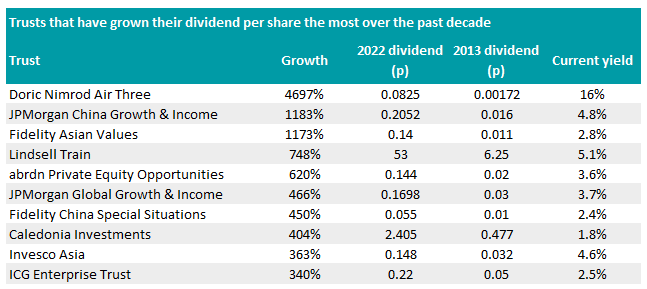

Those investing in trusts for a source of income may consider strong dividend growth as a sign that managers have consistently upped their payouts over a long time, but the data can be misleading.

QuotedData found the 10 portfolios that increased their pay-outs the most over the past decade, but few delivered sustainable growth.

Most of the biggest growers were trusts that had closed down and were repaying capital to shareholders via dividends, as their dividends were unnaturally inflated. As such, they were excluded from consideration.

The remaining portfolios had sizable leaps in pay-outs over the past decade, but did so by changing their dividend policy, ranking them comparatively higher than where they were at the start of the decade.

Source: QuotedData

Typically, these funds have allowed the dividends to be paid by a mixture of underlying dividends from holdings as well as capital gains.

David Johnson, senior analyst at QuotedData, said: “Their ability to hold unconventional assets and tap into their capital account to fund their dividends has allowed many non-conventional strategies to exhibit stellar dividend growth levels, although these are very specific instances and the sort of exponential growth seen cannot be sustainable, which is why it is important to look below the surface.”

While dividend growth is an important factor to income investors, it does not mean a lot if it lacks consistency, according to Johnson.

“Ultimately, the process of ranking trusts by their dividend growth is rife with pitfalls, though it does throw up a few interesting trends that are insightful,” he added.

Despite most of the trusts leaping on to the top grower list as a result of technicalities, analysts pointed out that there are a few names that could be of interest to income investors, such as the two J.P. Morgan trusts

Pay outs by the pair jumped after they introduced a plan to pay out 4% of their net asset value (NAV) in dividends every year.

Johnson said that their “explosive dividend growth” was so high because their preference for growth stocks meant they had a low starting yield.

This strategy could come under pressure during times of market weakness, however, as when the trust makes a loss over 12 months, the amount paid out should be relatively lower than the previous year.

Even so, the JPMorgan Global Growth & Income trust has increased its pay-out every year since introducing the new dividend policy in 2016, making it a stand out portfolio for income investors, according to Emma Bird, head of investment trust research at Winterflood.

She said: “This degree of consistency is commendable, particularly over a period with a range of market and macroeconomic conditions.

“We believe that the disciplined application of the managers’ style-agnostic, research-driven investment approach has been a key driver of the consistency of performance and would expect this to continue, which should in turn support future dividend increases.”

It was up 239% in total return terms over the past decade, beating its peers in the IT Global Equity Income sector by 117.8 percentage points.

Total return of trust vs benchmark and sector over the past 10 years

Source: FE Analytics

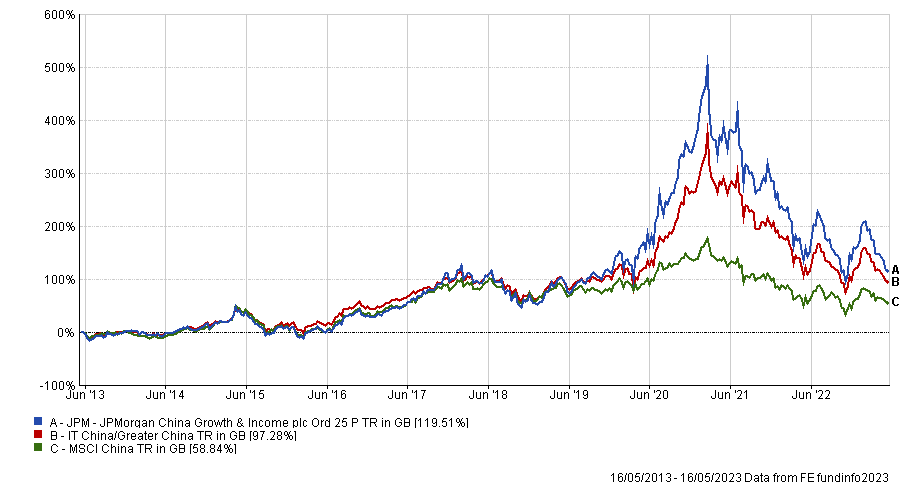

JPMorgan China Growth & Income, on the other hand, lowered its dividend from 5.7p per share last September to 3.42p at the same time this year as the NAV shrank, but that didn’t stop Chris Salih, senior research analyst at FundCalibre, remaining positive on the trust.

It made a total return of 119.5% over the past decade, beating the IA China/Greater China sector by 22.2 percentage points.

Performance more than halved from its peak of 505% peak in February 2021, but Salih said it was the most exciting trust on the list given the high potential in Chinese equities moving forward.

“China, from a stock perspective, is becoming more attractive for an income seeker as more companies are rolling off their growth and starting to use dividends, particularly in the internet and e-commerce space,” he said.

“Clearly it is in the early stages and there will be volatility, but there is significant scope for further dividend growth.”

Total return of trust vs sector and benchmark over the past 10 years

Source: FE Analytics

Johnson noted that the presence of four trusts investing in Asian equities highlights the growing income opportunities in the region.

“They reflect the success story of emerging market equities, not only because of the structural growth opportunities offered by the markets in which they invest, but also because of the general trend of improving corporate governance in these regions, which has led them to adopt more shareholder-friendly policies like paying higher dividends,” he said.

The Fidelity Asian Values, Fidelity China Special Situations and Invesco Asia trusts made total returns of 183%, 177.9% and 150.9% respectively over the past decade, beating each of their individual benchmarks and peer groups.

Total return of trusts over the past decade

Source: FE Analytics

However, Johnson noted that the board of Fidelity China Special Situations have signalled that the high rate of dividend growth it has experienced cannot be sustained in the long term.

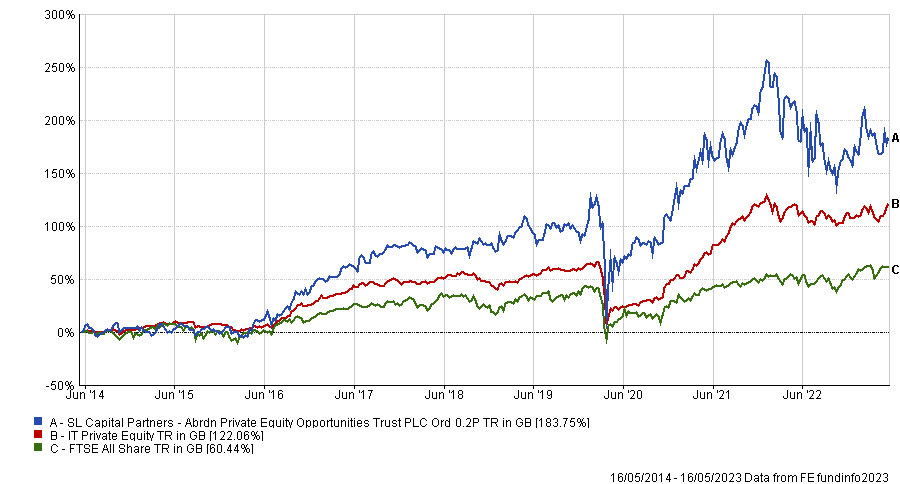

Dividend policy changes made some trusts on the list more attractive, even if the dividend growth is misleading. abrdn Private Equity Opportunities offers an appealing dividend in a sector with limited income opportunities, Johnson said.

Dividends leapt from 5.4p per share to 12p in 2017 after the trust changed its policy, allowing it to pay shareholders from capital rather than revenue alone.

Johnson said: “Thanks to its fund-of-fund model, and investments in more mature companies, its revenue generation has been more robust than one would expect from a private equity strategy and has not needed to materially rundown its NAV to fund its dividend since the policy change.”

“Its yield may not meet the threshold of every income investor, it is the closest they will get to being able to utilise the listed private equity market, which offers investors a powerful source of diversification.”

It also beat its peers on total return over the past decade, climbing 183.8% compared to the sector’s 60.4% average.

Total return of trust vs sector and benchmark over the past decade

Source: FE Analytics

Lindsell Train also offers an attractive income opportunity, according to Johnson. He said it is “a surprising member” given its preference for low-yielding quality-growth companies, yet the 40% exposure to its own management firm boosts its pay-out.

The firm pays out 80% of its profits as dividends, giving the shareholders a sustainable source of income, Johnson added.

“This effectively puts Lindsell Train in a unique position to fund its dividend and separating it from funds of a similar style profile who cannot generate anywhere near the same revenues,” he said.#

However, not all were appropriate for income investors, according to Johnson. The biggest grower of the past decade – Doric Nimrod Air Three – increased its dividend by a significant 4,697%, yet Johnson said its niche specialism in the aviation industry means it “is unlikely to meet most investors’ risk appetite”.