Somerset Capital Management is to transfer its UK funds to a new investment adviser, as the firm will be closing its wider institutional business in London.

The announcement came this morning, one month after the firm’s main client, St. James's Place, withdrew $2.5bn, which constituted almost two thirds of the company’s assets. The move triggered wider outflows, leaving Somerset with just about $1bn on its books.

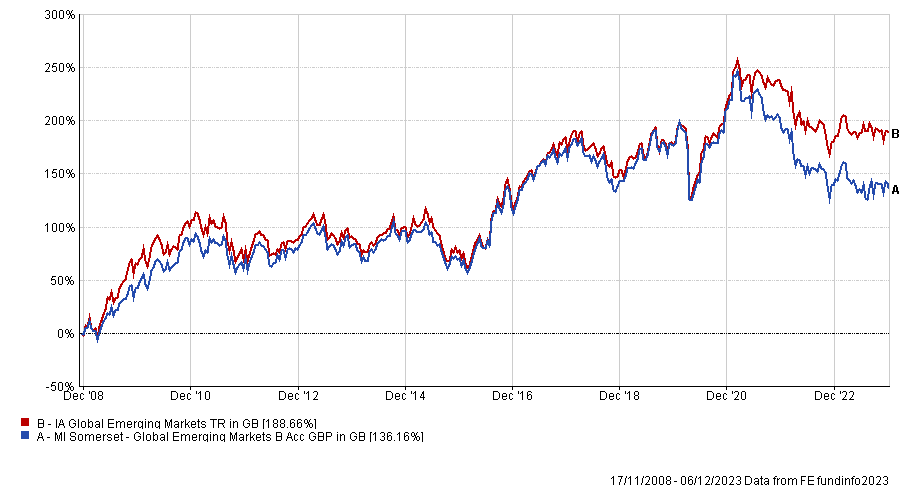

Co-founded by MP Jacob Rees-Mogg in 2007, Somerset is known for its emerging markets funds, the first of which, Somerset Global Emerging Markets, launched in 2008 and returned 136.2% since then, as shown in the chart below.

Performance of fund vs sector and index since launch

Source: FE Analytics

This and other UK vehicles managed by Somerset are set to transition to a new investment adviser, retaining the existing key investment team, fund and third-party infrastructure in an effort to “ensure the seamless continuity of these funds and their managers, while positioning them for continued growth”.

Partner Oliver Crawley remained confident in the future of the departing funds.

"The current teams have delivered strong performance for their investors and continue to do so,” he said. “We hope a transition can be secured which we believe will give the funds a bright future.”

The development is seen as a consequence of the latest Consumer Duty regulation encouraging asset managers to deliver good outcomes for their clients, on the back of which St James’s Place has started to reconsider its fee structure.