The Ruffer Investment Company has made its portfolio even more defensive as it prepares for a recession that the rest of the market appears to be overlooking.

In the investment trust’s annual report to the end of June 2023, managers Duncan MacInnes and Jasmine Yeo argued that portfolios need to protect against a rate hike-induced recession and liquidity withdrawal from markets.

“Currently markets are increasingly certain that policymakers will be able to bring inflation back to target and will do so without creating any financial instability: the much-fabled soft landing alongside an immaculate disinflation,” they said.

“Yet it would be highly unusual for the inflation bogeyman to be slain with household net worth rising, unemployment still at record lows and without a recession. The evidence is strong that we are approaching a developed world recession. We will look back and say the signs were there; markets chose, temporarily, to ignore them.”

MacInnes and Yeo pointed to nine indicators that suggest a recession is on the horizon:

- Yield curves around the globe are “deeply inverted”, which the managers believe to be a reliable predictor of recessions.

- A substantial and abrupt hiking cycle, which has seen the US Federal Reserve put 500 basis points onto the Federal Funds Rate plus quantitative tightening. “Plug that tightening into any macro model and you get a substantial drag on growth,” the managers said.

- Central banks have admitted that it worth risking a recession to tame inflation.

- The US personal savings rate has dropped to the lowest level since 2013 while pandemic excess savings are running out.

- The degree of tightening in credit conditions and banks' willingness to lend has only previously been seen in recessions, according to the Savings and Loan Officers Survey.

- The ability to lend is being constrained by bank failures, deposit flight and tightening of capital requirements.

- The strength of the US labour market is starting to falter, with average hours worked falling and temporary worker reductions at 30-year highs.

- The inventory to sales ratio in the US is at a 25-year high, suggesting weakening demand.

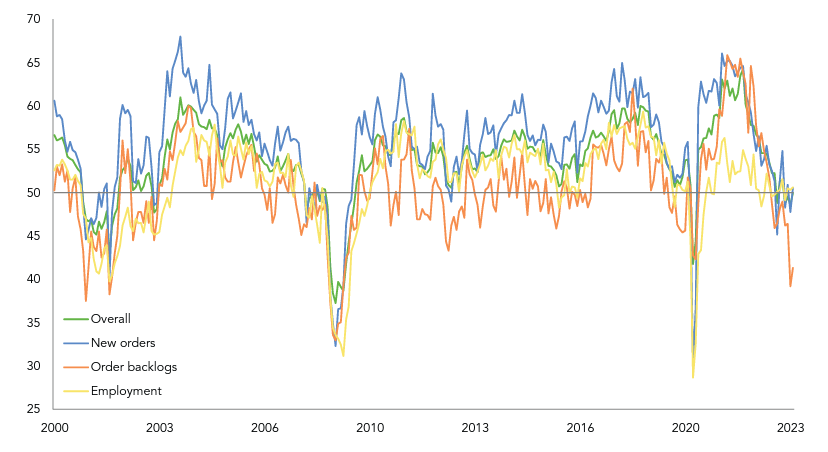

- Broadly measured, economic activity “is heading in the wrong direction”. This is shown in the chart below.

US economic activity

Source: Ruffer, FactSet. Data to Jun 2023

In addition to the risk of recession, the Ruffer managers are worried about liquidity withdrawal from risk assets. This would be caused by investors realising that they no longer need to own high levels of equities to hit return targets when higher interest rates make assets such as bonds more attractive with less risk.

“The danger is that everyone is pointing in the same direction, seeking to move from risky assets to less risky assets, potentially all at once. If everyone is a seller, who is the buyer? We worry about a global, synchronised de-risking of portfolios,” MacInnes and Yeo said.

“This isn’t about the investment merits of individual asset classes; this is a profound change in the landscape in which people seek to achieve their investment objectives.”

In light of this, the managers have made Ruffer Investment Company’s portfolio more defensive in four main ways.

Firstly, the allocation to equities has been dropped to 14% - a record low for the trust - reflecting the managers’ view that the equity risk premium looks “remarkably low”. At the same time, equity downside protection has been increased by adding index put options and VIX call options, the first time the trust has used these instruments since 2020.

Secondly, the portfolio’s duration has been increased, primarily by adding to long-dated US inflation-linked bonds. “We have high conviction that the rise in real yields is likely to prove temporary and too much for financial markets (and the economy) to handle and thus expect lower real yields to follow,” the managers explained.

Thirdly, exposure to the yen and US dollar has been increased, as the managers expect both currencies to appreciate in a period of market stress. The yen especially is a safe-haven favourite – for example, it rose by 48% against sterling in the global financial crisis.

Finally, exposure to gold and copper has been reduced. The managers didn’t give their reasoning behind this move, although the copper price is seen as a leading indicator of recession.

“The portfolio remains highly liquid and defensive as we wait for better opportunities to emerge, we believe in the coming quarters. After a 2023 rebound, asset allocators can convince themselves 2022 was an aberration for the 60/40 portfolio and therefore new, more thoughtful portfolio construction and diversification efforts are not required,” MacInnes and Yeo finished.

“We believe this is a mistake – gold, commodities, negative duration (via payer swaptions), asymmetric hedges and the ability to be short equities will all be useful tools in the toolkit.

“The portfolio needed today – low gross, defensive – to survive the oncoming recession and liquidation is not the portfolio needed in 12-18 months when the economy is recovering and stimulus is back on the table. It’s not the Fed that needs to pivot, it will be investors.”