UK equities have been unloved for many years and the funds in the UK sectors of the Investment Association universe have been suffering from this.

For instance, the IA UK All Companies sector was the most sold peer group in 2022 and a recovery does not seem to be around the corner, as UK funds suffered once more from strong outflows in June 2023, according to Calastone.

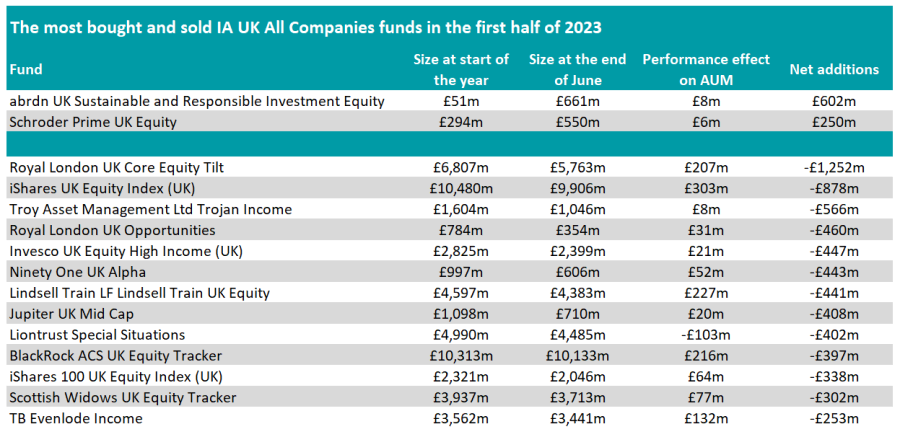

This is also what the below study – which looks at the most bought and sold UK funds in the first half of 2023 – illustrates.

In total, there were 13 funds in the IA UK All Companies sectors where investors took out more than £250m.

In comparison, there were only two funds where investors added at least £250m in the same period.

Royal London UK Core Equity Tilt is the fund that shed the most, with investors withdrawing over £1.2bn from the fund in the first half of the year. The fund largely tracks the FTSE 350, although it has the additional aim of having a carbon intensity which is at least 10% less than the benchmark.

Source: FE Analytics

Despite the outflows, all of the funds apart from Liontrust Special Situations made a positive return in the opening half of 2023. The Liontrust fund was down 0.9%, putting it in the bottom quartile of the sector.

The fund in the IA UK All Companies that captured the highest net inflows in the same period was abrdn UK Sustainable and Responsible Investment Equity, with over £600m added into the fund.

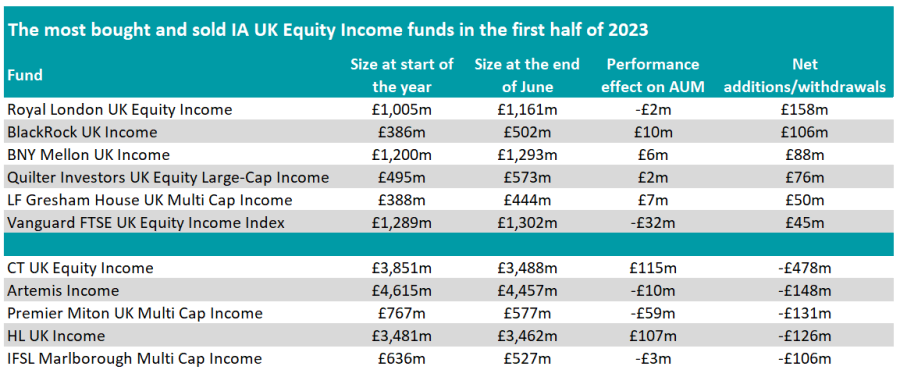

The IA UK Equity Income sector displayed a similar pattern, with five funds losing over £100m and only two receiving inflows over £100m.

With outflows of £478m, CT UK Equity Income is the fund in the sector that shed the most. Longstanding manager Richard Colwell retired at the end of 2022; the fund is currently run Jeremy Smith.

Source: FE Analytics

Negative returns compounded the outflows for three funds in the list: Artemis Income, Premier Miton UK Multi Cap Income and IFSL Marlborough Multi Cap Income.

The other way around, Royal London UK Equity Income gained £158m in AUM in the first half of the year.

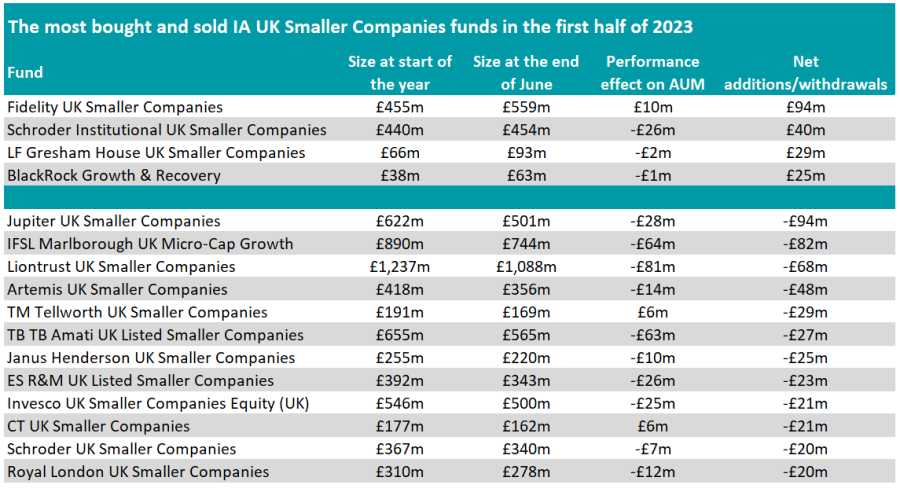

In the IA UK Smaller Companies, four funds attracted inflows of £20m or more, while 12 funds lost at least £20m.

Fidelity UK Smaller Companies is the fund that grew the most, with £94m added to its AUM between January and June.

Source: FE Analytics

In the same period, Jupiter UK Smaller Companies lost £94m and is the IA UK Smaller Companies fund that shed the most.

TM Tellworth UK Smaller Companies and CT UK Smaller Companies was the only funds losing with outflows of more than £20m that managed to make a positive return over the six months under review.