“Those classes of investments considered ‘best’ change from period to period. The pathetic fallacy is what are thought to be the best are in truth only the most popular – the most active, the most talked of, the most boosted, and consequently, the highest in price at that time.”

The above quote, from American stockbroker Fred Schwed Jr, pinpoints the fickleness of markets and how their drivers can change abruptly.

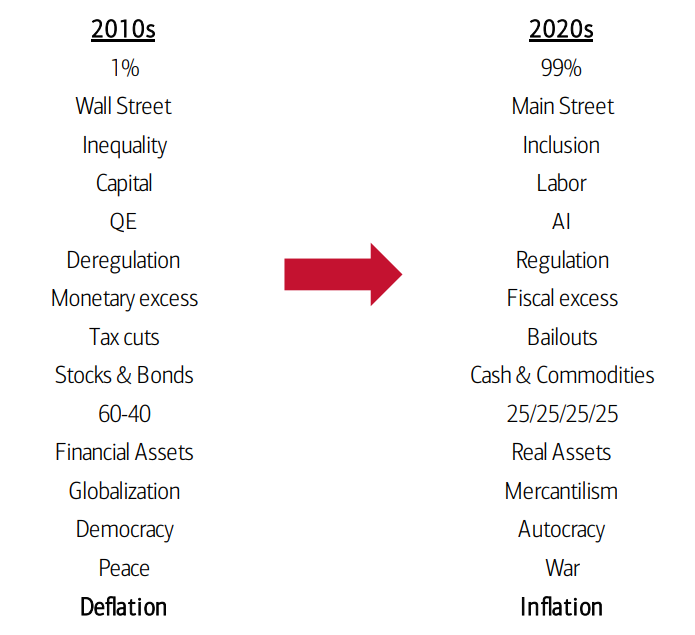

Strategists at Bank of America are of the same mind and in their annual The Longest Pictures report have forecast how they think the driving investment themes of the 2010s will change throughout the 2020s.

Investment themes for the 2010s vs 2020s

Source: FE Analytics

The strategists highlighted how the past four years have seen a series of events that have rocked markets and the global economy.

These include, but are not limited to, 4.5 billion people being in Covid lockdown, $30trn in policy stimulus, more than 2 billion people living with inflation in excess of 10%, conflicts in Europe and the Middle East, the Magnificent Seven accounting for 30% of US market cap, the first ever decline in China’s population and the rise of artificial intelligence.

“Tales of the unexpected set to continue,” the bank added.

The impact of these events could spark vast changes that investors need to be aware of over the coming decade. Bank of America sees the 2020s as being an era of higher inflation and interest rates, which is periodically interrupted by recession.

During this period, there will be booms and busts in “a big, fat equity trading range” driven by some of the factors appearing in the above list.

Among these are new trends in society (inequality to inclusion), policy (monetary to fiscal), the financial industry (leveraging to deleveraging), trade (globalisation to isolationism), geopolitics (peace to war), tech (AI), environment (net zero, energy/food security) and demographics (ageing).

For investors, this has wide-reaching consequences. Bank of America expects that a portfolio with a 25% split between stocks, bonds, commodities and cash will outperform a traditional 60/40 strategy.

This is based on forecasts that real assets will perform better than financial assets and that the consumer and the broad economy of Main Street will be stronger than the large corporations and financial institutions of Wall Street.

In light of this, Bank of America’s strategists said: “We buy secular contrarian plays in gold, small-cap, value stocks, global banks, emerging markets [and] distressed tech, in anticipation of recession & elections sparking inflationary policy panic in ’24.”