UK income funds were significantly better at limiting losses during times when the FTSE All Share index fell than taking advantage of upswings over the past decade, according to data from FE Analytics.

Looking at the upside and downside capture ratios of funds in the IA UK Equity Income sector, those that did better in rising markets did so by a smaller margin than has been seen in previous studies in this ongoing series.

When Trustnet looked at the IA UK All Companies sector, the highest upside capture ratio was 146.2%, while in the US and global sectors the best funds made around double that of their respective benchmarks during bull markets.

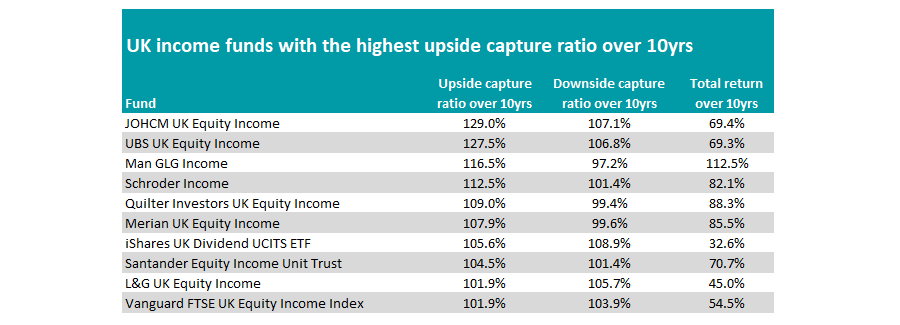

For UK income funds, however, the best at capturing the most of the FTSE All Share’s gains – JOHCM UK Equity Income – only had an upside capture ratio of 129%, the lowest in the series so far.

Income funds have struggled to keep pace with the rapidly rising growth sectors such as technology and healthcare, which have boomed over the past decade.

It is for this reason that few in the sector have beaten the index over the past 10 years – just 30% of the sector has made more than the 71.8% gain for the FTSE All Share.

Despite its top billing as the fund that has made the most during the good times, the JO Hambro fund has failed to beat the index, up 69.4%, as its comparably high downside capture ratio of 107.1% has held back some of its gains.

Yet investors had more chance of beating the index from funds with higher upside. Four of the top 10 portfolios for upside capture ratio beat the index, with the top performing Man GLG Income on the list.

Source: FE Analytics

The fund is up 112.5% over the past decade and has the third highest upside of all IA UK Equity Income funds, while also a downside capture ratio below 100%.

An upside capture score of greater than 100% means a fund has made more than the market when it has been rising. The opposite is true for the downside capture ratio. Both scores are calculated against a relevant benchmark: for the IA UK Equity Income sector, we used the FTSE All Share index.

The only other three funds on the list to beat the index over the decade with a top 10 upside capture ratio were Schroder Income, Quilter Investors UK Equity Income and Merian UK Equity Income.

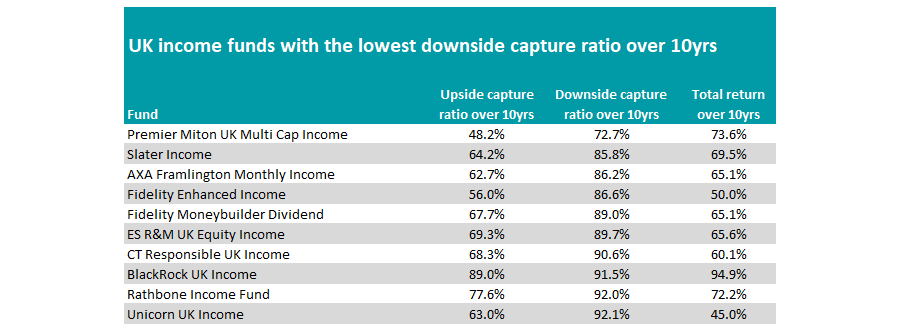

Turning to the defensive funds, only three portfolios of those with a top 10 downside capture ratio managed to beat the index over 10 years.

Premier Miton UK Multi Cap Income topped the list with the lowest ratio (72.7%), but also had the lowest upside of any portfolio in the sector (48.2%). Despite this, its defensive qualities meant that the fund made a total return of 73.6%.

Managers Gervais Williams and Martin Turner had put options during the Covid pandemic (hedging against a UK market fall), which contributed to the portfolio being one of the few to make money during the market nadir in 2020.

This, along with its high weighting to small- and mid-caps, has been a headwind over the past few years, however, as the large-cap end of the market has recovered strongly.

Source: FE Analytics

The best performer on the list is BlackRock UK Income, which has a more modest downside ratio of 91.5%, but it had a better upside than the rest of the top 10 defensive funds (89%). Overall it made 94.9%, the third best return in the sector over this time.

Rathbone Income was the other to beat the FTSE All Share index. Again it sat nearer the bottom of the top 10 with a downside capture ratio of 92%, but it had a slightly higher upside (77.6%) than the rest of the list.

This is part of a series looking at the best aggressive and cautious funds in different sectors over 10 years. Previously we have looked at UK all companies and emerging markets funds, as well as global and US portfolios.