Although they do not always realise it, children enjoy many benefits that adults wish they had. They are provided with board and lodging without having to provide anything in return, they do not have bills to pay and on the top of that, their parents will invest on their behalf with their hard-earned money.

When it comes to investing, children have a very long-term horizon and can, therefore, take more risks with their investments. At this point, they just need to grow their assets as much as possible to have a good start in their future adult life.

Jessica Ayres, chartered financial adviser at Timothy James & Partners, said: “When constructing a portfolio for a child, or anyone with a long-investment time horizon, the enemy at hand is inflation.

“We have had over 10 years of low inflation and many need reminding that long-term investors should invest into higher-risk assets, such as stocks and shares, if they wish to target a return above inflation.”

As inflation is likely to settle at a higher average than in the past decade, Ayres suggested that a suitable allocation for a child is to hold 80% in equities and 20% in diversifiers.

She chose four global funds, one passive and three actives, accounting together for 60% of the portfolio.

To get exposure to global equities on the cheap, Ayres suggested using Fidelity Index World, which charges 0.12% for tracking the MSCI World index and has a tracking error of 2.64% over 10 years.

She said: “I hold it in most portfolios to target equity returns at low cost.”

Moving on to the active global funds, Ayres selected Rathbone Global Opportunities, Fundsmith Equity and TB Evenlode Global Income.

Ayres said: “Each of these funds have a different investment style and are top performing in their sector with highly experienced fund managers.”

The Rathbone Global Opportunities fund, managed by James Thomson, typically invests in 40 to 60 stocks with higher growth rates.

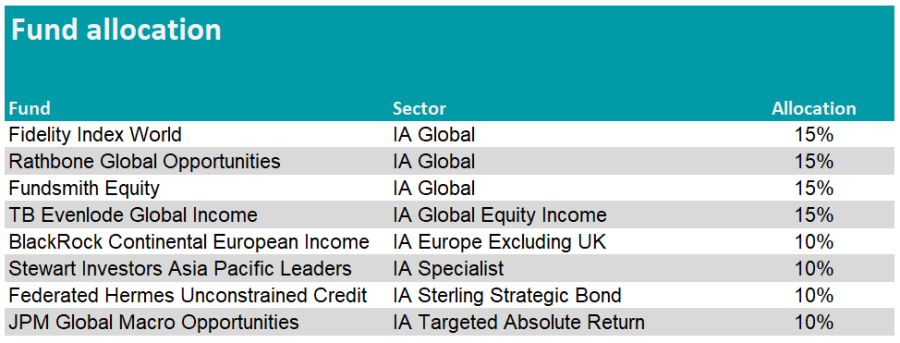

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

The fund sits in the first quartile of the IA Global sector over 10 years and one year. Ayres warned investors to expect volatility and to suffer in market crashes, but said the fund has a track record at outperforming global indices and peers.

She suggested pairing it with Terry Smith’s Fundsmith Equity, highlighting the difference in investment style.

Ayres said: “Smith seeks to invest in businesses that generate high, sustainable returns on capital, have a runway for growth, operate in sectors with intangible advantages, are resilient to change and can protect returns from competition.”

Total return of fund vs sector over 10yrs

Source: FE Analytics

The fund, which does not have an official benchmark, typically holds 20 to 30 stocks. It has made top quartile performance in the IA Global sector over 10 and five years.

The last global fund in the portfolio is TB Evenlode Global Income, an income fund that was launched in 2017.

Ayres said: “When looking for returns, it is important to note that dividend-yielding businesses can bring a quality aspect to the portfolio and dividends provide an important contribution to the total return.”

The fund is relatively concentrated, holding 35 to 40 businesses mostly from North America, Europe and the UK.

Ayres added: “They focus on finding highly cash-generative businesses with high returns on capital and strong free cashflow. They seek to buy businesses at an attractive valuation and hold them for the long term.”

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

TB Evenlode Global Income is a top-quartile fund in the IA Global Equity Income sector over five years and yields 2%.

Moving on to regional exposures, Ayres allocated 10% to both Europe and Asia via BlackRock Continental European Income and Stewart Investors Asia Pacific Leaders.

Ayres said that the BlackRock fund gives exposure to European quality businesses with strong balance sheets and dividend growth, which helps to beat inflation. The fund is concentrated around 30 to 45 stocks and has a low turnover.

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

The fund sits in the second quartile of the IA Europe Excluding UK sector over 10 years and has a yield of 3.87%.

Ayres chose Stewart Investors Asia Pacific Leaders for its prudent investment philosophy and track record. She said: “The fund typically holds 40-60 large-cap businesses that should benefit from, and contribute to, the sustainable development of the region.

“The fund seeks to invest in defensive companies with good cashflows and high barriers to entry. It is a consistent performer and a fund I view as a safe pair of hands."

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

The fund has a strong tilt toward Indian stocks, with Indian equities accounting for 48% of the portfolio. Japan and Australia are the two next largest country allocations in the fund. While the fund invests in the Asia-Pacific region, it is part of the IA Specialist sector.

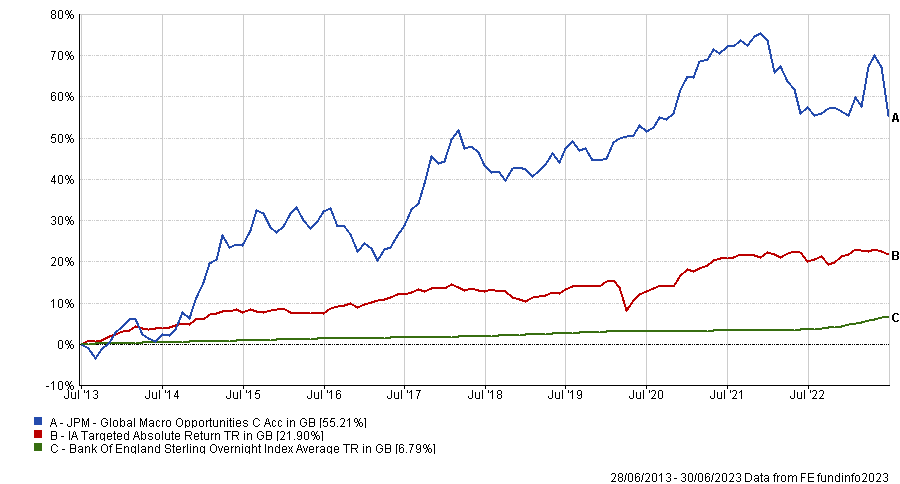

To protect the portfolio against downsides, Ayres allocated 10% to Federated Hermes Unconstrained Credit, a strategic bond fund.

She said: “The team has a reputation for managing high-conviction, flexible, global portfolios that aim to deliver outperformance and seeks to protect against the downside by allocating across the globe and using an options overlay to hedge high-conviction positions.

“This allows the managers to add risk during sell-offs and participate in the rebound as markets rally. The fund does not take on currency risk. If you feel you must add fixed income for diversification purposes, this is the fund to target long-term returns.”

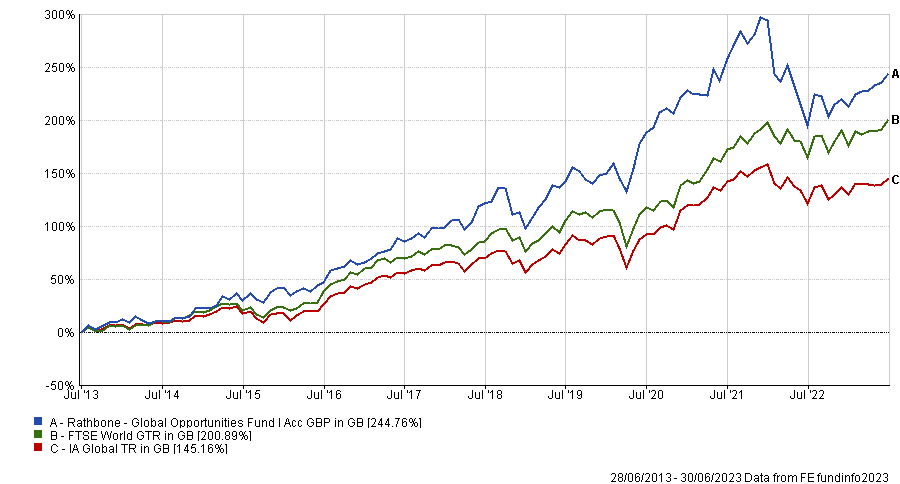

Total return of fund vs sector since launch

Source: FE Analytics

The fund was launched in May 2018 and sits in the second quartile of the IA Sterling Strategic Bond sector over five years.

The last 10% portfolio are allocated in the JPM Global Macro Opportunities, an absolute return fund investing across equity, fixed-income, currency, gold and derivatives.

Ayres said: “Over the medium term, the fund has demonstrated a low correlation to traditional assets and other multi-asset funds.

“It aims to deliver positive returns over cash in varying market environments, whilst keeping an expected level of realised volatility of less than 10% annualised over the medium term.”

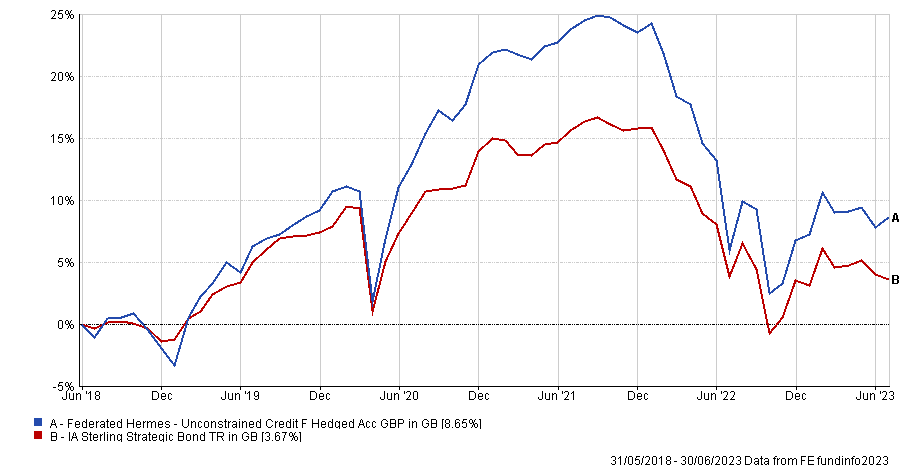

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

The fund is managed by FE fundinfo alpha manager Shrenick Shah and currently holds 39% of its assets in currency, 28.9% in equity, 27.7% in advanced derivatives and 4.4% in fixed income.