The arguments in favour of passive investing are manifold: the average active manager underperforms after fees, passive funds are much cheaper, and global equity indices are difficult to beat.

Jan Loeys, global long-term strategist at JPMorgan, has taken the debate one step further by proposing that all investors need to own is a global equity tracker and a corporate bond fund.

“There is extraordinary value to end investors of keeping things simple,” Loeys said. “Our industry loves complexity as it creates revenues and jobs. But end investors gains most from keeping products and strategies very simple and basic.”

Loeys is not alone in advocating a pared back, low cost approach to portfolios. Even Warren Buffett, arguably the world’s most famous active manager, advised his wife to put 90% of her savings into a cheap S&P 500 passive fund and the remaining 10% into short-term government bonds.

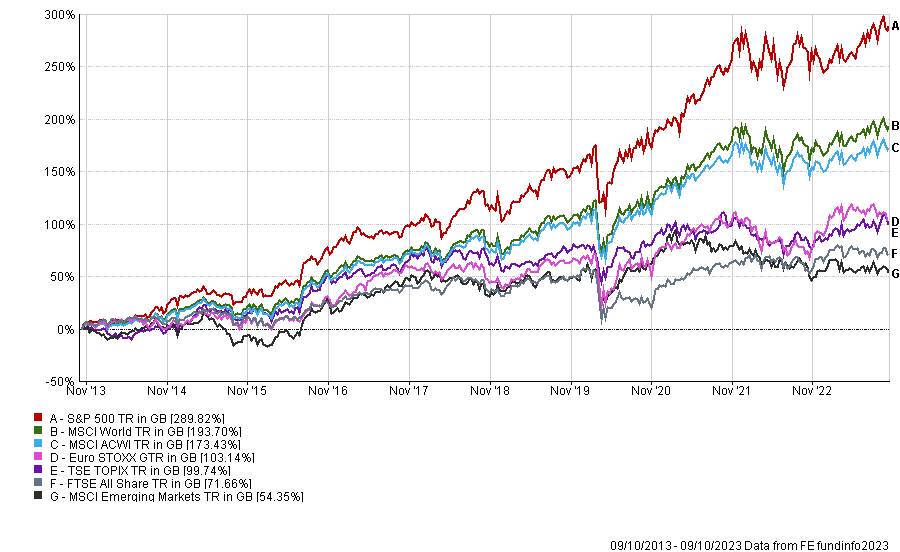

As to the merits of a global equity tracker, the numbers speak for themselves. Edward Allen, private client investment director at Tyndall Investment Management, acknowledged that “the MSCI World index has been tough to beat, particularly for sterling investors who would have picked up an almost 70% return from being out of sterling over the past 10 years.”

Performance of major indices over 10yrs

Source: FE Analytics

But is passive the right approach to take going forward?

Allen pointed out that “like all indices, the MSCI World is a momentum strategy, so you end up exposed to the biggest companies in the world.”

Investing in a global equity ETF would only make sense going forward, Allen said, “on the assumption that first, momentum continues to work and the big get ever bigger (how big can they get?) and second, sterling stays weak or weakens from here.”

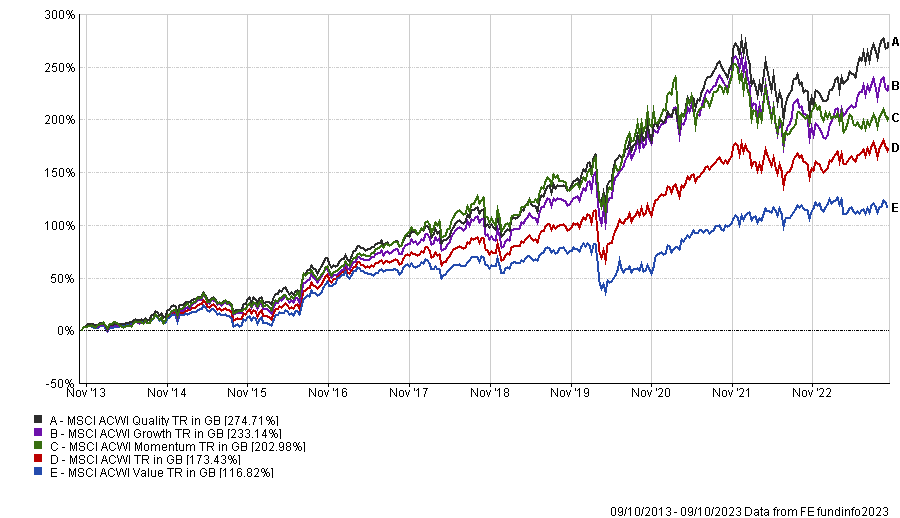

Indeed, buying stocks that have a quality, growth or momentum characteristic has been the most profitable way to invest over the past decade, with value stocks making almost half the returns of the other investment styles, as the below chart shows.

Performance of investment styles over 10yrs

Source: FE Analytics

Michel Perera, chief investment officer of Canaccord Genuity Wealth Management, was opposed to buying an equity tracker for similar reasons.

“At a time when some valuations are clearly very high and the discrepancy between investment styles is at historical extremes, buying today’s market weights and constituents, as is, could be a huge mistake,” he argued. “Think 1990 when Japan was 45% of global equities, which went down to 4% in the next three decades.”

The investment landscape looks markedly different now compared to the past 10-15 years of quantitative easing (QE), Perera continued, with central banks undertaking quantitative tightening (QT).

“If we are now in a world where central banks are no longer buying anything that moves (QE) but instead are selling their assets (QT); if we are in a world where inflation is likely to be stickier than at any time since the 1980s (due to deglobalisation, the demographic wall, decarbonisation, massive defence spending); if geopolitical fears will continue to scare investors from time to time, then buying markets wholesale is not a solution.”

Alternatively, investors might consider making separate allocations to a range of regional strategies – instead of investing in a global ETF with a large US weighting.

Sam Benstead, collectives specialist at interactive investor, said: “Adding trackers that own UK, European and Japanese shares would bring down a portfolio’s overall valuation multiple, which could make it more resilient if we enter another period of rising interest rates, and also help it capture returns from other markets if US dominance fades.”

On the fixed income side, JPMorgan’s Jan Loeys advocates holding a corporate bond fund in the investor’s domestic currency to avoid currency risk.

One fund highlighted by Eduardo Sánchez, associate research director of fixed income, alternatives and multi-asset at Square Mile Investment Consulting and Research, is Artemis Corporate Bond, which he described as a compelling proposition for investors seeking a combination of capital accumulation and income.

“It is a high conviction strategy managed by Stephen Snowden, whom we consider to be one of the most experienced managers in his peer group,” Sánchez said.

“While the team that supports him is relatively small, this means he can react more quickly to implement decisions when opportunities arise. Given this efficient decision-making process, the team can dedicate more time to company and market analysis.”

Ultimately, an extremely simple portfolio as advocated by Loeys for DIY investors and Buffett for his wife may not be practical for many private clients, said Canaccord Genuity’s Perera.

“Keeping the asset allocation stable over time has the advantage of removing emotion from the portfolios (and we all know to invest emotionally is bad), but it goes against human nature.

“I have never seen a private client (or even an institutional one at that) who would simply agree to have an unchanged asset allocation that you just rebalance every quarter,” he said.

“On paper, it looks efficient; in practice, however, the risk is that clients will pull the plug at the worst possible time, when they can’t take it anymore and hence the beautiful experiment will fail regardless of how good it could have been.”