Low-cost passive multi-asset funds have become increasingly popular as simple, one-stop-shop solutions for investors who don’t want the hassle of researching and selecting funds themselves.

Perhaps the most well-known is the Vanguard LifeStrategy series, which has been widely successful, with the Vanguard LifeStrategy 60% Equity fund reaching £13.7bn of assets under management (AUM).

But despite its popularity, two of the three experts we asked preferred the rival £3.6bn HSBC Global Strategy Balanced Portfolio.

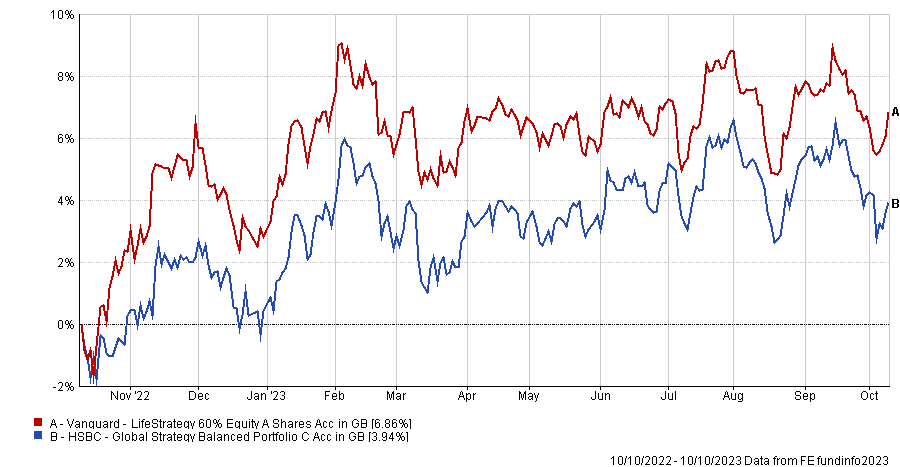

Performance of funds over 1yr

Source: FE Analytics

They pointed out that Vanguard is a passive strategy that only aims to track the market, while HSBC’s passive imprinting is enhanced by manager Kate Morrissey, who tweaks the core allocation of the portfolio with a tactical overlay, deviating from the model to take advantage of the current environment.

Tillit’s head of fund selection Sheridan Admans explained that Vanguard sticks to its stock and bond splits “religiously”, adjusting portfolios every day so they don’t become too concentrated in either area and to minimise portfolio drift.

Vanguard refers to this as its “timeless solution” to strategic asset allocation, with this fixed approach to asset allocation making it “a purer passive play”.

As for the HSBC Global Strategy Balanced Portfolio, Morrissey’s tilts are “usually small and typically based on short-term views”.

Over the past three years, the HSBC fund has had a much higher skew to the US, while the Vanguard fund has held a higher weight to the UK and Europe.

“Vanguard makes a point that the UK will generally form one of the largest single-country exposure in its portfolio,” Admans noted.

Morrissey’s ability to express tactical plays that attracted Jason Hollands, managing director of Bestinvest.

“I would opt for the HSBC fund on the basis that it has greater asset allocation flexibility than the Vanguard fund and that means it can adapt to changing market conditions,” he said.

“Also, the HSBC product can invest in a wider range of assets than just equities and bonds. Currently, this is reflected in a 4.7% allocation to property, albeit this is via listed real estate equities rather than bricks and mortar.”

A further difference between the two strategies is price. The ongoing charge figure (OCF) of the HSBC fund is 0.17%, five basis points lower than Vanguard, which was enough for Peter Sleep, senior portfolio manager at 7IM, to choose the cheaper option.

“I am not sure there is much to choose between the two funds, they are both 60% equity and 40% bonds and have behaved in a near identical way over the past five years,” he said.

“More recently, HSBC has opened a small performance gap, but I would not get too carried away with this as that could easily reverse. I would chose the HSBC funds to support the one with keener pricing.”

On this point, investors should not forget to take platform fees into account too, Hollands stressed.

Admans added: “Both the Vanguard LifeStrategy 60% fund and the HSBC Strategy Balanced Portfolio mainly invest in in-house funds, providing a home bias and helping to keep costs to a minimum.”

While choosing one fund over the other is a matter of preference, he suggested sticking to one rather than trying to switch between the two in the hope of squeezing out marginal returns or trying to time and second-guess how either would behave in different market conditions.

“Vanguard takes a more traditional plain vanilla approach, while the HSBC proposition is more dynamic. Our preference is for the Vanguard fund, its simplistic approach limits the possibility of a surprise,” he concluded.