Many global investors have little exposure to emerging markets because these countries are deemed unsafe. There are so many things to worry about – populist politicians causing havoc on the streets; economic turmoil; rabid inflation; governance issues; and central bankers’ questionable competence.

But look again at that worry list and lots of it can apply to developed market nations, too. Think back to the riots on Capitol Hill in the US and the Liz Truss regime in the UK. Public confidence in the Bank of England has fallen to a record low.

At the Conservative party conference we heard calls for the prime minister to be able to fire the Bank of England governor. The Federal Reserve is under fire in the US too.

A case could be made that emerging market central bankers have demonstrated more competence than their counterparts in the developed world. Many started hiking rates much more aggressively and much earlier than the Bank of England and European Central Bank and they are now ready to cut them.

I do not want to trash developed market economies. The real point here is that those of us living in them can often hold prejudices about so-called emerging economies that deserve to be challenged.

We have been increasing our exposure to emerging markets recently, and in particular to Brazil, where inflation is just 5.2% – lower than the UK’s (though inflation does appear to be falling at last here).

Brazil is an agricultural heavyweight, supplying soya beans, beef, coffee and sugar (amongst others) to many parts of the world. This abundance of natural resources gives the economy significant advantages. For much of 2022, elevated commodity prices and the central bank’s decision to hike interest rates early and quickly supported the equity market.

In recent months political risks have taken centre stage, as they often have for Brazil in the past few decades. Former two-time president Luiz Ignacio Lula da Silva beat incumbent President Jair Bolsonaro in October. Investors worried about Lula’s fiscal plans and the potential impact of his left-wing administration on state-controlled enterprises.

Historically we have found periods of political uncertainty to present good opportunities for investors. Selling can often be indiscriminate in volatile periods.

This week we have seen the success of “El Loco” – the Madman – Javier Milei in neighbouring Argentina. The former TV pundit (echoes of Donald Trump?) won huge support after waving a chainsaw at campaign events, threatening to take it to the economic and political status quo.

Supporters began to bring their own chainsaws to events. Yes, it sounds risky in every way. But politics often matters less than economics, especially with multinational companies.

While not oblivious to the political risk, we focus primarily on the fundamentals of the businesses we might invest in. In Brazil substantial dividends are on offer, with good growth and attractive valuations. Despite improvements in balance sheet positions, some state-controlled businesses are trading at their lowest ever valuations.

With interest rates at 12.5% and inflation lower than in many parts of Europe, financials stand to benefit from the favourable spreads and real yields on offer. This looks enticing and explains our investment in Banco do Brasil (we also hold Petrobras).

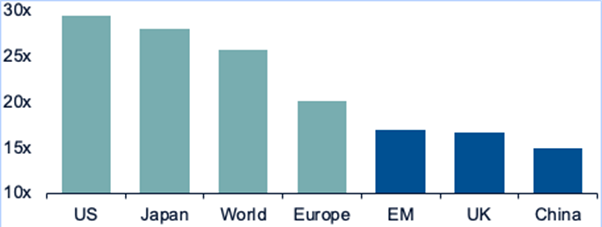

The cyclically adjusted Shiller p/e ratio suggests investors view the UK alongside China and Emerging Markets

Source: Artemis

If you invest in emerging markets you can expect more volatility. You do have to watch the newsflow. And you have to watch out for poor corporate governance. There is often government risk, as we saw following Russia effectively confiscating Western held shares following its invasion of Ukraine. If you invest in Chinese state-owned-enterprises are they run for China or for Western shareholders?

These issues will always be there. But the notion of emerging markets is changing. Many of us will certainly have more exposure to them than is immediately apparent. Take my portfolio. Half of HSBC, listed in the UK, is in China. The shares are cheap enough that if China’s current troubles became bigger, it would not create major losses. Spain’s Santander is big in Brazil and the UK. And Japan’s Mitsubishi Bank owns banks in Thailand and Indonesia.

Increasingly, large multi-national companies in emerging markets are coming on to our radar. Their shares are about as cheap as the UK’s, which are famously beaten up. That signals an opportunity for those who can see it and helps explain why we have about 9% of the portfolio in the UK and a similar amount in emerging markets.

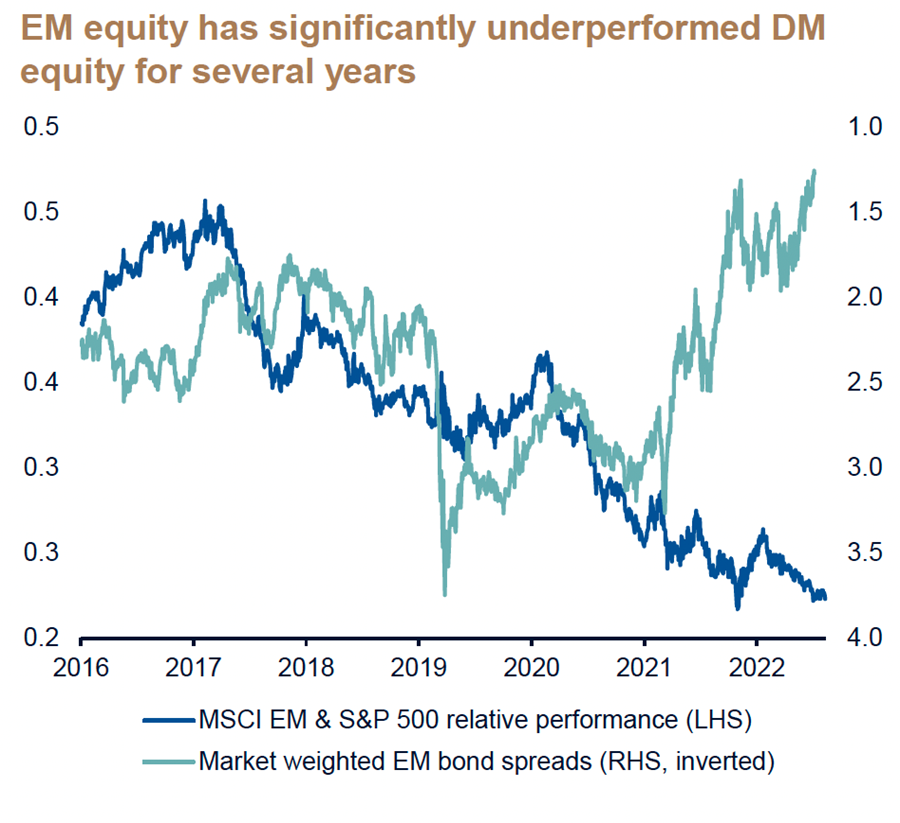

Source: Artemis

Preconceptions and prejudices can cost us as investors. Those who do their research may find many emerging market countries more stable than they expected and an array of well-run, multi-national companies as good as any in developed countries. On current valuations, and for income investors in particular, now seems a good time to consider including some in your portfolio.

Jacob de Tusch-Lec is co-manager of the Artemis Global Income fund. The views expressed above should not be taken as investment advice.