‘If you love them, let them go’ is not only true for relationships, but also for mid-caps. Jean Roche, manager of the Schroder UK Mid Cap trust, knows that, and said that for her, success is when a company moves up a step and outside the FTSE 250 index in which she invests.

“When mid-sized companies move to the FTSE 100, it means that they have been thriving in the incubation phase of the FTSE 250 and have grown,” she said. “But most importantly, this is also where we capture the most outperformance.”

The Schroders UK Mid Cap trust, with £170.5m of assets under management (AUM), invests in FTSE 250 companies (excluding investment companies) with ‘unique assets’, scarcity value and franchise power, as well as more cyclical businesses that are undergoing changes, industry consolidation or where supply is retreating out of the market.

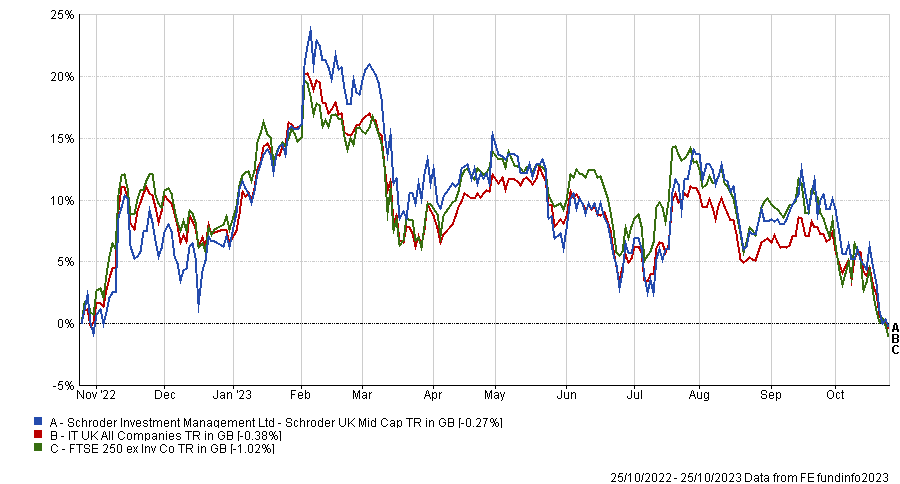

Performance of fund vs sector and index over 1yr

Source: FE Analytics

It’s “an attractive pond to be fishing in”, said Roche, for a reason that could come as a surprise to many: research by Schroders has shown that a UK-listed company chosen at random is more likely to return 30 times its value over 30 years than a company listed in the US, with many of these UK-based ‘30-baggers’ making most of their gains as mid-sized businesses.

Below, the manager shares four of her favourite stocks that could soon be FTSE 100 constituents, “if calling them out in this way won’t spell doom for the stock, as it usually does”, she added.

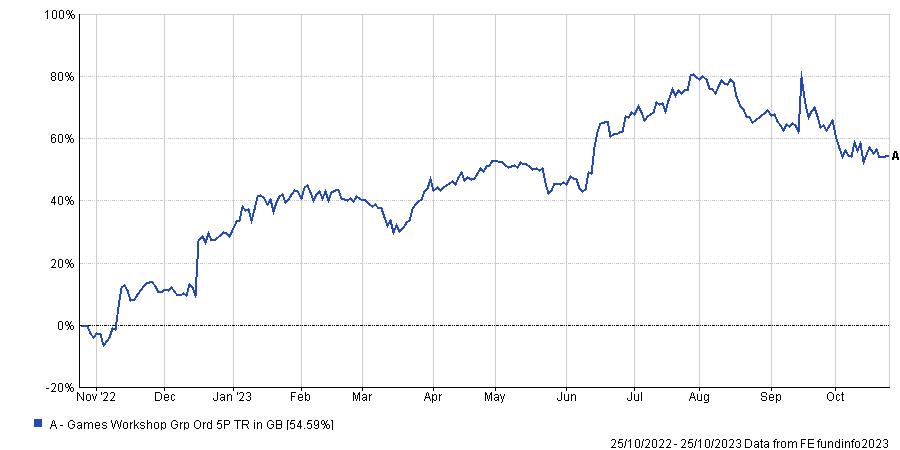

The first up was Games Workshop, the company behind the Warhammer franchise.

Performance of stock over the past year

Source: FE Analytics

“It performed very well on the back of news it had struck an agreement in principle with Amazon to develop its intellectual property into film and TV productions. Its earnings upgraded 8% over the past 18 months,” Roche said.

“We have long seen scope for the company to selectively licence its intellectual property to grow the fan base and create a truly global franchise. The Amazon deal has brought this potential to the attention of the wider market.”

On top of this momentum, the company is “incredibly well-run”, with a “prudent” management team which is avoiding acquisitions “to not destroy value” and only distributing surplus cash instead.

The company also generates “very high returns on capital with low barriers to entry and has access to the unique Warhammer brand which no other company can offer”.

The second up was Spectris, an industrials company and the trust’s largest holding at 4.4%.

Performance of stock over the past year

Source: FE Analytics

“Its earnings upgraded by 18% over the past 18 months. The company is quietly just generating top line growth by enabling businesses to do what they do in a more efficient way, for example allowing generic drugs to be developed without having to be tested for a year to see how safe they are,” Roche explained.

“It has a type of equipment that can tell you within a day or two how a compound changes over a year, so it can literally shrink time for industry players and speed up manufacturing.”

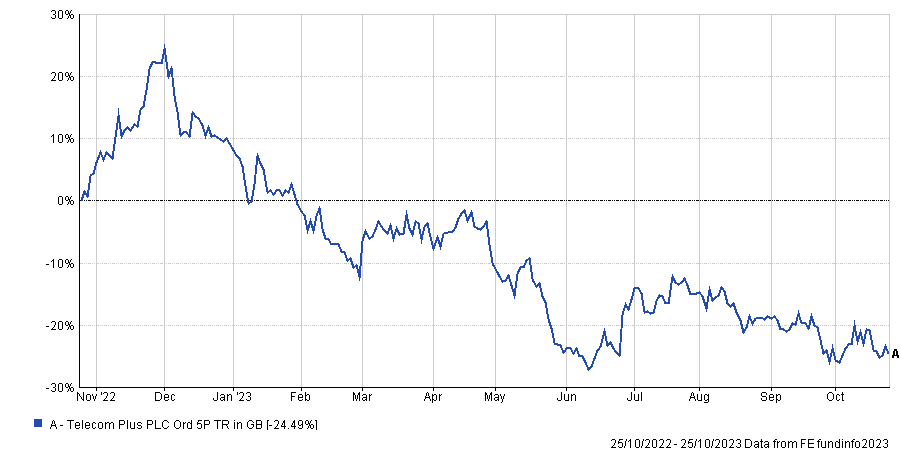

Utility player Telecom Plus was the manager’s third candidate in the run to the FTSE 100. As of 30 September, it was the 10th largest holding in the portfolio with a 3.1% weighting.

Performance of stock over the past year

Source: FE Analytics

“Its earnings went up 25% over the past 18 months,” she said. “Most recently, though, even though energy prices have been coming down, it’s still at 14%, showing that it can achieve top-line growth and carry on growing.”

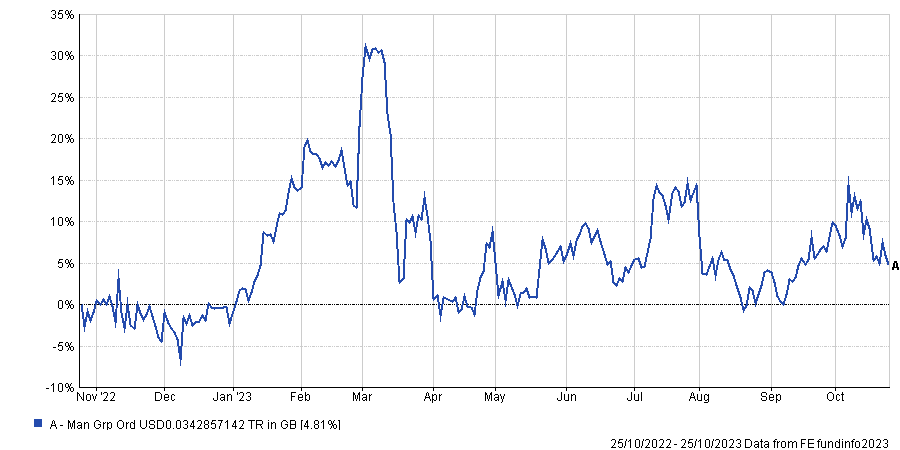

Finally, the manager drew attention to the financials company Man Group. This “240-year-old disruptor”, which makes up 2.3% of the trust’s portfolio, is analysing “millions of bits of data every day” and has been buying up to 1 million in its own shares over the past five years.

Performance of stock over the past year

Source: FE Analytics

“UK mid-caps have been suffering a bit of a public relations problem lately, but all of these companies are doing something different and can give investors exposure to many different niches,” she said.

“Also, importantly, they can potentially go into the FTSE 100, which is what we like to see happening at this trust.”