Dividend growth is an appealing attribute that those investing in trusts for income often look out for, but Trustnet found that seeking dividend growth alone can be littered with irregularities.

However, the AIC’s 19 Dividend Heroes have increased their pay-outs for a minimum of 20 years, providing investors with the consistent growth they desire.

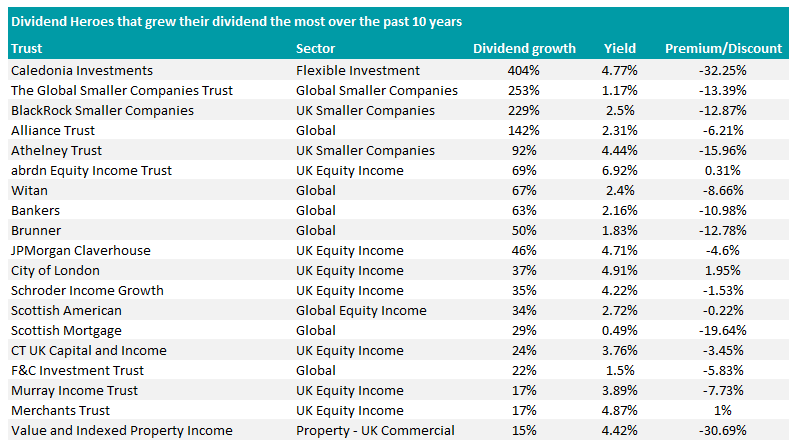

Using research from QuotedData, we look at the Dividend Heroes that have increased their pay-outs to shareholders the most over the past decade.

Source: QuotedData

All of them upped their dividend annually, but only four – Caledonia, Global Smaller Companies, BlackRock Smaller Companies and Alliance Trust – increased pay-outs by more than 100% over the past decade.

Of those, Caledonia was “the true standout”, according to David Johnson, analyst at QuotedData. It grew its dividend by 404% over the period at an average annual growth rate of 48%, which is “far in excess” of its peers.

Johnson credited this strong growth to the trust’s high allocation to private equity, with two-thirds (66%) of the portfolio held in unlisted companies and private equity funds.

This differentiates it to its fellow Dividend Heroes who do not have such a high allocation to unlisted assets, according to Johnson.

Analysts at Kepler Trust Intelligence added: “It offers investors a differentiated approach to global equity investing, whereby it combines listed equities with a majority position in unlisted companies, leading Caledonia to provide its shareholders with strong-diversifying potential.

“Caledonia is arguably best suited to investors with a very long-time horizon, as such a duration is required to fully realise the value in the private equity holdings. Such investments require investors to remain committed for many years.”

The two special dividends it paid out over the past 10 years are also likely to have boosted overall growth. This typically happened when the trust gained a significant excess of cash, such as its sale of Deep Sea Electronics and BioAgilytix in 2022 which resulted in a 175p pay-out per share.

Caledonia led dividend growth over the past decade, but it also upped pay-outs over the long term too. It has the longest record among the Dividend Heroes alongside Alliance Trust, increasing its dividend for 56 consecutive years.

Johnson said: “When making investments, Caledonia gives consideration to their ability to generate sustainable income and, reflecting this, its most recent dividend was fully covered by revenue.”

It also outperformed on total return, climbing 145.5% over the past decade and beating both the FTSE All Share benchmark and IT Flexible Investment sector.

Total return of trust vs benchmark and sector over 10yrs

-1.png)

Source: FE Analytics

Columbia Threadneedle’s Global Smaller Companies trust was the second biggest dividend grower over the past decade, more than tripling (253%) its pay-outs to shareholders.

Unlike Caledonia, Johnson said there was no special attribute boosting the trust’s yield, simply good management: “Its dividend growth has been the result of judicious management by its board; it is a trust which has a preference for high-quality, but not necessarily too highly valued, smaller companies.”

Peter Ewins has managed the trust since 2009, but analysts at RSMR pointed out that he is supported by multiple teams that each focus on a different region.

“This is a well-managed trust with reasonable performance that would provide differentiated exposure to global small caps,” they said. “It may be suitable for a client with a higher risk appetite, as a satellite holding, with a longer-term time horizon in mind.”

This strong management team with its proven stock-picking skills has led the trust to naturally cover its dividend growth for nine of the past 10 years without having to dip into reserves. The only year it failed to do so was 2021 when impact of Covid lockdowns restricted revenues.

The Global Smaller Companies trust beat its peers in the IT Global Smaller Companies sector with a total return of 108% over the past decade, but it trailed 56.4 percentage points behind its MSCI World ex UK Small Cap Index benchmark.

Total return of trust vs benchmarks and sector over 10yrs

-1.png)

Source: FE Analytics

Another beneficiary of cash generative small-caps was the BlackRock Smaller Companies trust, which upped its dividend payments by 229% over the past 10 years.

Despite being the youngest Dividend Hero (only just making it into the group with its 20 year record for consecutive growth), it was also able to naturally cover its dividend for nine of the past 10 years.

BlackRock Smaller Companies was up 154.6% over the period, overtaking its peers in the IT UK Smaller Companies sector by 16.6 percentage points.

Total return of trust vs sector and benchmark over 10yrs

.png)

Source: FE Analytics

Johnson noted that the appearance of two smaller companies trusts – one global and one UK – in the top spot illustrates the dividend growth opportunities in small-caps.

“One thing that clearly remains in focus here is the importance of quality amongst those in the small-cap space,” he said.

“It appears that with a focus on profitable, cash generative businesses and diligent management teams, a strong and growing dividend becomes a natural by-product.”

Alliance Trust was the only other Dividend Hero to more than double its dividend, with pay-outs growing 142% over the past decade.

Johnson said that it was the least surprising constituent given the “drastic changes” it went through over the period, most notably its pivot to a multi-manager strategy under Willis Towers Watson.

It went from a self-managed trust to one that is run by nine separate teams, with Rajiv Jain, Brian Kersmanc and Sudarshan Murthy at GQG Partners running the largest portion (at 21% of the portfolio).

The trust still works well despite having so many managers, according to Johnson, who said: “The portfolio of global listed equities has few style deviations from the MSCI AC World index by design and therefore seeks to add value through stock selection.”

Returns were up 187% over the past decade, flying 57.8 percentage points ahead of the IT Global sector.

Total return of trust vs benchmark and sector over the past 10 years

-1.png)

Source: FE Analytics

Although all four of these trusts hiked their dividends by sizable amounts, Johnson said that the was almost no correlation between these increases and their yields.

Only Caledonia’s yield of 4.8% would catch the eye of most income investors, Johnson added, yet less than half of the Dividend Heroes have a yield exceeding 4%.

Income-seeking investors may have overlooked some of these trusts in pursuit of high yields, but they would have missed out on some sizable and consistent dividend growth.