Investment trusts may have fallen to their widest discount since the global financial crisis but the downfall has been even more pronounced for private equities specialists.

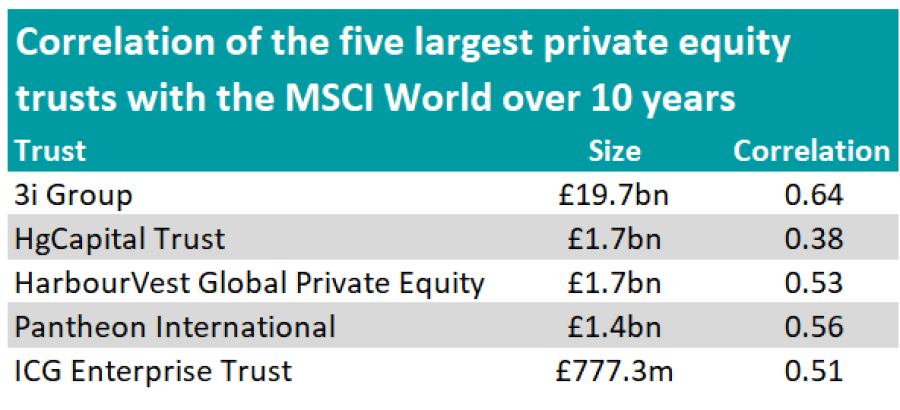

The average investment trust is trading on an -21.1% discount, while the discount for the IT Private Equity sector stands at -36.7%, according to Quoteddata.

There are further nuances within the sector, as the discount level varies depending on the strategy or the maturity stage of the underlying investee companies. For instance, growth capital trusts are trading on the widest discounts, averaging close to 50%, while the average discount of funds of funds stands at 40%, according to Quilter Cheviot. Meanwhile, direct private equity trusts have the lowest discount, at -27%.

Matt Ennion, fund research analyst at Quilter Cheviot, said: “There are various reasons for these discounts such as economic concerns, liquidity, fees, inertia and lack of buyers as well as stock specific reasons such as balance sheet risk, leverage and a lack of trust in valuations and net asset values.”

This situation is not unheard of and consistent with previous bear market periods. In fact, private equity trusts often trade below their net asset value due to the illiquid nature of their underlying assets and the risk associated with the asset class, but both Ennion and Tom Hopkins, senior portfolio manager at BRI Wealth Management, believe discounts are now excessive in many cases.

Hopkins said: “One area of concern typically for investors is the valuation of the trusts’ underlying assets. When markets fall unlisted assets tend to follow suit but as there is a lag in the reporting, it’s this uncertainty investors are wary of.

“However so far, most private equity firms have only reported minor haircuts to valuations. With share on a more than 40% discount to net asset value, we think it’s excessive given earnings at many underlying companies continue to be relatively robust.”

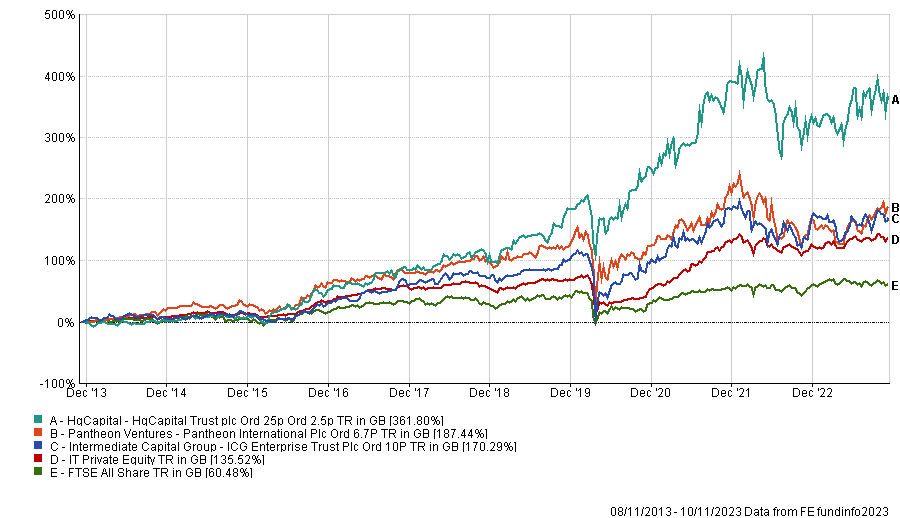

Source: FE Analytics

Source: FE Analytics

Ennion also highlighted that boards and managers of private equity trusts are beginning to be more proactive in targeting these discounts with the introduction of buybacks, improvement in portfolio disclosures and marketing efforts to help investors understand the trusts better.

Therefore, today’s significant discount levels could provide an attractive entry point for long-term investors.

Hopkins added: “Private equity makes for an excellent diversification tool as part of a wider equity allocation in portfolios. There is a perception that private equity investment is all about loading companies with debt. That is far from the truth, most of the listed private equity funds set out to build businesses, working in partnership with management.

“For an investor that can look through the short-term noise it’s an interesting asset class to revisit, even more so given the current discounts to NAV.”

This is something that Quilter Cheviot is also considering. The wealth manager is currently underweight the asset class in its allocation models as it has adopted a more defensive stance due to the current market environment. Yet, “regular discussions” around making further allocations are taking place due the inherent value in the private equity sector.

Ennion warned, however, that investors have to be selective when selecting private equity trusts as there are good and bad trusts within the private equity universe and all are “unique”, he said.

Hopkins also looks for a range of criteria before investing in a private equity trust. His preference is for large, liquid, high-quality investment trusts with good long-term track records and “excellent” management teams that have consistently proved they can add value despite economic conditions.

That includes ICG Enterprise Trust and Pantheon International, which both offer different approaches to private equities.

He said: “In a rising rate world, we take comfort from ICG Enterprise’s approach of profitable, cash-generative, private-market investments with its conservative approach to valuations and robust balance sheet, whilst funds-of-funds managers such as Pantheon International offer great levels of diversification and an exceptional management team.”

Hopkins warned, however, that it is important to keep an eye on the level of debt these trusts carry in their underlying portfolio given the rate environment. He would also be wary of significant addition into venture capital exposure due to the tricky economy.

Performance of trusts over 10yrs vs sector and benchmark

Source: FE Analytics

While Quilter Cheviot invests in several private equity investment trusts to meet different client requirements, Ennion highlighted HgCapital Trust* in particular.

He said: “Some of the criteria we focus on when selecting a private equity trust are the strategy the trust uses and the associated return and risks outcomes, the quality of the manager and the resources they have to manage the portfolio and the managers ability to access high quality assets and deliver the proposed strategy returns.

“It is important to invest in top-quartile managers and returns tend to be persistent in private markets. HgCapital would be an example of a trust in which we have high conviction and delivers on the above criteria.”

*HgCapital Trust is an investor in FE fundinfo.