Not many experts were suggesting investors sell Baillie Gifford funds when their performance had been suffering due to the rising interest rates. Most advice back then was to hold these positions in underperforming strategies.

Now the funds have recovered somewhat, with growth investing returning to the fore on the back of a perceived conclusion of a higher-inflation and higher-rates regime.

But investors shouldn’t get carried away and immediately return to old patterns, but instead consider the situation carefully before entering new growth positions or buying a Baillie Gifford fund. In fact, experts even suggested this might be the time to re-think the position and possibly get out.

For Shannon Lancaster, fund analyst at Ravenscroft Group, who focuses on longer-term trends like changing demographics, accelerating innovation, environmental solutions and the rise of the emerging middle class, it’s usually uncommon to try to time trades in growth funds, which are usually held with a long time horizon.

But, seen from a valuation discipline point of view, things could be different.

“At the start of the year, many funds including Baillie Gifford’s, were looking relatively attractive versus their long-term valuation history. This may prompt a review of the fund and the space and the position could be added to,” she said.

“But after a period of strong performance and monitoring underlying valuations, if they look expensive, we could rethink position size.”

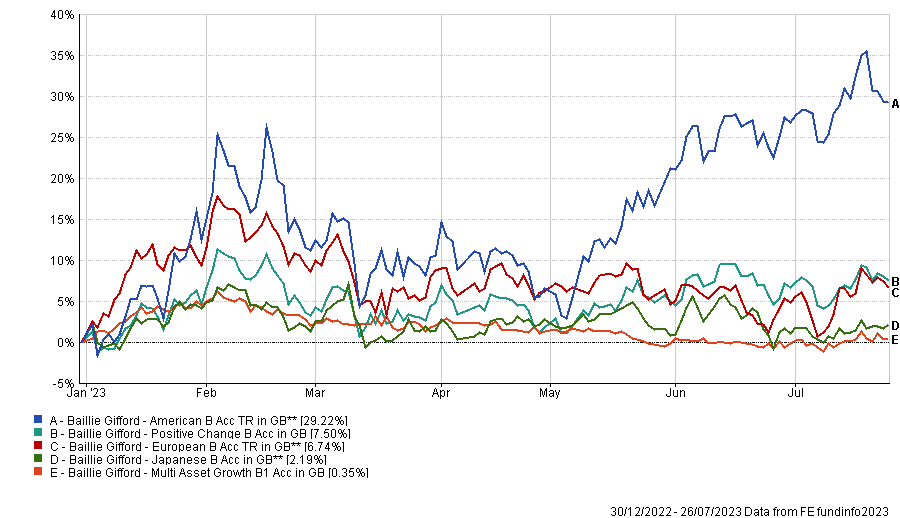

Performance of funds over the year to date

Source: FE Analytics

The funds’ rebounds, as illustrated in the chart below, could actually be the perfect chance for investors to trim their exposure, according to Juliet Schooling Latter, research director at Chelsea Financial Services.

“Growth has done better year-to-date, but it's mainly been concentrated in mega-cap tech names. Some big Baillie Gifford positions like Moderna are down a lot this year, but generally the funds have performed better,” she said.

“I would not be piling into growth after this strong rally though. It looked a much better opportunity at the start of the year. The overall US market looks quite expensive relative to what is now available in fixed income.

“If you were heavily exposed to growth and Baillie Gifford funds but have been holding tight, now might be a good time to reduce your style risk on this bounce.”

Performance of stock over the year to date

Source: Google FInance

Schooling Latter specified she is only talking about open-ended funds, not the investment trusts, which now all trade “on very large discounts and most are probably worth holding or even adding to at this point”.

She concluded by suggesting retaining some growth exposure, as “it could certainly continue to benefit if inflation rolls over”.

Funds investing in growth companies indeed feature a lot among those that should benefit from a receding inflation – something that experts predict in the next few years.

But currently, Chris Metcalfe, IBOSS chief investment officer, said he preferred other investment styles. He removed several Baillie Gifford funds from his core portfolios back in February, after it had become apparent that the asset management house would not sway from their growth strategies.

“We never doubted when we were exiting the funds that, at some point, their range would have a broad-based resurgence once market conditions changed. The extreme underperformance of high-profile funds such as their Baillie Gifford American and Baillie Gifford Managed funds ended around June last year when the period of relative outsized returns for value finished,” he said.

While conscious that Baillie Gifford vehicles could still benefit from the market’s evolvements, Metcalfe prefers to be less constrained by a single investment style.

“We believe markets remain at a major inflexion point after years of low inflation, low interest rates and money printing. In this environment, we want the funds that make up the building blocks of our portfolios to be managed in a less dogmatic style,” he continued.

“We feel this is a period where investment styles can benefit from more of a blended approach or even style agnosticism. That said, we know that not all the Baillie Gifford managers manage their funds precisely the same way, but as ever, we have many options to choose from.”