With the dust of the US election result slowly settling, fund managers and investors are analysing which areas of the global markets might do well during Donald Trump’s upcoming presidency.

Today we are casting our minds back to Trump 1.0, scanning the market from when he first got elected in 2017 to when he lost to Joe Biden in 2021. The goal is to find out which sectors and funds worked back then and ask whether they might re-emerge as winners.

There are a few caveats, however. Although the 2017-2021 era is not too long ago, the context was different. Technology-focussed investments were top performers, but valuations had not reached today’s heightened levels.

Also of note, China was propping up portfolios during the first Trump administration, despite the introduction of trade tariffs, whereas during the past couple of years, the Chinese market has been a drag on returns.

Whether these trends are about to turn is anyone’s guess. History rhymes but rarely repeats itself.

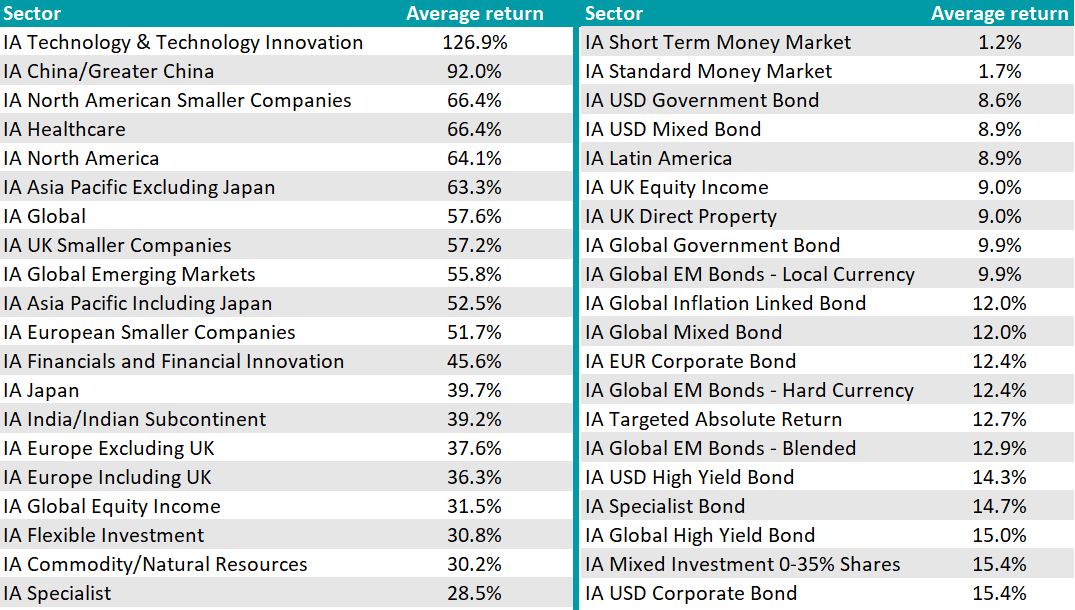

Top and bottom 20 Investment Association sectors between 2017 and 2021

Source: FE Analytics

US equities delivered double-digit returns during Trump’s first term, despite the Covid outbreak near the end of his period in office.

Greg Eckel, portfolio manager of Canadian General Investments, said: “Even in his final year, which encompassed the onset of a pandemic and significant market volatility, most subsectors maintained the positive trends seen before the pandemic.”

Leading the returns by quite a margin during Trump’s first presidency was technology, followed by China.

Eckel expects the technology sector’s dominance to continue and described Nvidia, Amazon and Microsoft as “logical US large-cap choices”. For pureplay e-commerce growth, Shopify “fits the bill”.

US smaller companies were the third-best sector, returning more than the average IA North America fund. James Yardley, senior research director at Chelsea Financial Services, believes history might repeat itself here. “Trump's ‘America first’ approach and potential tariffs, especially on Chinese goods, may create advantages for US-based small and mid-cap companies,” he said.

James Yardley also thinks US defence companies are poised for gains. “The conversation around environmental, social and governance (ESG) principles is evolving, with more investors recognising the importance of security and defence in today's geopolitical climate, which could lead to broader investment in defence stocks, potentially making them an attractive option in a Trump-led global economy,” he said.

Healthcare did well during Trump 1.0 but Eckel is sceptical about the sector’s future. “Be wary and expect a volatile environment irrespective of the next administration as the US healthcare industry is extremely complicated and highly prone to changes in government policy,” he said.

The right-hand side of the table above, which highlights the bottom 20 sectors, was filled with US bond funds, including corporate and high-yield, whose high-single digit and low-double digit returns were in line with European and global bonds.

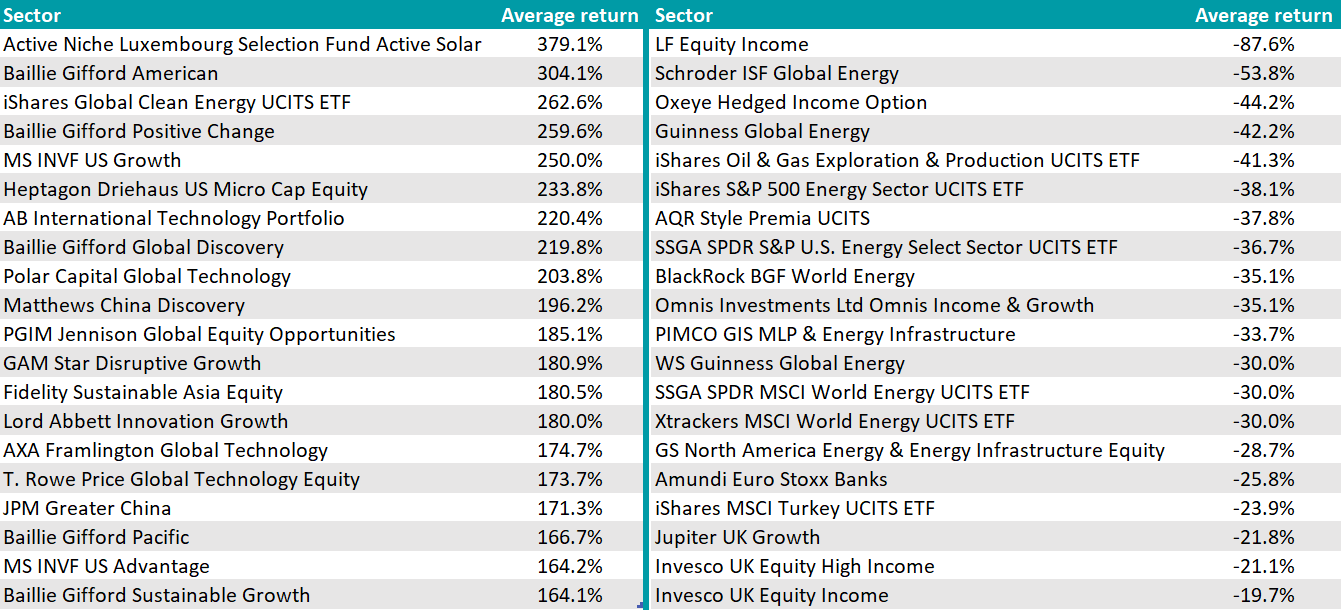

Top and bottom 20 funds between 2017 and 2021

Source: FE Analytics

On a fund level, another trend emerges, with clean energy and ethically-minded funds and trackers coming out on top of the list, which might come as a surprise.

Despite Trump’s mantra of “drill, baby, drill”, many energy, oil and gas funds crashed spectacularly between 2017 and 2021, registering double-digit losses in the period, while clean energy flourished, as the table above shows.

Renewable energy stocks have struggled lately but Nigel Green, chief executive officer of deVere Group, thinks the recent sell-off “will be perceived as a strategic buying opportunity by savvy investors”.

Ultimately, no one’s crystal ball is better than anyone else’s, and the jury will be out for the next four years.