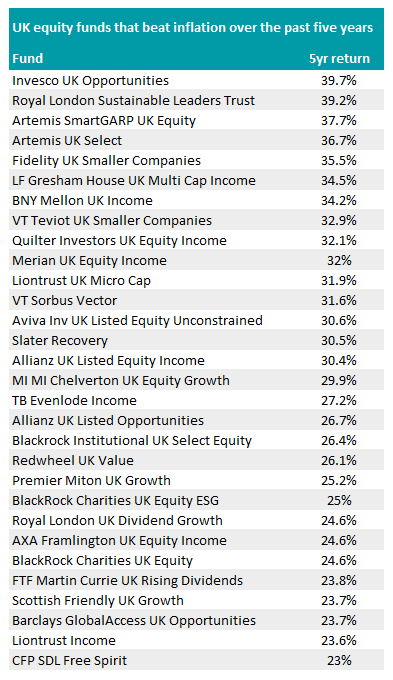

Only 30 of the 341 funds investing in UK equities succeeded in beating inflation over the past five years, according to data from FE Analytics.

The fundamental reason that most people invest is to outpace the rate of inflation, but only 8.8% of UK funds fulfilled the goal of protecting the pricing power of their clients’ savings.

This comes not long after Trustnet revealed that over two-thirds (68%) of all Investment Association (IA) funds failed to beat UK inflation over the past five years. Over that period, 45 of the 57 IA sectors contained a majority of funds that underperformed the 22.9% hike in the consumer price index (CPI), which included all UK sectors.

However, there were 30 portfolios in the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors that were able to beat inflation in their home market.

Source: FE Analytics

The greatest outperformance of all came from Invesco UK Opportunities, which generated a total return of 39.7% over the past five years, which was more than four times higher than the 9% gain made by most IA UK All Companies funds.

Analysts at RSMR note that managers Martin Walker and Bethany Shard’s value-oriented approach to stock picking should generate “strong risk-adjusted returns” when that style of investing is in vogue.

Similarly, the following three best performing UK funds – Royal London Sustainable Leaders Trust, Artemis SmartGARP UK Equity and Artemis UK Select – were all situated in the IA UK All Companies sector.

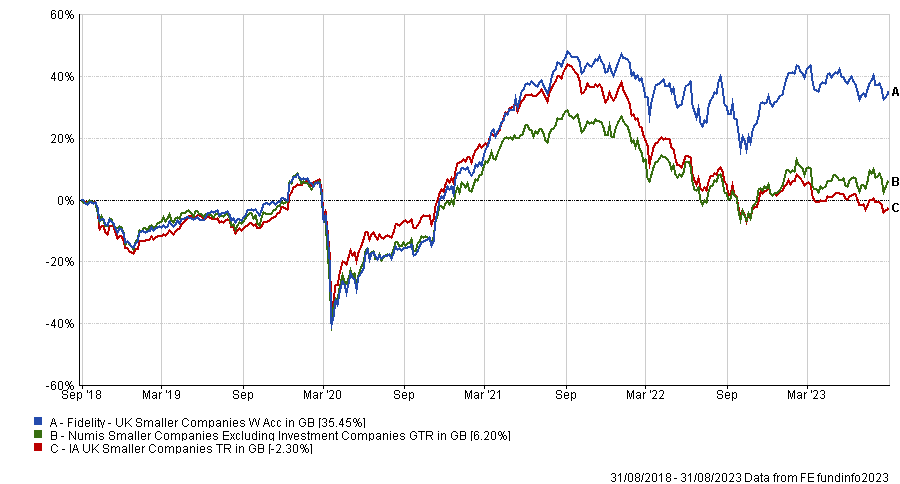

Total return of funds vs sector over the past five years

Source: FE Analytics

In fact, over two-thirds of all the UK funds that beat inflation were in this sector, with 23% in IA UK Equity Income and just 10% in IA UK Smaller Companies.

Funds investing in small-cap stocks were particularly vulnerable to rising rates, hence why only three of the 44 portfolios in the sector with a five-year track record beat inflation over that period, but it didn’t stop Fidelity UK Smaller Companies from being the fifth best performing UK fund.

It was up 35.5% over the past five years whilst its peers in the IA UK Smaller Companies sector made an average 2.3% loss.

Total return of fund vs benchmark and sector over the past five years

Source: FE Analytics

Jonathan Winton was lead manager for most of that period, taking over from Alex Wright (who he worked alongside since 2014) in 2019, but researchers at Square Mile raised concerns around “his relative inexperience as a fund manager operating in a highly specialist area of the market”.

Nevertheless, Winton’s ability to generate a return that outpaced inflation in an especially challenging environment for his asset class soothed their concerns.

“We continue to take comfort from his focus on downside risk and the subsequent protection of capital during times of market distress, which we view as an extremely sensible approach in what has, historically, been a volatile asset class,” the Square Mile researchers said.

“The philosophy centres around the principle that markets can be slow to react to a changing situation of companies and therefore the manager searches for unloved firms that are entering a period of positive change. The manager is essentially looking to purchase companies before the market has recognised their prospects for improving growth.”

Two of the expert fund pickers Trustnet spoke to highlighted one fund on the list as a standout portfolio – WS Evenlode Income. It was up 27.2% over the past five years, beating the IA UK All Companies sector average by 18.2 percentage points.

Rob Morgan, chief investment analyst at Charles Stanley, said the fund’s “straightforward, repeatable strategy” gives investors “a growing income with capital growth on top”.

He added: “The managers focus on what they call cash compounders – businesses able to generate high returns on their investments without the need for debt.

“Focusing on cash generation helps them avoid many of the pitfalls in the UK market, and although the fund can suffer at times from holding more expensively valued companies, owning these higher-quality businesses has helped weather the turbulent markets of the past few years.”

Total return of fund vs benchmark and sector over the past five years

Source: FE Analytics

Indeed, this approach has steered Alpha Managers Hugh Yarrow and Ben Peters away from indebted companies that may have been a drag on performance in a high interest rate environment.

Bestinvest managing director Jason Hollands noted that this process led them away from companies with a high number of physical assets that require constant reinvestment on maintenance.

This has resulted in low allocations to areas such as energy and a preference for industrials and consumer staples, which collectively account for 61.6% of the £3.5bn fund.

Hollands added that Evenlode Income’s high exposure to global companies also gives it an advantage over more domestic-oriented UK funds.

He said: “Although it is a UK equity fund, a look through to the aggregate earnings profile of the companies held by the fund reveals it to be one of the most international portfolios among funds in the IA UK All Companies sector. In the current environment with a strong dollar, this should benefit the portfolio.”

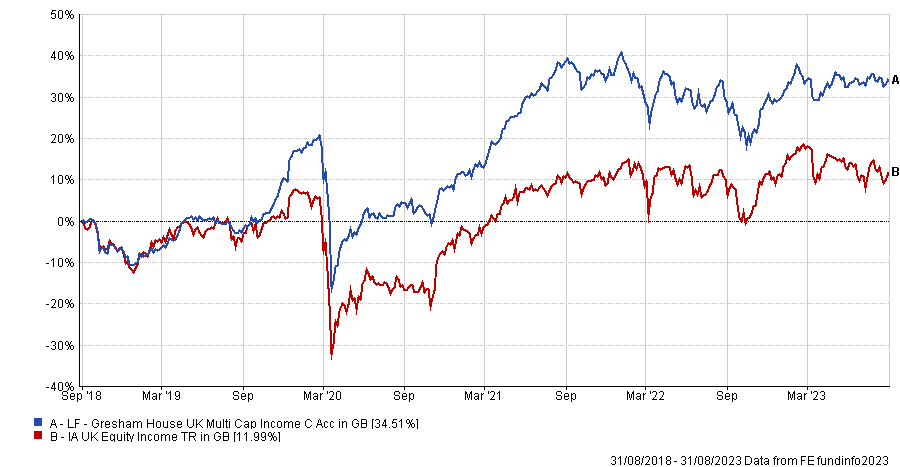

Alternatively, the Gresham House UK Multi Cap Income fund stood out to Gavin Haynes, investment consultant at Fairview Investing, as the best fund on the list.

Alpha Manager Ken Wotton made a total return of 34.5% over the past five years by investing across the market-cap spectrum but he had a preference for smaller companies, with 34.3% of the £500m fund in FTSE AIM stocks and an additional 20% in FTSE Small Cap names.

Total return of fund vs sector over the past five years

Source: FE Analytics

Haynes said he likes the fund’s focus on buying and holding companies for the long term that can weather difficult market conditions and make “impressive” returns even in hard times.

“What sets it apart is they take a private equity long-term approach to investing in public markets,” he added. “They will be patient in looking to realise value and the turnover of the fund is just 9%.”