The average worker in the UK will end up paying £2,500 extra in income tax by 2028, while some higher rate earners can expect to pay £13,000 more than they would have done if the government had upped thresholds rather than freezing them, new data from AJ Bell has revealed.

UK inflation remains high, with today’s September figure from the Office for National Statistics (ONS) revealing prices rose 6.7% on the previous year, adding to the cost-of-living crisis.

Rising prices have been a problem for many over the past 18 months or so, with supply chain issues and Covid-related costs, spiking oil prices caused by – among other things – the war in Ukraine, and a backtrack from globalisation all contributing to inflation.

There was some respite for the average worker this week, as ONS data reported an 8.1% increase in total earnings, including bonuses, in the three months to August 2023 compared to the same period in the previous year.

However, this combination of high inflation and rising wages has not been matched by rising tax bands – a detriment to those who have enjoyed pay rises tipping them into a new tax bracket.

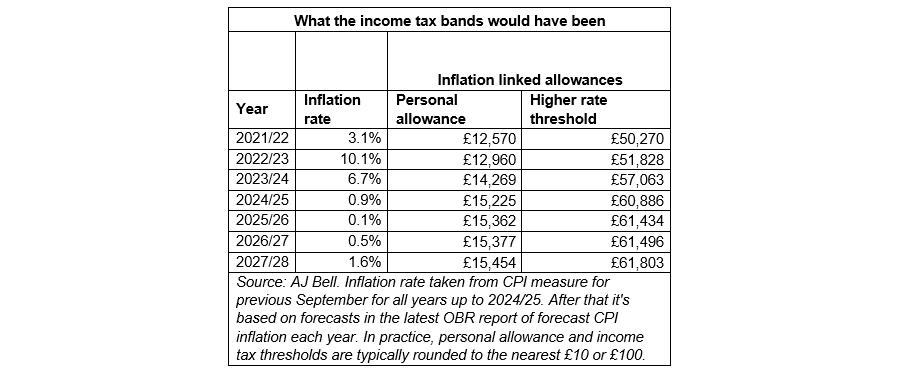

Laura Suter, head of personal finance at AJ Bell, said: “September’s inflation figure, published today, would usually set the increase for the Personal Allowance and Basic Rate tax band for the following April. Had Rishi Sunak not put tax bands in a deep freeze we’d all be able to earn 6.7% more tax free from April next year and have the same percentage increase in the Basic Rate band, before 40% income tax is due.

“However, taxpayers will instead face another year with frozen allowances, at a time when inflation is far above the government’s 2% target and wage growth continues to surge ahead.”

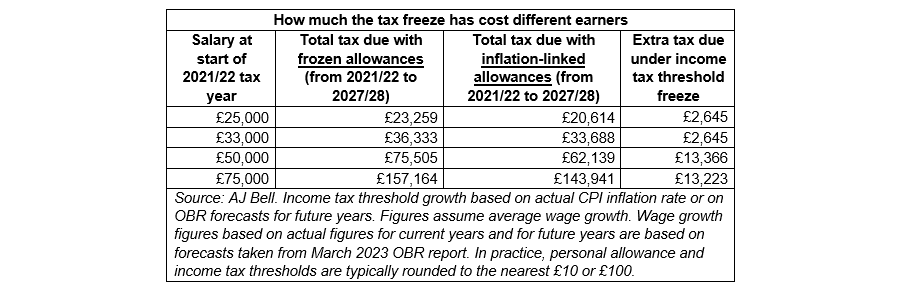

Below is a table showing how much people will pay at different salaries with and without the personal allowance increasing.

Had the government not frozen the Personal Allowance since 2021, people would be able to earn £14,269 for the current year, rising to £15,225 tax-free from April, data from AJ Bell shows. Instead it remains at £12,570.

Similarly, the higher-rate threshold has been frozen at £50,270 but would stand at £57,053 this year rising to £60,886 from April.

“Based on OBR forecasts, if we look ahead to the end of the freeze in 2027/28, someone would have been able to earn almost £61,500 before hitting the higher rate income tax band – £11,000 more than the actual limit will be,” Suter said.

Someone who was on the average UK salary of £33,000 at the start of the income tax band freeze will pay £2,576 more in tax over the entire duration of the freeze, assuming average wage increases during that time, AJ Bell’s data shows.

Someone earning £50,000 is hit even harder, paying £13,366 more in tax, as they would have avoided the tax band altogether had the freeze not been in place.

Suter said the government freeze had been a “cash cow” for the government but had left a “big dent” in the pockets of workers.

“Fresh estimates from the [Institute for Fiscal Studies] IFS yesterday show that the stealth tax freeze is set to net the government £52bn a year by 2027. But it’s also costing the average worker thousands of pounds in extra tax over the duration of the freeze,” she concluded.