Unicorn Mastertrust has a bias towards the most unpopular investment trust sectors – UK smaller companies and private equity – yet they have been manager Peter Walls’ best performers.

Some of the names he holds are generating “stunning outcomes” in an environment geared against them, yet continual poor sentiment has driven their discounts ever lower.

Here, the FE fundinfo Alpha Manager tells Trustnet which investment companies he’s picking up for a bargain and why it still pays to be sceptical of a large discount.

What is the purpose of the fund?

I like to think of it really as a one-stop shop for people that are attracted by the concept of investment trusts but are perhaps deterred by some of their complexities.

It is trying to give a very broad exposure to the investment company sector by investing in trusts that make the best use of the structure. That has always led me to have a structural bias towards areas that are less liquid and more specialised.

Which sectors has that led you to?

It really translated into having a big weighting to listed private equity and smaller companies funds, both in the UK and internationally.

They’ve both been areas that are somewhat out of favour of late, particularly in discount terms, but I really do believe in the smaller companies effect as they can grow at a much faster rate over time.

Meanwhile, if you look at the long-term returns from listed private equity trusts you see they have been far superior to listed market returns.

Trying to time the market is fool’s gold, so I would say that a lot of my holdings are core holdings I expect to hold for a very long time – probably forever.

I don't think what I've achieved in the past has been out of any additional skill or genius that I've added to the equation. It’s just that I'm working with good quality products.

Do you worry that trust discounts risk becoming entrenched?

Yes and I think it will take time to recover. What I would say is that that Darwinian process does take place and as it accelerates, you’ll find that discounts across the board will narrow together.

Increasingly this year there has been quite a lot of mergers and we will see more of that activity taking place.

Over time that will eradicate discounts and it may well be that the sector overall has to shrink in size in that process, but it will happen.

I’m almost dancing on the table with excitement because I can see value in discounted trusts that have the ability in a more rational marketplace to deliver strong upside without anything happening at the underlying net asset value (NAV) level. You might have to wait a while though.

Is a big discount a call to buy?

Everything is not a simple mathematical equation. There are a number of situations where big discounts could lead to significant moves in share price, but that's more speculation than investment.

There's a few things out there that are on big discounts where I find it difficult to see what the catalyst for a re-rating will be.

I’m talking about trusts such as Tetragon and Petershill where you don't get any shareholder votes and there’s question marks around corporate government, which means they don't get on to the radar of many investors and those discounts might prevail for a very long time indeed.

Which discounts stand out to you as being particularly attractive?

I recently bought RTW Biotech, which is really quite an obscure fund, but it’s trading on a 30% plus discount to NAV in a sector that's been through its second worst bear market in history.

Yet it has a very accomplished investment management team behind it and a profile that hasn't been particularly well known in the UK market, so I have seen some discount narrowing there already, but I think there is still a long way to go.

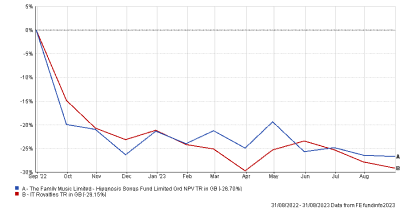

I also hold both the music trusts – Hypgnosis Songs and Round Hill Music Royalty – and people have been questioning the validity of their valuations, so the discounts there are very, very wide.

People lost a bit of faith in Hypnosis in particular and we're waiting on news imminently about an expected continuation vote in September.

What’s been your best performer over the past year?

It’s been the listed private equity names. They’ve made incremental (albeit very small) improvements in NAV yet their discounts really haven't reflected that.

My best returns came from my number one holding, Oakley Capital. It was up around 12% over the past year.

It had some great realisations, particularly in one of its specialist areas: education. It owned the largest online university in Germany, which has since been refinanced with the backing of some great private equity people.

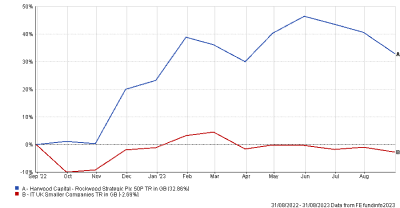

Similarly, UK small caps have been in the doldrums since the Brexit referendum yet I've got a holding in a very small fund called Rockwood Strategic run by Richard Staveley that has produced some stunning outcomes. It is up more than 30% in the past year.

Total return of trusts vs sector over the past year

Source: FE Analytics

What was your worst performer?

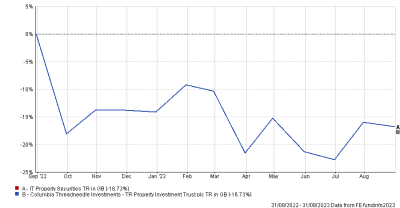

That would be Hypgnosis, which is down about 26%. There was also TR Property, which is a long-term core holding of ours managed by Marcus Phayre-Mudge. It has a very strong long-term record, but the share price is down around 16% over 12 months.

Total return of trusts vs sector over the past year

Source: FE Analytics

What are your interests outside of fund management?

I’m an avid walker, so I try and walk about eight to 10 kilometres a day, which takes up quite a bit of time at lunch or in the early morning. I’ve also got five grandkids, so they take up a bit of time.