Bond yields are so high now that it would be very difficult to lose money in fixed income next year and, depending on the speed and extent of rate cuts, returns from bonds could be in double digits, according to experts at Insight Investment.

Total returns from fixed income could even rival those from equities next year, Adam Whiteley, head of global credit, said. “The income is now back in fixed income and you’re being paid to be impatient.”

Gareth Colesmith, head of global rates and macro research at the firm, added that the prospects for absolute returns from core fixed income are better than they have been for 15 years. Total returns should be positive next year, he said, regardless of the economic scenario because yields are so high – and if there is a soft landing, risk assets across the board should do well.

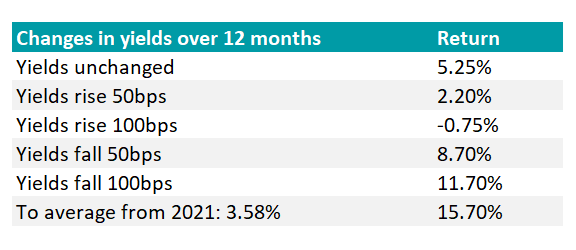

The chart below summarises expected returns from a US core bond portfolio in four scenarios: yields remain unchanged and central banks keep rates on hold; yields rise; yields fall as rates are cut; and yields return to their average levels since 2021.

Total returns look attractive in most of these scenarios; yields would have to rise by 100 basis points for core bonds to lose money, which most fund managers agree is unlikely.

Total returns from a US core bond portfolio in relation to yields

Source: Insight Investment

For the data, Insight has used the Bloomberg US Aggregate Index as a proxy for a core bond portfolio as it includes government bonds and investment grade credit. The table is based on data to 30 November 2023.

Ultimately, returns will hinge upon whether, when and how much central banks cut rates. Insight expects central banks to keep rates near their current levels for longer than the market has priced in because inflation is likely to be remain volatile due to deglobalisation, demographic trends and decarbonisation.

Matthew Merritt, Insight’s head of multi-asset strategy, said that assuming July was the last hike, this is a good time to buy bonds and extend duration. Long plateaus while the US Federal Reserve pauses between the end of its hiking cycle and its first cut have historically caused rallies in both US equities and US Treasuries. This cycle has been a bit of an outlier, with steep falls in October then a rally in November.

Insight has been underweight duration for most of this year but shifted to become flat-to-long duration by mid-October, said Adrian Grey, global chief investment officer. “We’ve been leaning into that as markets have waxed and waned.”

Grey described investment grade credit as the “sweet spot” and “centre of gravity” because it will provide investors with a combination of duration and income. Within credit, investors are looking at shorter maturities where yields are as good as longer-dated bonds and there may be an added comfort factor, Grey said. Then investors are using government bonds when they want to make a duration play.

Investors no longer need to take as much risk to achieve their target returns, Whiteley added, so they are shifting one notch down the risk ladder, from high yield to investment grade credit or from investment grade to government bonds.

Beyond Insight’s base case, other outcomes listed in the table above are plausible, even a scenario where yields might fall as much as 100 basis points.

Like Insight, JP Morgan Asset Management’s global strategists expect central banks to demure, but once they eventually set out on the path towards monetary easing, they could cut interest rates severely, by at least 100 basis points. That would imply an 11.7% total return.

Even if the reverse occurs and yields drift upwards from here (which might happen if inflation remains stubborn and central banks defy expectations and become more hawkish) the high levels of income available from core fixed income portfolios would cushion investors against capital losses.