Yields on 10-year US Treasury yields shot to a 16-year high of almost 4.9% on Friday after fresh economic data proved the Federal Reserve’s (Fed) efforts to tame inflation was less effective than expected.

The latest US nonfarm payroll report revealed an additional 336,000 jobs in September, but most prior forecasts expected a much lower number.

Janet Mui, head of market analysis at RBC Brewin Dolphin, said that this “jaw-dropping” result has made markets less confident in the Fed’s plan to bring wage-push inflation down.

As such economists now expect interest rates to remain higher for longer than originally thought, which has ramped up the yields on long-dated bonds.

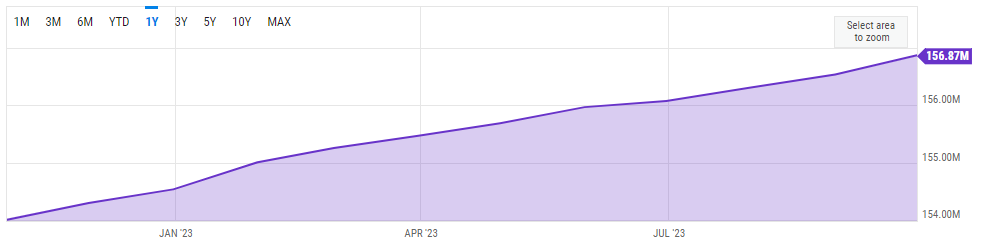

US total nonfarm payrolls over the past year

Source: Y Charts

Mui added: “The 336,000 job gained blows past even the most bullish estimate. Despite the Federal Reserve’s aggressive interest rate increases and some pockets of weakness in the US economy, this report raises concern the labour market can remain too hot for too long.

“Perhaps the only solace is that wage growth has slowed modestly and came in below estimate but with the recent rebound in US job openings and a lack of increase in the labour participation rate the Federal Reserve may remain concerned about underlying inflation pressure on the economy.”

Bonds yields rose to compensate investors for these new expectations, with prices falling commensurately.

Steve Ellis, global chief investment officer of fixed income at Fidelity, said the sell-off in bonds is highly unexpected at this stage in the cycle because interest rates and yields are still on the rise.

“The recent sell-off in government bond markets has taken many in the market by surprise, not least because it runs contrary to the direction of travel on inflation,” he explained. “With price growth coming down, long-term bond yields should be peaking.

“We are discovering again that bonds are not functioning as an equity diversifier. There is and will be demand for them, but it will come at a price. The US is suffering from endemic fiscal deficits, and rising interest costs only add to the headline deficit. The fiscal trends are unsustainable, and that’s before we confront what could still turn out to be a hard recession next year.”

Indeed, JP Morgan’s global liquidity market strategist Mike Bell warned that, despite yields rising to these new expectations, markets should not disregard the potential for a recession.

Consensus forecasts say a recession is unlikely but Bell said a mild recession could happen next year if the Fed continues on its current course.

“The more investors believe a recession can be avoided the more likely an eventual recession becomes,” he said. “If enough people believe that rates can stay high without causing a recession, then the subsequent rise in long bond yields that we have seen in recent months increases the eventual risk of recession by raising borrowing costs.”

For the time being, Bell said owning short-dated bonds of up to one year or shorter would be the best option to avoid this volatility.

Many investors may have sold out of bonds on the back of these unforeseen forecasts, but PIMCO economist Tiffany Wilding suggested that this could be an attractive entry point into the asset class.

The new ‘higher for longer’ rhetoric may be painful for bondholders who may have bought long-dated Treasuries expecting interest rates to soon reach their peak, but some bonds now offer high yields at cheaper prices.

Wilding said: “Starting yields are high relative to history and to other asset classes on a risk-adjusted basis. This can create a yield cushion amid a still highly uncertain outlook.”