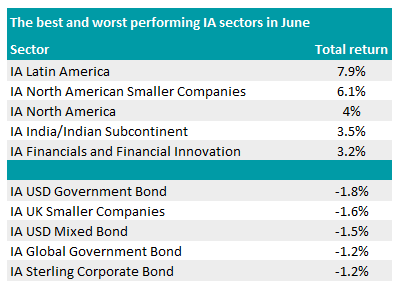

Funds in the IA Latin America sector beat all other portfolios in June, with the group climbing by an average of 7.9% throughout the month.

This was largely driven by souring relations between the US and China, with countries in Southern America becoming a more favourable option for the United States, according to Ben Yearsley, director of Fairview Investing.

The US imported $537bn worth of goods from China last year, according to the Peterson Institute for International Economics, but tension between the two nations has made markets more positive on Latin America as a supplier to the States.

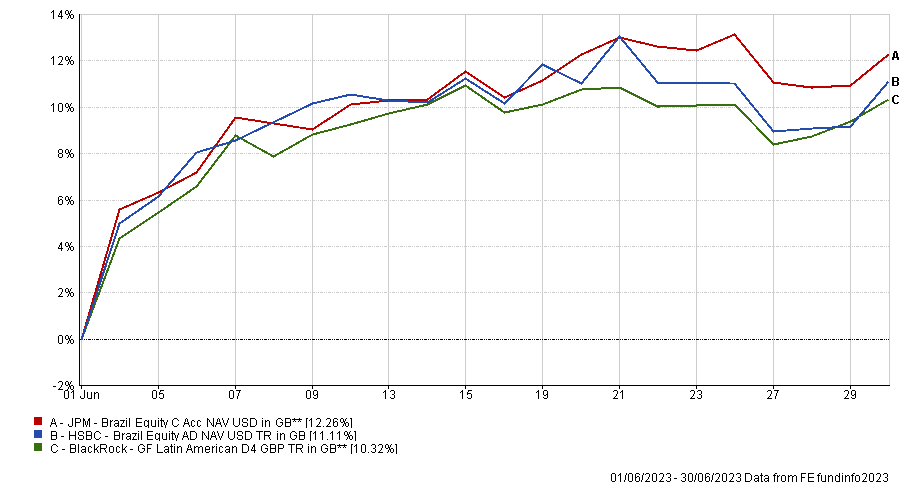

Source: FE Analytics

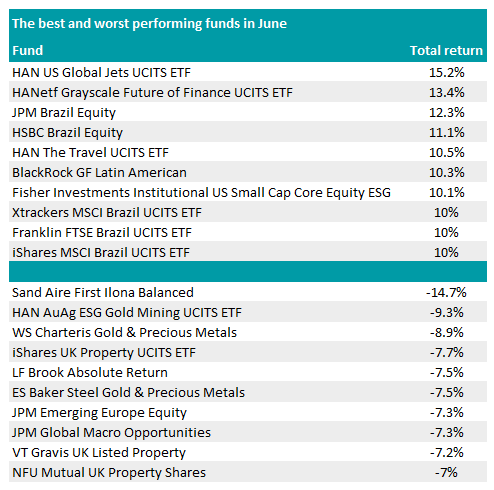

This was reflected in the top performing funds of June as JPM Brazil Equity, HSBC Brazil Equity and BlackRock GF Latin American led the charge with total returns of 12.3%, 11.1% and 10.3% respectively throughout the month.

Indeed, half of the top 10 portfolios of June were invested purely in Brazilian equities, revealing the surge in positive sentiment towards the region.

Yearsley pointed out that this newfound partnership was also positive for funds invested in US equities too, with the IA North American Smaller Companies and IA North America trailing behind with increases of 6.1% and 4% respectively in June.

Total return of funds in June

Source: FE Analytics

The Fisher Investments Institutional US Small Cap Core Equity ESG fund was among the top 10 best performers of the month, climbing 10.1% over the 30-day period.

This £268m fund also outperformed over the long term, climbing 143.5% since launching in 2016 and beating the IA US Smaller Companies sector by 35.2 percentage points.

Four of its five managers have been running the portfolio since launch, with Michael Hanson joining the team less than a year after its inception.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

Top 10 performers also included some less conventional names, such as three tracker funds run by HANetf.

The HAN US Global Jets UCITS ETF – which invests in the global airline industry – was the best performing fund in June, soaring 15.2%.

Similarly, its HAN The Travel UCITS ETF was also among the best performers after climbing 10.5% in June. It invests in hotels, cruise liners and online booking companies as well as airlines.

Source: FE Analytics

At the bottom of the pile were mostly fixed income funds, with the IA USD Government Bond sector falling the furthest, down 1.8%.

With the monetary outlook still hazy, Yearsley said “it’s fair to say bond markets have taken fright about where interest rates might end up”.

Funds that dropped the most included commodity trackers such as HAN AuAg ESG Gold Mining UCITS ETF, WS Charteris Gold & Precious Metals and ES Baker Steel Gold & Precious Metals, which fell 9.3%, 8.9% and 7.5% respectively.

There were also three property funds – iShares UK Property UCITS ETF, VT Gravis UK Listed Property and NFU Mutual UK Property Shares – that dropped by more than 7% throughout June.

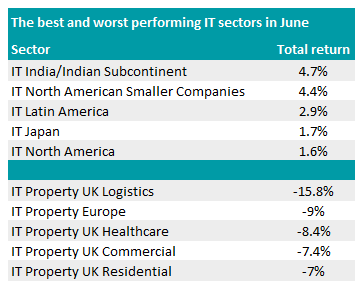

This underperformance was even more pronounced in the investment trusts world, with six of the 10 worst performing sectors investing in property.

Source: FE Analytics

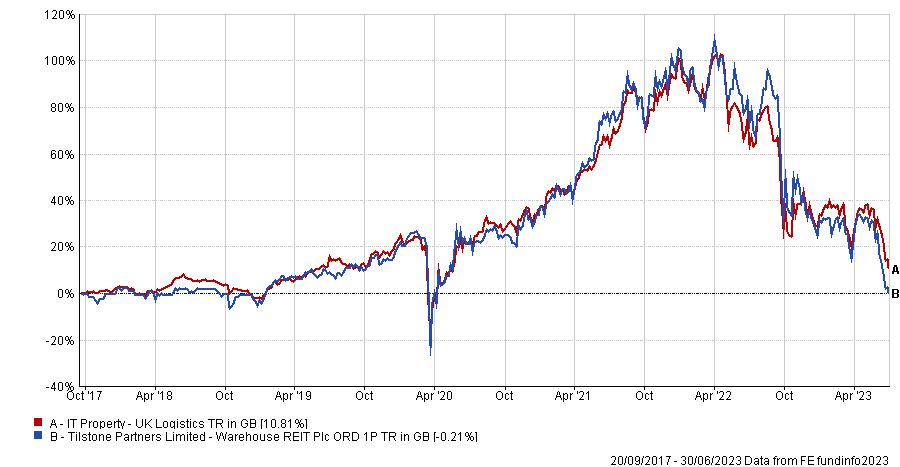

The IT Property UK Logistics sector performed worst overall, with returns sinking 15.8% throughout the month.

One of the trusts in the sector – Tilstone Partners Limited Warehouse – was among the worst performers throughout the month as shares fell 20.7%.

Its share price more than halved from its peak in April last year, with returns now up a modest 0.2% since launching in 2017. The discount has widened to 36.2%.

Total return of trust vs sector since launch

Source: FE Analytics

However, the top end of the investment trust universe is benefiting from similar tailwinds to the closes-ended world, with IT North American Smaller Companies and IT Latin America up 4.4% and 2.9% respectively over the past month.