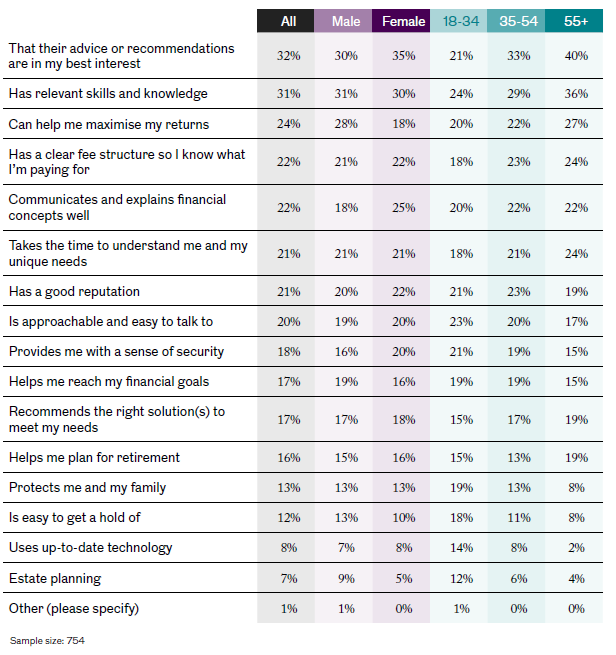

People who use a financial adviser prize recommendations in their best interests above all else, according to a survey by Royal London.

Relevant skills and knowledge, and a clear fee structure are also important, but not as much as maximising investment returns or receiving advice that is tailored and relevant.

The survey included 2,000 UK consumers as well as a poll financial of advisers on how people define value for money. It found that soft skills are crucial in financial advice, with one saver noting it is important “how the person talks and reacts, how friendly and clear they are”.

A quarter of respondents said the most important thing would be finding someone who could help them reach their financial goals (25%) and give advice in their best interests (26%).

Another respondent appreciated their adviser having “good expertise and knowledge and a genuine interest in my needs.”

A third added that advisers should “have up-to-date knowledge on everything” and “be open, honest and not push you into decisions.”

What people value when they use a financial adviser

Source: Royal London

Some 29% of people who do not yet have a financial adviser but might consider using one said they would base their choice on an adviser’s reputation.

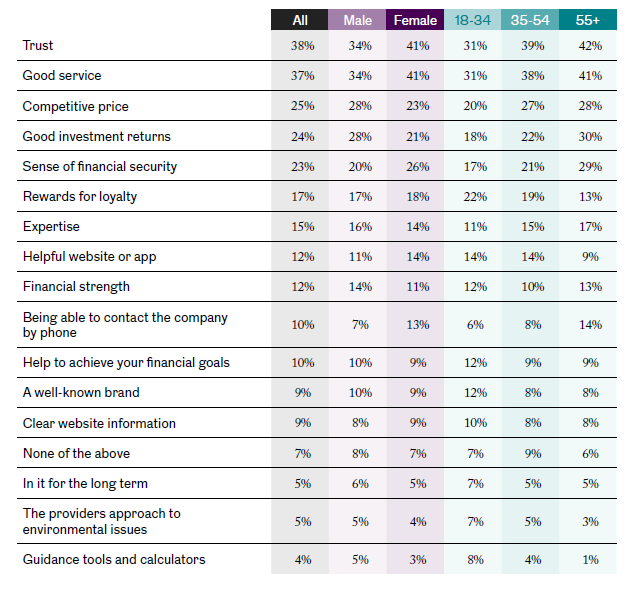

How do people choose a financial product?

When selecting a financial product such as a pension, ISA or fund, good client service and trust are savers’ top priorities, while competitive pricing and investment returns are also important, as the table below reveals.

What savers look for when selecting a financial services product provider

Source: Royal London

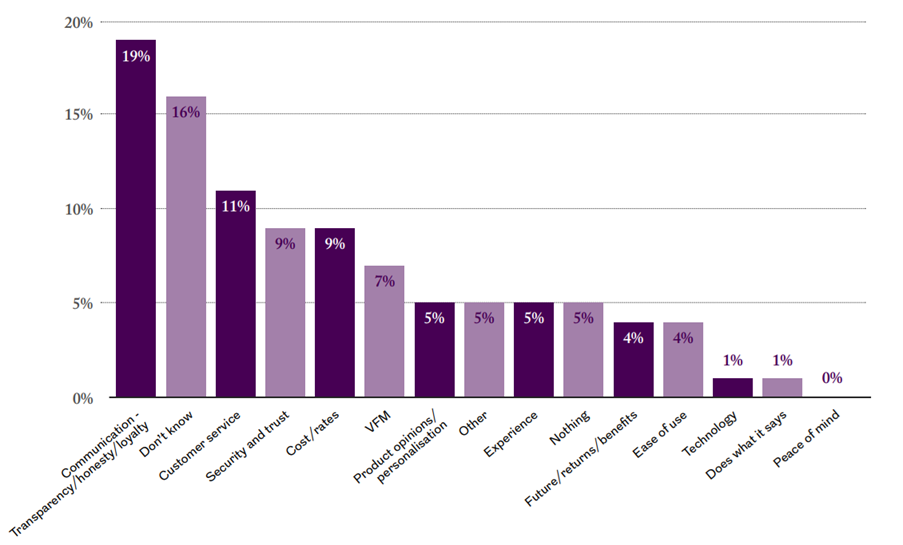

In a similar vein, savers value communication and transparency above all else from the financial services providers they already use. Good customer service is even more important that costs and fees, as the chart below shows.

What savers value most from the financial services providers they use

Source: Royal London (VFM stands for 'value for money')

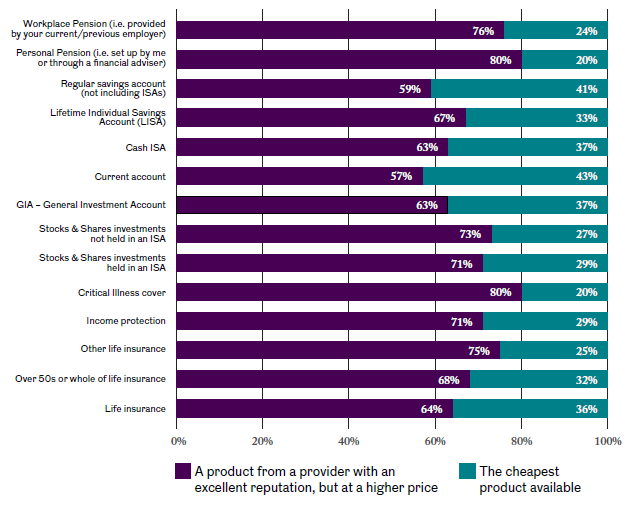

Most savers would pay higher fees for a product if the financial services provider had an excellent reputation, rather than opting for the cheapest product on the market, as the chart below illustrates.

Savers would spurn cheap products for providers with better reputations

Source: Royal London

Financial advisers who select products on behalf of their clients said they focus on providers who are best suited to meet their clients’ needs. They also look for financial strength, profitability and a sustainable business model.

Price is not the first port of call for advisers or consumers. One adviser told the Lang Cat: “I select providers based mainly on the quality and features of their product set, with the price being a secondary consideration. Price is relevant only in the context of what is being provided.”

How do advisers structure their fees?

Fees for financial advice are, of course, a significant component of the costs that savers pay. Around a third of advisers have changed their fee structure in response to the Financial Conduct Authority’s increased focus on value, the Lang Cat found. The clear direction of travel is towards fixed or capped fees.

Most advisers use fixed or capped fees for initial advice (89%) and ongoing services (64%), while about half of advisers (49%) have fixed or capped fees for implementation.

“Consumer Duty requires a clearer articulation of the fees being paid and why they represent fair value, but also introduces additional requirements to monitor and evidence these standards are being met,” the Lang Cat said.

“The challenge for advisers is to create the right fee structure that balances out commercial reality, but also ensures fair value. For the majority of respondents, fixed and/or capped fees are an essential mechanism to achieve these dual aims.”