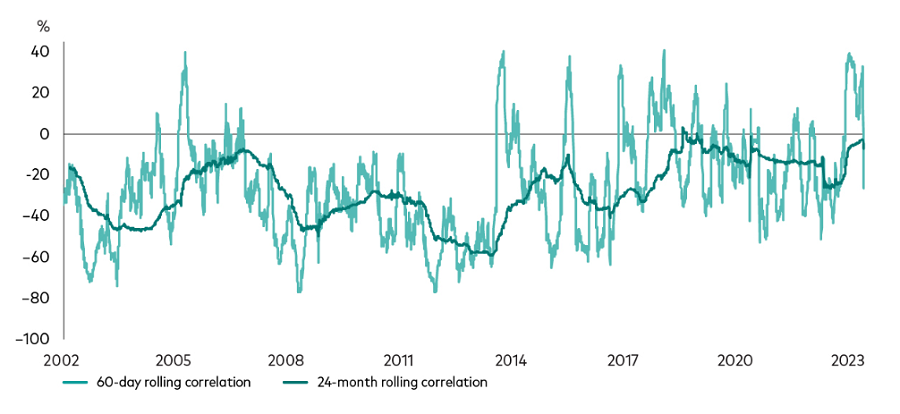

The below chart shows this through the rolling correlation of daily stock and bond returns over both 60 business days and over two-year periods since 2002.

It suggests that the return correlation between stocks and bonds has been negative for the past 20 years when looked at on a two-year view but it is “not uncommon” to see a positive correlation over shorter time frames.

Short- and long-term stock and bond return correlation

Source: Vanguard calculations in GBP, based on data from Refinitiv

“That’s why, for long-term investors, we advocate an allocation to bonds as part of a multi-asset portfolio, because bonds have historically offered some protection from equity market downturns,” Dhir said.

“It would be remiss not to acknowledge the double fall of both stock and bond markets in 2022, but occasionally this can happen before the negative return correlation between equities and bonds reasserts itself. Indeed, global bond prices rose in the first half of March as global equities sold-off.”

This is the oppositive view taken by BlackRock, which has spend much of 2023 effectively calling time on the 60/40 portfolio.

In a recent note, strategists at the BlackRock Investment Institute said investors need to adopt a more nimble tactical approach, take a more granular look at assets and pay more attention to income, rather than retaining a 60/40 allocation.

“We don’t see the return of a joint stock-bond bull market like we saw in the ‘Great Moderation’. That was a decades-long period of largely stable activity and inflation when most assets rallied and bonds provided diversification when stocks slumped,” BlackRock senior portfolio strategist Paul Henderson said.

“We think strategic allocations of five years and beyond built on these old assumptions do not reflect the new regime we’re in – one where major central banks are hiking interest rates into recession to try to bring inflation down.”

Over at Vanguard, Dhir argued in favour of the more strategic method to asset allocation that comes with models such as the 60/40 portfolio, suggesting that tactical approaches to asset allocation are “very difficult to get right consistently”.

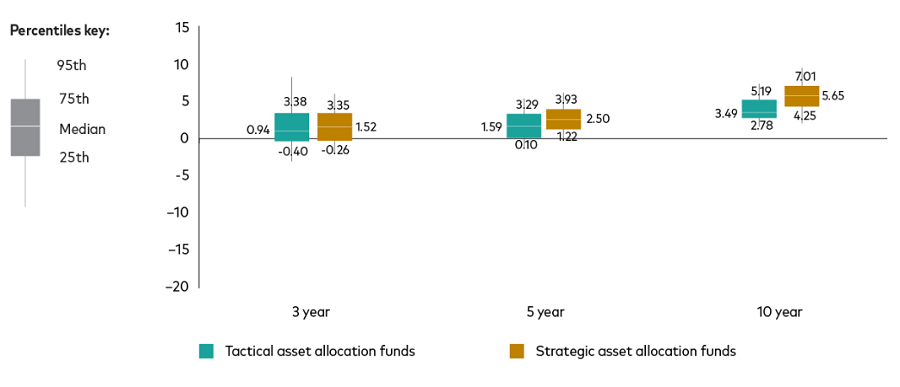

Distribution of returns for strategic vs tactical funds over different time periods

Source: Vanguard calculations using Morningstar data

The chart above shows how tactical allocation funds had a lower median return and greater distribution of outcomes than strategic allocation counterparts over three, five and 10-year periods.

“In other words, tactical funds take more risk than strategic funds and often they get it wrong,” Dhir said.